From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUK-US Trade Deal Sparks Optimism: EU Steel Market Reacts with Rising Production and Export Potential

Europe’s steel market sentiment is very positive, driven by the UK-US trade agreement and corresponding production adjustments. The “UK industry welcomes US-UK trade deal canceling 25% import tariff on steel and aluminum“ directly correlates with observed activity at European plants, suggesting preparations for increased export opportunities. While the news of “Will the UK’s exemption lead to a “dilution” of US steel tariffs?” introduces concerns about potential price declines in the US market, European producers are seemingly gearing up to capitalize on the tariff removal.

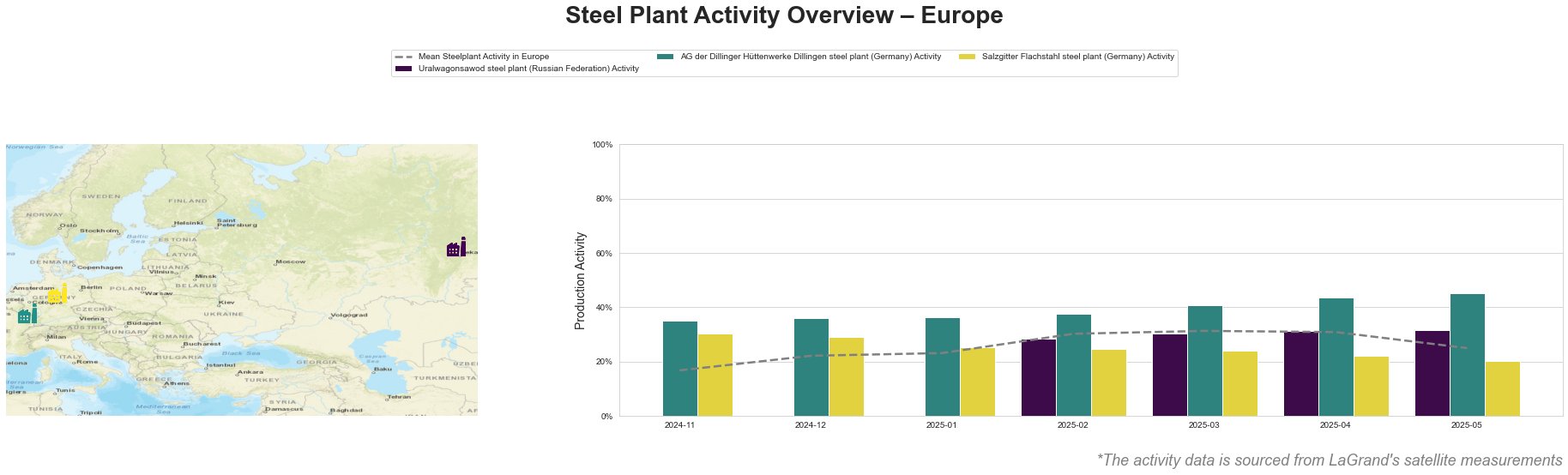

The mean steel plant activity in Europe shows a significant increase from November 2024 (17.0%) to April 2025 (31.0%), before dropping to 25% in May 2025. AG der Dillinger Hüttenwerke consistently operated above the European average, peaking at 45% in May 2025. Salzgitter Flachstahl, while starting higher than the European average, decreased to 20% in May 2025, significantly below the mean. Data is missing for Uralwagonsawod until February 2025. No direct correlation between the activity trends of Salzgitter Flachstahl and the news articles could be established based on the provided data.

Uralwagonsawod steel plant, a Russian Federation-based plant focusing on defense sector products, shows a slight increase in activity from 29% in February 2025 to 32% in May 2025. Given its focus on the defense sector, its activity may be driven by factors unrelated to the UK-US trade agreement, and therefore, no explicit connection can be established.

AG der Dillinger Hüttenwerke, a German integrated steel plant with a BOF capacity of 2760 ttpa, produces semi-finished and finished rolled products for various sectors. Its activity consistently exceeded the European average, reaching 45% in May 2025, the highest among the observed plants. The rise in activity could be attributed to increased export prospects arising from the UK-US trade deal, as highlighted in the article “UK industry welcomes US-UK trade deal canceling 25% import tariff on steel and aluminum,” though a direct causal link cannot be definitively proven with the available information.

Salzgitter Flachstahl, another German integrated steel plant with a BOF capacity of 5200 ttpa, produces hot and cold-rolled products. Its activity decreased steadily from 30% in November 2024 to 20% in May 2025, falling significantly below the European average. This decline occurs despite the positive news regarding the UK-US trade deal. No direct relationship between the news and this plant’s activity trend can be established based on the provided data.

Evaluated Market Implications:

The observed increase in activity at AG der Dillinger Hüttenwerke, coupled with the UK-US trade deal, suggests potential increased demand for European steel exports.

Recommended Procurement Actions:

- For Steel Buyers: Closely monitor price fluctuations and lead times from AG der Dillinger Hüttenwerke, anticipate potential increases due to heightened demand linked to the “UK industry welcomes US-UK trade deal canceling 25% import tariff on steel and aluminum.” Consider securing supply contracts to mitigate price volatility, particularly for products like heavy-plate and high-strength steels.

- For Market Analysts: Track the export volumes from AG der Dillinger Hüttenwerke to the UK and US to quantify the impact of the trade agreement. Assess the impact of decreased activity at Salzgitter Flachstahl by researching potential causes and effects on market supply and pricing.