From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Exports Mixed: Flat Rolled Gains Offset Overall Decline, European Plant Activity Stable

Europe’s steel market presents a mixed picture, with Ukrainian export dynamics influencing regional supply. While overall Ukrainian steel exports have decreased, certain product categories are showing growth, potentially impacting specific segments within the European market. This is happening alongside relatively stable steel plant activity levels observed via satellite data across selected European facilities. According to “Ukraine’s total steel exports down 9.9 percent in Jan-Oct 2025,” total steel exports decreased by 9.9%, which may impact availability within the EU. However, the article “Ukraine exported 1.47 million tons of flat rolled steel in January-October” states that flat rolled steel exports increased by 1.4%, indicating potential shifts in product availability and demand. While there’s no direct satellite data to correlate these export changes to European plant activity, the trade dynamics suggest possible impacts on regional steel supply chains and pricing, in particular as the news article “Ukraine reduced exports of semi-finished products by 35.5% y/y in January-October” highlights.

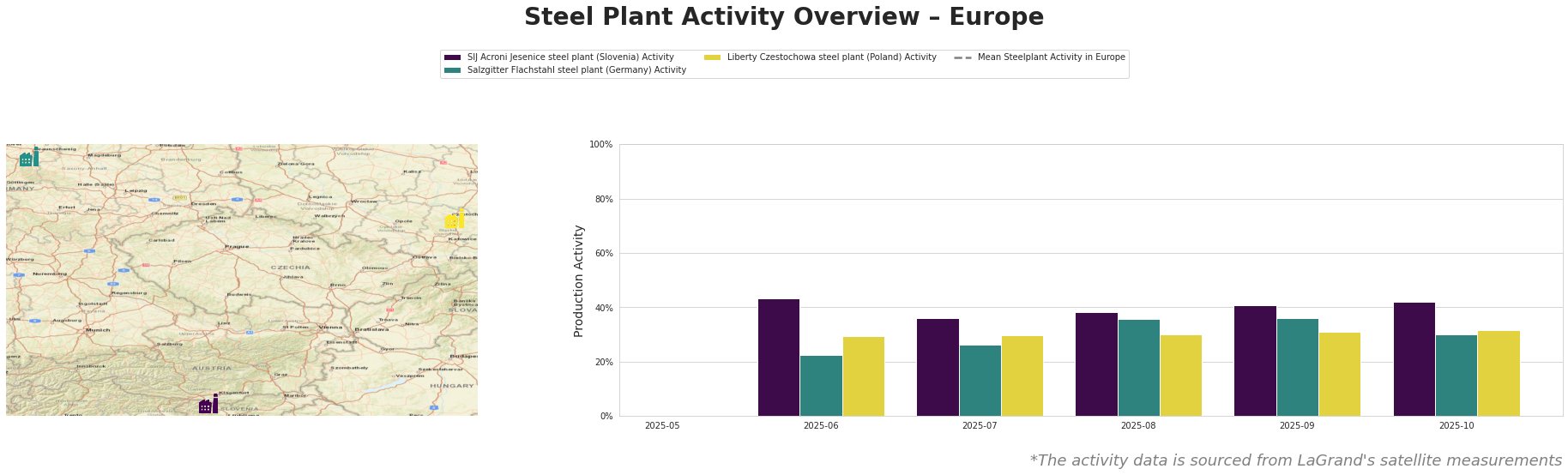

Here’s a summary of observed steel plant activity:

The “Mean Steelplant Activity in Europe” fluctuates considerably over the observed months, ranging from approximately 271 million to 407 million, without showing a clear upward or downward trend.

SIJ Acroni Jesenice steel plant: This Slovenian plant, with a capacity of 726 thousand tons of crude steel produced via EAF, shows relatively stable activity between June and October 2025, ranging from 36% to 43%. There is a decrease from June to July, and an increase from July until October, despite the mean European steelplant activity seeing a decrease. This plant focuses on flat rolled steel products. No direct link can be established between the news articles about Ukraine and the activity at SIJ Acroni Jesenice.

Salzgitter Flachstahl steel plant: This integrated German plant (5.2 million tons crude steel capacity via BOF) exhibits greater activity fluctuations, with a low of 22% in June 2025 and a peak of 36% in August and September. It produces a wide range of flat rolled products. Its activity decreased to 30% in October. No direct link can be established between the news articles about Ukraine and the activity at Salzgitter Flachstahl. However, the overall decrease in Ukrainian steel exports reported in “Ukraine’s total steel exports down 9.9 percent in Jan-Oct 2025” may indirectly influence demand patterns and production schedules.

Liberty Czestochowa steel plant: The Polish EAF-based plant (840 thousand tons crude steel capacity) demonstrates a very stable activity level, fluctuating only slightly between 30% and 32% from June to October 2025. It specializes in plate production. The stability might reflect consistent demand for its specific product segment. There is no apparent correlation with the Ukrainian export trends highlighted in the provided news articles.

Given the mixed signals from Ukrainian export data (“Ukraine’s total steel exports down 9.9 percent in Jan-Oct 2025” vs. “Ukraine exported 1.47 million tons of flat rolled steel in January-October“) and the stable-to-slightly-fluctuating activity levels at the observed European plants, the following procurement actions are recommended:

- For buyers of flat rolled steel products: Monitor Ukrainian export volumes closely, specifically for hot-rolled, cold-rolled, and coated products, as cited in “Ukraine exported 1.47 million tons of flat rolled steel in January-October“. Given that the article states flat-rolled export volumes are up 1.4%, negotiate contracts that reflect the stability of this supply, but acknowledge the revenue decrease of 7.1% year-on-year by securing favorable pricing.

- For buyers relying on semi-finished steel: Be aware of the 35.5% year-on-year reduction of exports of semi-finished products, outlined in the article “Ukraine reduced exports of semi-finished products by 35.5% y/y in January-October“. Since Poland is one of the key importers of such semi-finished products, buyers should assess inventory levels and diversify supply chains. Given the slight increase in activity observed at the Liberty Czestochowa steel plant in Poland, assess it as a potential alternative provider of plates.

- Overall: While direct links between Ukrainian export shifts and specific European plant activity are not always evident, the general downward trend in overall exports warrants careful monitoring of price volatility and supply chain resilience. Ensure contract clauses allow for flexibility in sourcing and consider hedging strategies to mitigate potential price increases.