From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUK Steel Import Caps & Energy Costs Drive Uncertain European Production Outlook

Europe’s steel market faces evolving dynamics due to potential import restrictions in the UK and energy cost pressures, as highlighted in the news articles “UK may impose country-specific caps on three steel product categories,” “UK Steel: TRA’s quota cap recommendation falls short,” “British industry calls for lower electricity prices,” “UK Steel, 7Steel call for reduced electricity prices,” and “UK industry calls for lower electricity prices to sustain investments and net zero transition efforts“. These issues impact production levels at key plants, though direct links to recent activity data are not always apparent.

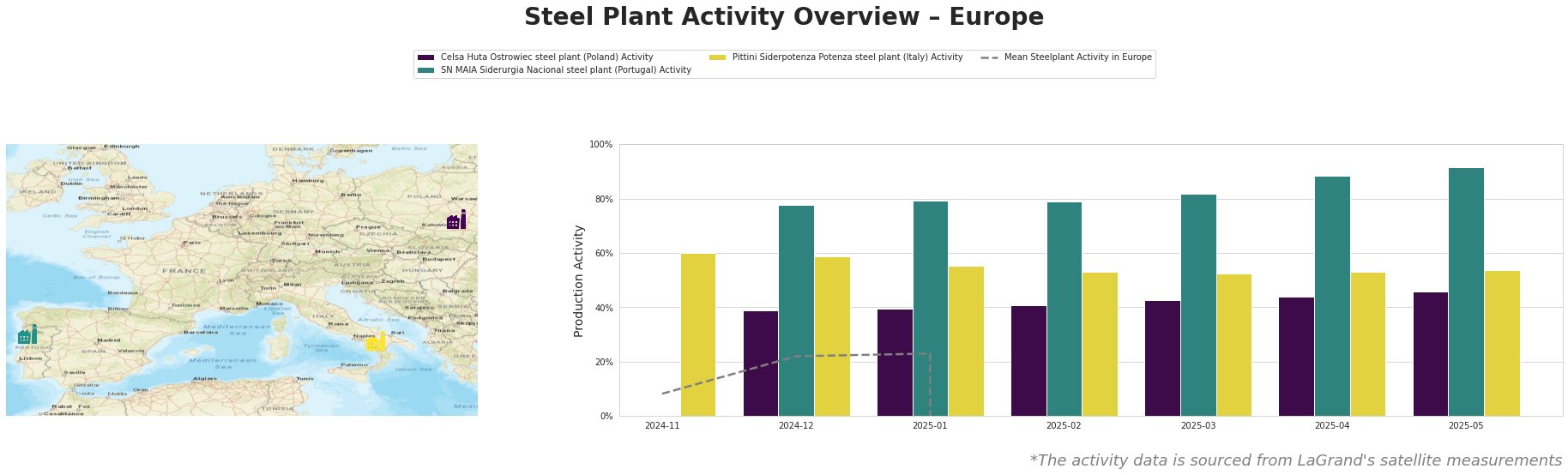

Measured Activity Overview

The provided mean steelplant activity data contains invalid negative values starting in February 2025, rendering it unusable for analysis of overall European activity. Celsa Huta Ostrowiec’s activity in Poland shows a steady increase from 39.0% in December 2024 to 46.0% in May 2025. SN MAIA Siderurgia Nacional in Portugal exhibited high activity levels, rising from 78.0% to 92.0% over the same period. Pittini Siderpotenza in Italy remained relatively stable, fluctuating between 53.0% and 60.0%.

Celsa Huta Ostrowiec, a Polish steel plant with a 900 ttpa EAF-based capacity focused on producing finished rolled products like rebar for the building and infrastructure sectors, shows steadily increased activity. There is no immediate connection apparent in the news that might be driving this activity.

SN MAIA Siderurgia Nacional, a Portuguese steel plant with a 600 ttpa EAF-based capacity producing semi-finished and finished rolled products like rebar, exhibited consistently high activity. Similar to Celsa, no explicit connection could be found linking it’s rise to news article content.

Pittini Siderpotenza, an Italian steel plant with a 700 ttpa EAF-based capacity, concentrates on semi-finished and finished rolled products such as rebar for building and infrastructure. Its stable activity levels do not appear to correlate directly with any specific news events.

Evaluated Market Implications

The UK’s potential imposition of country-specific import caps, as discussed in “UK may impose country-specific caps on three steel product categories,” may lead to supply disruptions, particularly for metallic coated sheet, non-alloy and other alloy quarto plates, and rebar. Given the concerns raised by UK Steel in “UK Steel: TRA’s quota cap recommendation falls short” about the inadequacy of these measures and the potential for increased US tariffs to divert steel imports into the UK, steel buyers should anticipate potential price volatility and longer lead times for these specific product categories.

Recommended procurement action: Diversify supply sources outside of countries potentially affected by the UK import caps, especially for rebar. Given the focus of Celsa Huta Ostrowiec, SN MAIA Siderurgia Nacional and Pittini Siderpotenza plants on rebar, monitor the product pricing for rebar coming from the EU in general.