From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market: Consumption Surges Amidst Export Shifts, Plant Activity Varies

Ukraine’s steel market presents a mixed picture, with domestic consumption rising while exports face downward pressure. According to “Consumption of steel products in Ukraine grew by 39.5% y/y in January-September,” domestic consumption surged, even as total steel exports declined as reported in “Ukraine’s total steel exports down 12.2 percent in Jan-Sept 2025“. The news articles highlight the challenges and opportunities shaping the industry.

Observed plant activity does not directly correspond to the consumption surge, suggesting imports are fulfilling the increased demand or domestic sales are using existing output.

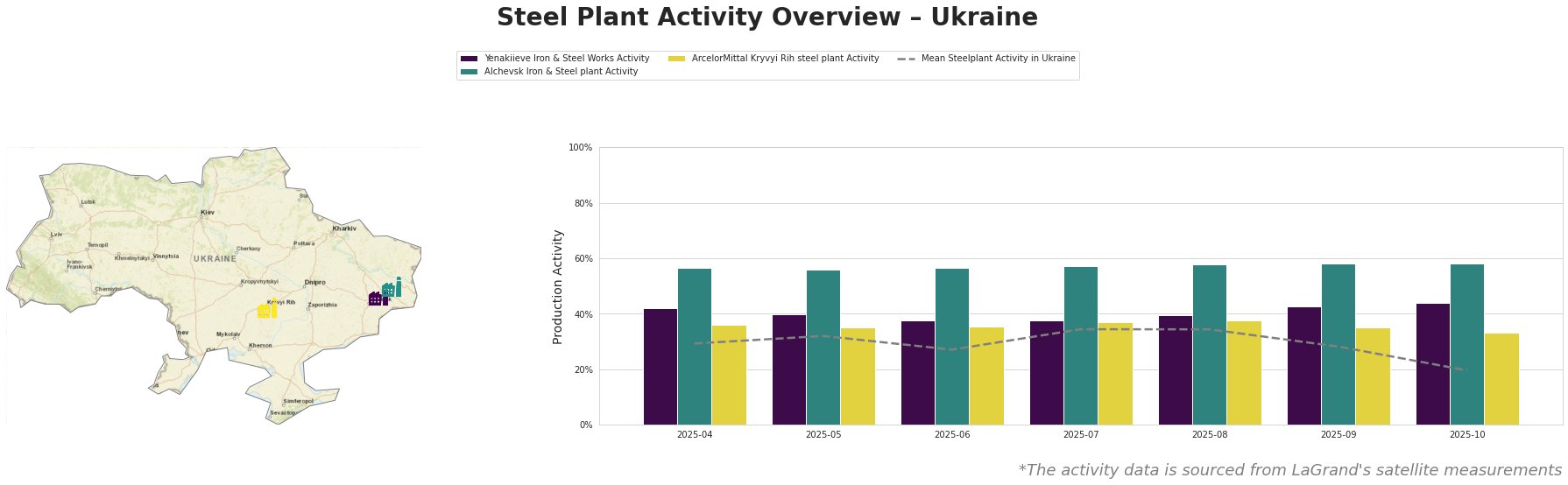

Measured Activity Overview

The mean steel plant activity in Ukraine shows volatility. Activity peaked in July-August 2025 at 34% and experienced the sharpest drop to 20% in October 2025.

Yenakiieve Iron & Steel Works has consistently operated above the mean activity level of Ukrainian steel plants. Its activity has remained relatively stable, fluctuating between 38% and 44%, reaching its highest level in October.

Alchevsk Iron & Steel plant shows the highest and most stable activity, consistently around 56-58%.

ArcelorMittal Kryvyi Rih steel plant consistently operates around or below the mean, showing less volatility. The activity level of ArcelorMittal Kryvyi Rih peaked in August 2025 at 38% and has decreased to 33% in October.

It is important to note, that a direct connection between the reported 2.5% drop in “Industrial production in Ukraine fell by 2.5% y/y in January-August” and the plant activities is not directly reflected in the steel plant activity metrics.

Steel Plant Information

Yenakiieve Iron & Steel Works, located in Donetsk, primarily uses basic oxygen furnace (BOF) technology to produce 3.3 million tons of crude steel annually, focusing on semi-finished and finished rolled products like rebar and wire rods. Activity at Yenakiieve has increased to 44% in October, while most other plants slowed down. No direct relationship to the cited news articles could be established.

Alchevsk Iron & Steel plant in Luhansk, also relying on BOF technology, boasts a higher crude steel capacity of 5.472 million tons, producing slabs and square billets. This plant’s activity has remained consistently high, around 56-58%, throughout the observed period, indicating stable operations despite the overall market fluctuations. No direct relationship to the cited news articles could be established.

ArcelorMittal Kryvyi Rih, in Dnipropetrovsk, has the largest crude steel capacity at 8 million tons, employing both BOF and OHF processes. Its product range includes billets, rebar, and wire rod, targeting building and infrastructure sectors. Activity at ArcelorMittal Kryvyi Rih peaked in August 2025 at 38% and has decreased to 33% in October. No direct relationship to the cited news articles could be established.

Evaluated Market Implications

The surge in domestic steel consumption, as highlighted in “Consumption of steel products in Ukraine grew by 39.5% y/y in January-September,” combined with the observed decrease in mean steel plant activity in Ukraine in October, suggests a potential reliance on imports to meet demand or possible supply disruptions. This is reinforced by the news that “Ukraine’s total steel exports down 12.2 percent in Jan-Sept 2025“.

Procurement Actions for Steel Buyers and Analysts:

- Diversify Supply Sources: Given the increase in imports and decline in exports, as reported in “Consumption of steel products in Ukraine grew by 39.5% y/y in January-September” and “Ukraine’s total steel exports down 12.2 percent in Jan-Sept 2025” respectively, buyers should actively diversify their supply sources, with a focus on European markets, to mitigate potential supply chain disruptions, which seems to be a good strategy in the near term.

- Monitor Ferroalloy and Scrap Markets: Considering the volatility in exports reported in “Ukraine’s ferroalloy industry exported 77.5 thousand tons of products in January-September” and the surge in scrap exports detailed in “Scrap exports from Ukraine reached 311,000 tons in January-September,” buyers should closely monitor these markets. The proposed export restrictions on scrap exports may impact scrap availability and prices.