From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Exports Surge: Positive Signals for European Steel Supply Amidst Scrap Export Concerns

Europe’s steel market is showing very positive sentiment, influenced by increased Ukrainian steel exports detailed in several recent reports. This report analyzes these trends, linking them to observed steel plant activity using satellite data. Specifically, the increase in flat product exports as reported in “Ukraine increased exports of flat products to 554 thousand tons in January-April” might exert pressure on European producers of similar goods. Conversely, increased Ukrainian scrap exports highlighted in “Ukraine increased scrap metal exports by 45% in 4 months” and “Ukraine increased exports of ferrous scrap by 95% year-on-year” could potentially limit EAF steelmaking capacity within Ukraine, influencing production strategies.

It remains unclear if or how any of these news events directly affect the plants in this report.

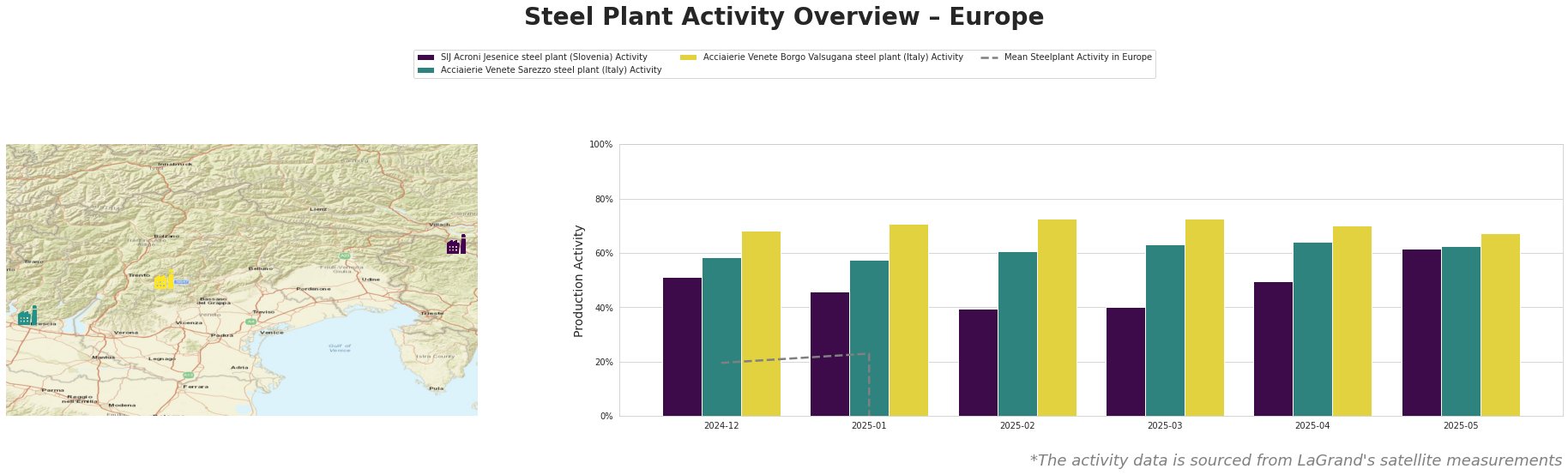

The mean activity level across all observed plants in Europe shows a large anomaly, so is not representative of the whole market.

SIJ Acroni Jesenice steel plant showed an increase from 51% in December 2024 to 62% in May 2025, with a drop to 39% in February 2025. Acciaierie Venete Sarezzo steel plant exhibited relative stability, fluctuating between 58% and 64%. Acciaierie Venete Borgo Valsugana steel plant showed a high and stable activity, ranging from 67% to 73%.

SIJ Acroni Jesenice, a Slovenian steel plant with an EAF capacity of 726 thousand tons, specializes in flat-rolled steel products. The plant has shown fluctuating activity levels in the observed period, with a notable rise to 62% in May 2025 after a low of 39% in February 2025. While “Ukraine increased exports of flat products to 554 thousand tons in January-April” indicates growing competition in flat products, it’s unclear if this directly influences SIJ Acroni Jesenice’s operational tempo.

Acciaierie Venete Sarezzo, an Italian steel plant producing bars and wire rod via EAF (540 thousand tons capacity), demonstrated relatively stable activity, hovering around the 60% level. Given that the plant’s product focus differs from Ukraine’s increased flat product exports, as reported in “Ukraine increased exports of flat products to 554 thousand tons in January-April,” no direct impact on its activity can be established.

Acciaierie Venete Borgo Valsugana, another Italian EAF-based plant (600 thousand tons capacity) focused on bars and wire rod, maintained consistently high activity levels (above 67%). Like its sister plant in Sarezzo, its product mix is distinct from the Ukrainian flat product export surge; therefore, no immediate connection can be made with “Ukraine increased exports of flat products to 554 thousand tons in January-April“.

The reports “Ukraine increased scrap metal exports by 45% in 4 months” and “Ukraine increased exports of ferrous scrap by 95% year-on-year” raise concerns about potential scrap shortages impacting EAF-based steel production in Ukraine. Considering Ukraine’s increased imports of long products by 81.1% as per “Ukraine increased imports of long products by 81.1% y/y in January-April“, steel buyers should:

- Monitor scrap prices closely: The surge in Ukrainian scrap exports may drive up scrap costs for European EAF steelmakers in the long run.

- Diversify sourcing of long products: Given Ukraine’s increased imports of long products, buyers should broaden their supplier base to mitigate potential disruptions from Ukrainian trade dynamics and focus on the Turkey region.

While Ukrainian exports are generally positive, the potential impact of scrap exports, and an observed need to import finished long products might shift steel supply chains. The plant data provides no direct supporting observations.