From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUK Steel Import Quota Tightening Sparks European Rebar Production Surge; SN Maia Faces Headwinds

Europe’s steel market sentiment remains very positive, yet recent UK import restrictions are poised to reshape trade dynamics. The “UK business secretary imposes 15pc quota on HDG“, “The UK tightens quotas on steel imports from Vietnam, South Korea, and Algeria“, “UK steel safeguards to be further tightened“, and “UK to impose stricter country-specific caps on three steel product categories” articles signal a strategic shift to protect domestic producers. Observed satellite data reveals fluctuations in European steel plant activity, with potential implications for supply chains, though direct relationships between UK import policies and specific plant activity levels cannot always be directly established.

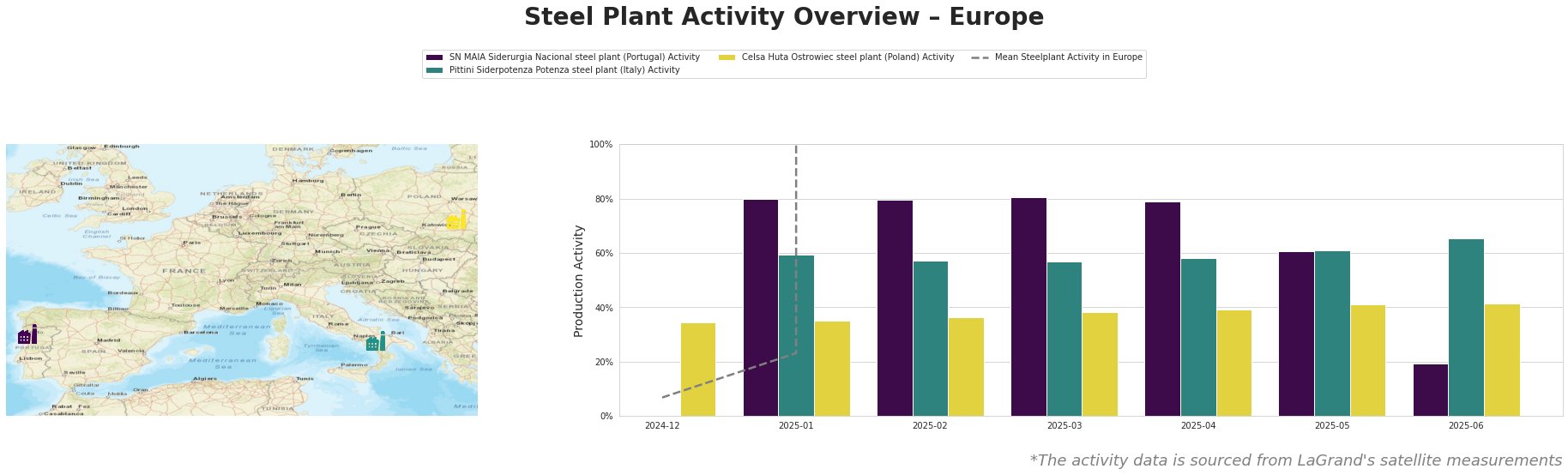

Overall, mean steel plant activity in Europe has been highly volatile, rising sharply from December 2024 to May 2025, followed by a sharp decrease in June 2025. However, the large absolute values make it hard to interpret.

SN MAIA Siderurgia Nacional, a Portuguese EAF-based rebar producer with a 600ktpa capacity, initially showed high activity levels (80-81%) from January to April 2025. However, activity dropped significantly to 61% in May and plummeted to 19% in June. This recent downturn does not directly correlate with any of the UK-focused news articles, suggesting other factors are at play. As it is a rebar producer, it might be affected indirectly, though.

Pittini Siderpotenza, an Italian EAF-based rebar producer with 700ktpa capacity, exhibited relatively stable activity between 57% and 61% from January to May 2025, followed by a rise to 65% in June. This increase could be driven by anticipation of increased demand within Europe due to UK import restrictions; however, a direct causal link cannot be confirmed based on the provided news.

Celsa Huta Ostrowiec, a Polish EAF-based bar and rebar producer with 900ktpa capacity, demonstrates a consistently increasing activity trend from December 2024 (34%) to June 2025 (42%). This upward trajectory suggests robust domestic or regional demand, but no direct connection to UK import policy changes can be established from the given information.

Evaluated Market Implications:

The UK’s stricter import quotas, specifically the caps on rebar imports outlined in “UK to impose stricter country-specific caps on three steel product categories”, are likely to redirect steel flows within Europe. While SN Maia’s recent activity drop doesn’t directly correlate, the tightening UK market could indirectly intensify competition within the EU.

Recommended Procurement Actions:

-

Steel Buyers Focused on Rebar: Given the UK’s tightening import quotas and increasing activity at Pittini Siderpotenza and Celsa Huta Ostrowiec, European steel buyers should:

- Strengthen Relationships: Prioritize and secure contracts with producers like Pittini and Celsa, anticipating potential increased demand within the EU.

- Diversify Sourcing: Explore alternative rebar suppliers within the EU to mitigate potential supply disruptions caused by redirected trade flows. The increased competition due to the UK imposing stricter import limits will most likely decrease the price of rebar.

- Monitor SN Maia: Closely monitor SN Maia’s production levels and financial health. The sharp decline in activity warrants further investigation into potential operational or market-related challenges.

- Steel Market Analysts: Focus on tracking the impact of redirected steel flows on regional price dynamics within the EU, especially for rebar. Analyzing trade data in Q3 2025 will be crucial to validate the impact of the UK’s policy changes.