From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUK Steel Safeguards Drive Positive EU Market Sentiment: Activity Up in Spain, Mixed Elsewhere

The European steel market shows a very positive sentiment, influenced by trade policy changes in the UK. Specifically, the news that “The UK has opened consultations on trade defense measures for steel,” “UK government seeks stakeholder input on post-2026 steel safeguard,” and “UK Secretary of State tightens guarantees for steel imports” suggest a proactive approach to protecting domestic steel production. However, a direct correlation between these news articles and immediate activity level changes at the ArcelorMittal Dunkerque and LME Trith-Saint-Léger steel plants could not be established using the current data.

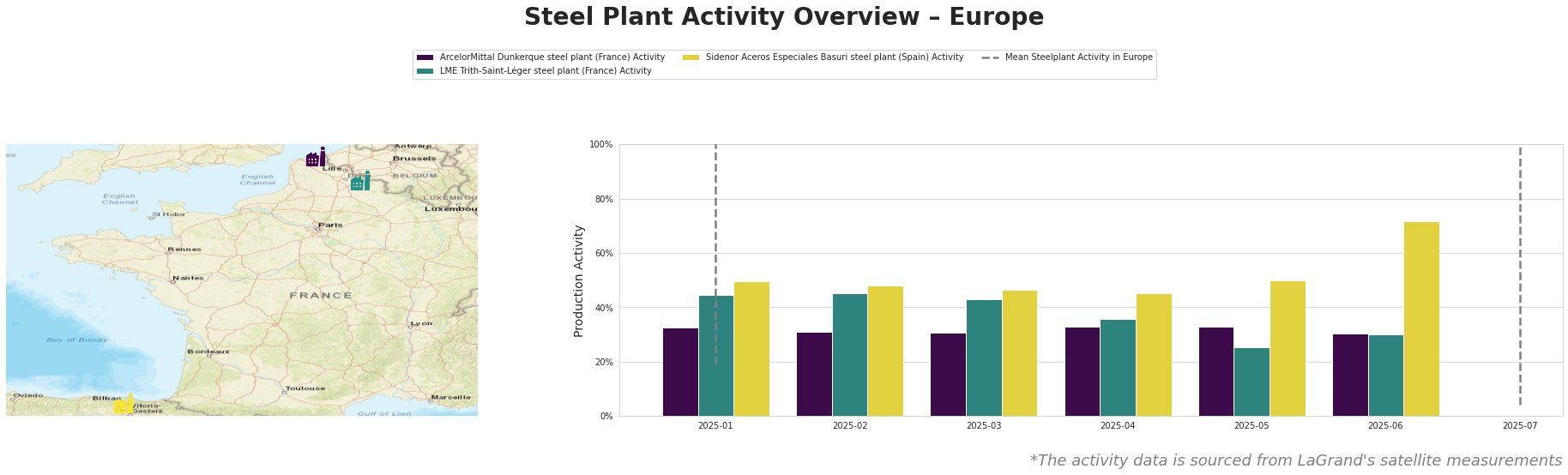

Recent activity levels across selected European steel plants present a mixed picture:

The mean European steel plant activity is showing volatile behavior with extremely high, likely erroneous values, until it drops to 3.0 in July.

ArcelorMittal Dunkerque, a large integrated BF/BOF plant producing 6.75 million tonnes of crude steel annually, had consistent activity at around 33% until a drop to 30% in June.

LME Trith-Saint-Léger, an EAF-based plant with a capacity of 850,000 tonnes, shows a more significant decline from 45% in January/February to 25% in May, recovering slightly to 30% in June. No direct connection to the named news articles could be established.

Sidenor Aceros Especiales Basuri, an EAF-based plant producing 740,000 tonnes of special steel long products, demonstrates a clear upward trend, peaking at 72% activity in June, significantly above its initial level of 50% in January and the mean European activity. No direct connection to the named news articles could be established.

The ArcelorMittal Dunkerque steel plant, an integrated facility using BF/BOF technology with a capacity of 6.75 million tonnes of crude steel and producing slabs and hot-rolled coil, maintained relatively stable activity between January and May, followed by a small drop to 30% in June. This may reflect broader market adjustments, but a direct link to the UK-specific trade news is not evident.

The LME Trith-Saint-Léger steel plant, which utilizes EAF technology to produce 850,000 tonnes of crude steel annually, mainly focusing on hot-rolled products and coil, experienced a significant activity drop to 25% in May. This reduction might be due to factors beyond the UK’s trade policies. Activity has returned slightly to 30% in June.

Sidenor Aceros Especiales Basuri, with its EAF production of 740,000 tonnes specializing in special steel bars and rolled products for automotive and other sectors, shows a marked increase in activity to 72% in June. This surge suggests strong demand for its specialized products, potentially independent of the UK’s trade actions, though increased confidence due to the UK market situation could contribute.

Based on the increased steel restrictions from the UK, there are likely supply disruptions for specific steel categories, especially metal-coated sheets and hot-rolled products where the UK relies on imports. Buyers and analysts should note the news of “UK Secretary of State tightens guarantees for steel imports“, especially given the reductions in tariff quotas. It is recommended to:

- Diversify Sourcing: Reduce reliance on UK-bound steel, particularly for categories facing stricter import controls, especially metal-coated sheets and hot-rolled products.

- Monitor Import Data: Closely track UK import statistics to identify categories experiencing the most significant supply constraints.

- Consider Sidenor: Explore Sidenor’s special steel products as a possible alternative, given its high activity levels suggesting strong production capacity.

- Assess UK Market Impact: Analyze how the UK’s post-2026 trade policies might affect your business depending on which inputs are needed, following the “UK government seeks stakeholder input on post-2026 steel safeguard” news.

- Be aware of volatility: The mean steel plant activity data shows high volatility, and should be used with caution.