From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUK Steel Safeguards Drive Optimism Despite Fluctuating Ukrainian Plant Activity

The Ukrainian steel market demonstrates a positive sentiment amid global trade shifts, despite some domestic production fluctuations. UK’s tightening of steel import safeguards is a key factor, as highlighted in articles such as “UK steel safeguards to be further tightened“, “UK to impose stricter country-specific caps on three steel product categories“, and “Britain strengthens steel shield: new restrictions to protect national industry“. While these UK measures aim to protect its domestic market, no direct correlation to the observed activity at Ukrainian steel plants could be explicitly established in this analysis.

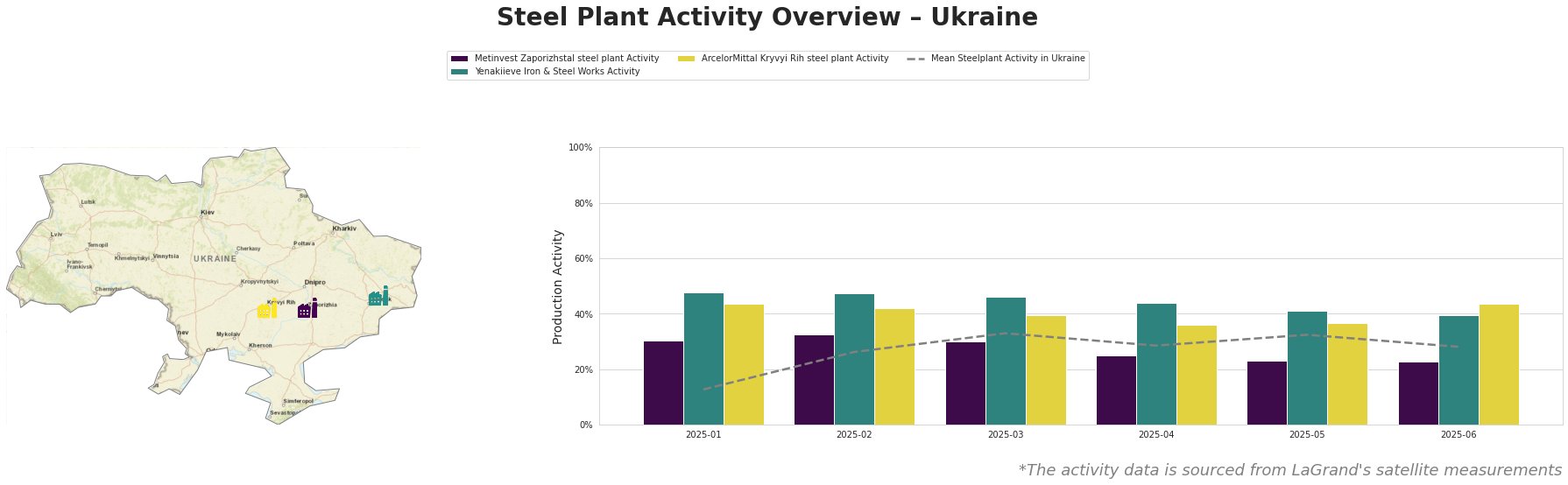

Ukrainian Steel Plant Activity (2025)

The average steel plant activity in Ukraine showed an overall increasing trend from January (13.0%) to March (33.0%), followed by a decrease to 28.0% in June. Metinvest Zaporizhstal saw a steady decline in activity from 30.0% in January to 23.0% in both May and June. Yenakiieve Iron & Steel Works exhibited relatively high activity compared to other plants, starting at 48.0% in January and gradually decreasing to 39.0% in June. ArcelorMittal Kryvyi Rih displayed a fluctuating pattern, starting at 44.0% in January, decreasing to 36.0% in April, and then rising to 44.0% in June. No direct connection could be established between these fluctuating plant activities and the news articles regarding UK steel safeguards.

Plant-Specific Analysis

Metinvest Zaporizhstal, an integrated steel plant with a crude steel capacity of 4.1 million tonnes per annum (TTPA) primarily using the Open Hearth Furnace (OHF) process, experienced a consistent decline in activity levels throughout the observed period. Activity dropped from 30.0% in January to 23.0% in June. While this decline may be influenced by various factors, including maintenance schedules or raw material availability, no direct link to the UK’s import safeguard measures, as reported in “UK Secretary of State tightens guarantees for steel imports“, could be established.

Yenakiieve Iron & Steel Works, an integrated steel plant with a 3.3 million TTPA crude steel capacity utilizing Basic Oxygen Furnace (BOF), showed relatively high activity levels compared to the average across Ukraine. However, its activity also decreased steadily from 48.0% in January to 39.0% in June. Although the UK’s protectionist measures detailed in “Precautions regarding the British steel industry will be further tightened.” might indirectly impact global steel trade flows, there is no explicit evidence to connect it directly to the production adjustments at Yenakiieve.

ArcelorMittal Kryvyi Rih, with a significant crude steel capacity of 8 million TTPA using both BOF and OHF processes, demonstrated a more volatile activity pattern. After an initial decrease from 44.0% in January to 36.0% in April, activity rebounded to 44.0% in June. This suggests operational adjustments within the plant, potentially related to market demand or maintenance. Despite the UK government’s intent, described in “The UK will impose stricter restrictions on three categories of steel products, depending on the country.“, to prevent steel redirection and protect its industry, the satellite data provides no explicit indication that these policies are directly affecting ArcelorMittal Kryvyi Rih’s activity.

Evaluated Market Implications

While the UK’s tightening steel import restrictions, as reported across all articles, signals a potentially reduced outlet for steel exports from some countries, no direct correlation can be drawn at this time to disruptions or fluctuations in Ukrainian steel plant activity as seen in the satellite observations.

Recommended Procurement Actions:

Given the overall positive market sentiment, potentially driven by global trends unrelated to specific activity changes at Ukrainian plants:

- Monitor Global Trade Flows: Procurement professionals should closely monitor global steel trade flows and price fluctuations, particularly those stemming from countries affected by the new UK import restrictions. While no direct impact is observed currently, diverted supply from other nations could indirectly influence pricing in Ukraine.

- Maintain Flexible Sourcing Strategies: Diversify sourcing options and build relationships with multiple suppliers to mitigate risks associated with potential indirect supply chain disruptions stemming from changes in UK import policies. Ensure optionality of supply in response to shifting world trade.

These recommendations are based on the overall Very Positive market sentiment and the potential, though unconfirmed, for global trade adjustments resulting from UK policy changes to impact Ukrainian steel market dynamics. Continuous monitoring and adaptation will be crucial for informed procurement decisions.