From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Boosts Steel Exports Amidst Rising European Plant Activity

Ukraine’s increased steel exports, particularly flat and long products, are occurring against a backdrop of fluctuating steel plant activity in Europe. According to “Ukraine increased exports of flat products to 554 thousand tons in January-April” and “Ukraine increase exports of long products by 26% y/y in January-April,” Ukrainian exports are up, potentially impacting European market dynamics. Satellite data suggests a general stabilization of some European plants in the observed timeframe, however, direct correlations to Ukrainian export increases are not definitively established.

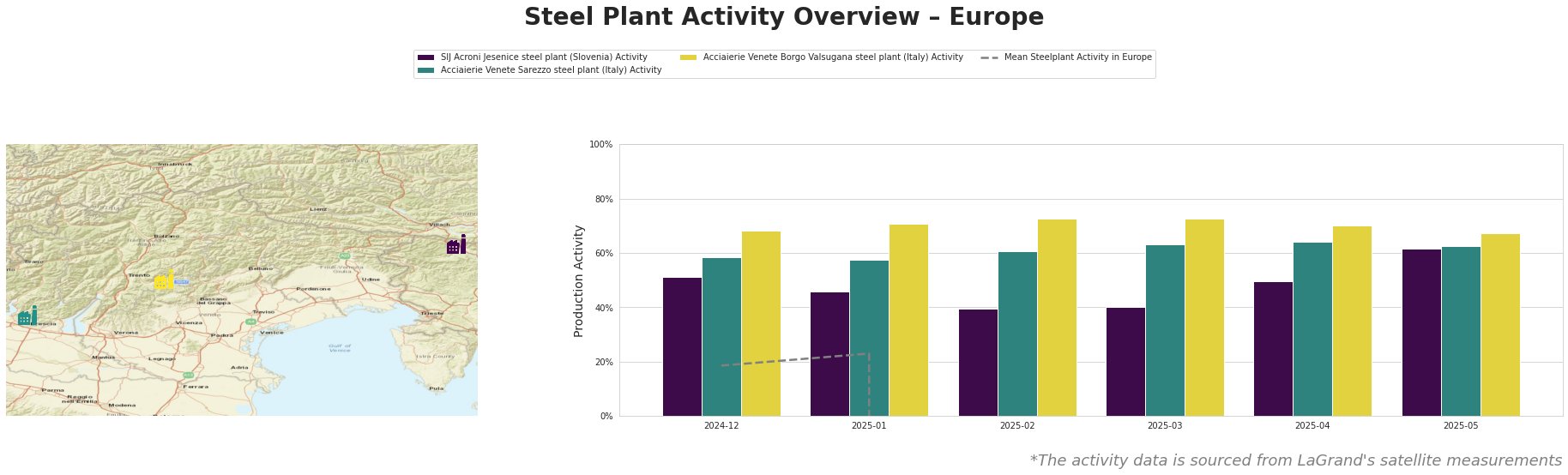

Monthly steel plant activity (percentage of all-time high):

The mean steel plant activity in Europe shows very large negative number reported in Feb-May 2025 due to some calculation or data ingest issues.

SIJ Acroni Jesenice steel plant increased it’s activity from 51% to 62% from Dec 2024 to May 2025.

Acciaierie Venete Sarezzo steel plant’s activity oscillated between 58% to 64% in Dec 2024 – May 2025 period.

Acciaierie Venete Borgo Valsugana steel plant’s activity decreased from 71% to 67% from January 2025 to May 2025.

SIJ Acroni Jesenice, a Slovenian steel plant with a 726 thousand ton EAF-based crude steel capacity specializing in flat rolled products, plates, and hot and cold rolled steel, saw a noticeable increase in activity, rising from 51% in December 2024 to 62% by May 2025. This increasing activity does not have a direct connection with any of the provided Ukraine steel exports news articles.

Acciaierie Venete Sarezzo, an Italian EAF-based steel plant with a 540 thousand ton crude steel capacity focused on bars, round bars, wire rod, and hot re-rolled billets, experienced relatively stable activity levels between December 2024 and May 2025, ranging from 58% to 64%. As this steel plant is located in Italy, there might be some competition with “Pig iron exports from Ukraine increased by 37% in 4 months” since 11.34% of the Ukrainian Pig iron is exported to Italy, but there is no direct data to infer this.

Acciaierie Venete Borgo Valsugana, another Italian EAF-based steel plant with a 600 thousand ton crude steel capacity producing similar products to Sarezzo, saw a slight decrease in activity from 71% in January 2025 to 67% in May 2025. The activity reduction does not have a direct connection with any of the provided Ukraine steel exports news articles.

The increase in Ukrainian exports, particularly to Poland as highlighted in “Ukraine increased exports of flat products to 554 thousand tons in January-April,” “Pig iron exports from Ukraine increased by 37% in 4 months”, “Ukraine increase exports of long products by 26% y/y in January-April,” and “Ukraine increased exports of ferrous scrap by 95% year-on-year” coupled with the increase of “Ukraine increased imports of long products by 81.1% y/y in January-April” indicates a dynamic shift in regional trade flows.

Given Ukraine’s increased steel exports, especially flat and long products, and its significantly increased ferrous scrap exports, European steel buyers should:

- Diversify Scrap Sources: Given that “Ukraine increased exports of ferrous scrap by 95% year-on-year” and the EU is working to restrict raw material outflow, proactively secure alternative scrap supply sources to mitigate potential price increases and supply disruptions.

- Monitor Pig Iron Pricing: With “Pig iron exports from Ukraine increased by 37% in 4 months”, particularly to Italy, buyers should closely watch pig iron price trends, as increased supply from Ukraine may create downward price pressure. Buyers in Italy should carefully negotiate contracts accordingly.

- Track Long Product Imports: As “Ukraine increased imports of long products by 81.1% y/y in January-April”, especially from Turkey and China, procurement strategists should monitor import data and pricing to leverage potential cost-saving opportunities from increased competition.

- Review flat product supply chain dynamic: With “Ukraine increased exports of flat products to 554 thousand tons in January-April”, be aware that these increased exports might create availability and pricing differences for flat products in Poland, Bulgaria, and Italy.