From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market Braces for Price Hikes: CBAM and Tariffs Impacting Local Production

Ukraine’s steel market is poised for significant changes due to evolving EU and UK trade policies. The evolving situation at key steel plants are indirectly influenced by new trade frameworks. Specifically, the impacts are anticipated based on insights from the news articles “All Steels: EU and UK steel prices set to surge as new tariffs and CBAM framework take effect,” “All types of steel: steel prices in the EU and the UK will rise as new tariffs and the CBAM framework come into force.” and “New tariffs and CBAM will push up steel prices in the EU and the UK – forecast“. The news explicitly relates CBAM, new import quotas, and revised safeguard systems that will drive price increases in the EU and UK. A direct relationship between these factors and activity changes at Ukrainian steel plants cannot be explicitly established from the provided news articles or data.

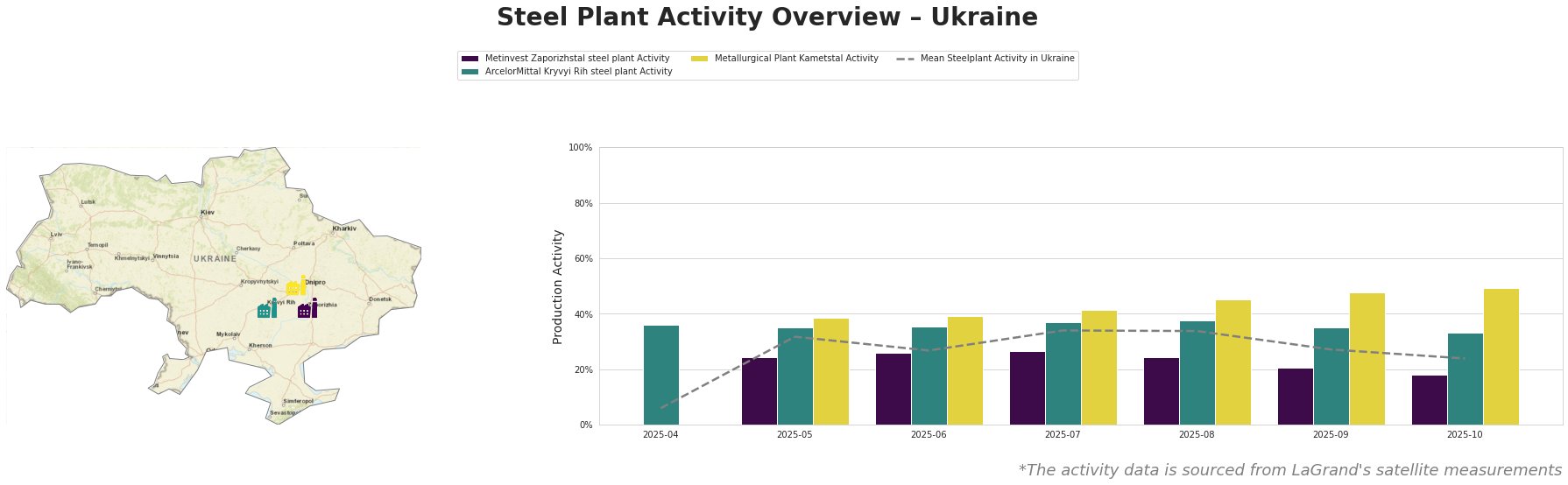

The average steel plant activity in Ukraine fluctuated considerably. After an initial low of 6% in April, it peaked at 34% in July and August before declining to 24% in October. The Metinvest Zaporizhstal plant consistently operated below the national average. ArcelorMittal Kryvyi Rih showed activity levels around the national average, peaking in August, while Metallurgical Plant Kametstal displayed the highest activity levels, reaching 49% in October.

Metinvest Zaporizhstal steel plant, with a crude steel capacity of 4.1 million tonnes per annum (TTPA) using basic oxygen furnace (OHF) technology, showed a decrease in activity from 26% in June and July to 18% in October. Given Zaporizhstal’s focus on finished rolled products for automotive and steel packaging, this decline may indicate a cautious approach in anticipation of CBAM-related market shifts described in “All Steels: EU and UK steel prices set to surge as new tariffs and CBAM framework take effect,” where increased local sourcing in the EU and UK is expected. However, a direct relationship cannot be explicitly established.

ArcelorMittal Kryvyi Rih steel plant, an integrated plant with a substantial 8 million TTPA crude steel capacity utilizing both BOF and OHF processes, displayed relatively stable activity. The plant’s activity fluctuated around the mean activity level, from 38% in August to 33% in October. As the EU and UK transition towards increased domestic production “New tariffs and CBAM will push up steel prices in the EU and the UK – forecast,” ArcelorMittal Kryvyi Rih could see increased demand for its semi-finished products like billet, rebar, and wire rod to meet potential supply gaps, which may positively influence activity. But no specific impact on the Ukrainian plant can be tied to the news reports.

Metallurgical Plant Kametstal, possessing a crude steel capacity of 4.2 million TTPA via the BOF process, demonstrated the most robust activity levels among the observed plants. A consistent increase from 39% in May and June to a high of 49% in October. While the plant focuses on semi-finished and finished rolled products such as square billets and wire rods, serving the energy and transport sectors, a direct link between this increased activity and the CBAM-related EU/UK market changes discussed in “All types of steel: steel prices in the EU and the UK will rise as new tariffs and the CBAM framework come into force.” cannot be explicitly established.

Considering the information presented, procurement professionals should proactively:

- Monitor Kametstal’s output closely. The plant’s higher-than-average activity, even without a directly established link to CBAM-related developments, suggests its potential to cater to domestic demand, making it a vital source for immediate needs. Diversify supply chains to include Kametstal to mitigate risks from potential EU/UK import disruptions.

- Evaluate sourcing options for hot-rolled coil and sheets. Given Zaporizhstal’s activity decline combined with its focus on finished products destined for sectors potentially affected by EU/UK import shifts. Secure alternative sources or explore forward contracts with Zaporizhstal, with clear clauses addressing CBAM-related cost increases, to manage potential supply disruptions.