From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUK Clean Energy Investments and Reduced Electricity Costs Fuel Optimistic European Steel Market Outlook

Europe’s steel market sentiment is very positive, influenced by the UK’s strategic investments and policy changes. The announcements in “The UK will reduce electricity costs for industry,” “UK set to boost clean energy investments by £30bn/yr,” and “The UK will increase investment in clean energy to over £30 billion per year” signal reduced operational costs for energy-intensive industries. However, a direct correlation between these announcements and immediate changes in plant activity levels observed via satellite cannot be established.

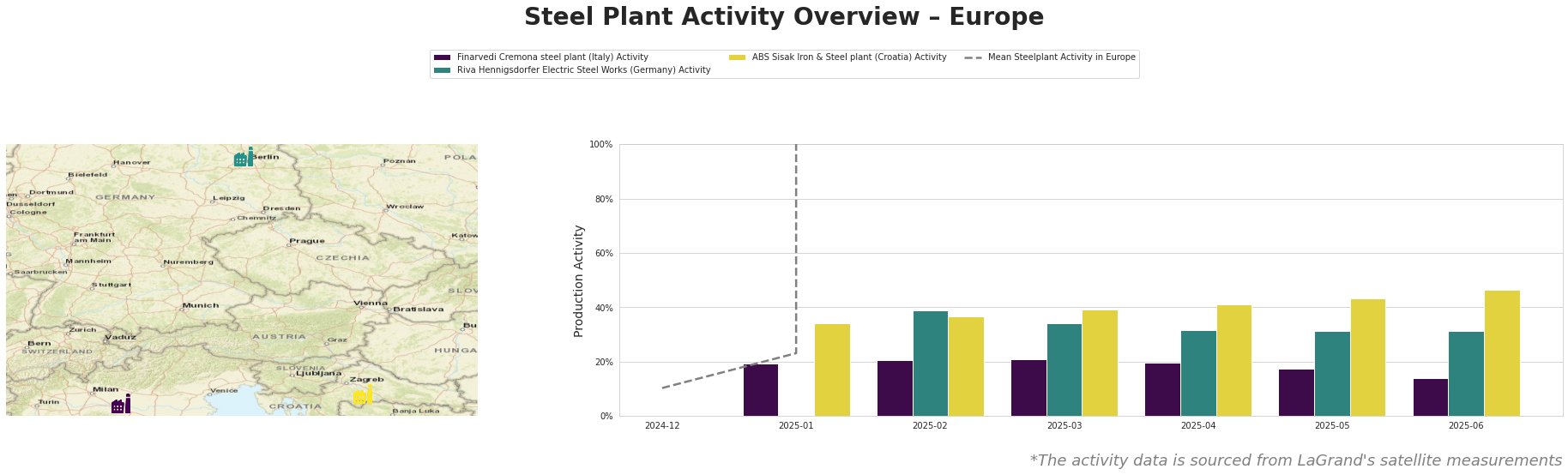

The mean steel plant activity in Europe exhibited substantial volatility from January to June 2025, with significant peaks in February, March, and May.

Finarvedi Cremona, an Italian steel plant with a 3,850 ttpa crude steel capacity utilizing exclusively EAF technology, showed a steady decrease in activity from January (19%) to June (14%). This decline does not appear to have a direct connection to the UK news events. The plant focuses on hot rolled coil, galvanized, and pickled products for the automotive sector.

Riva Hennigsdorfer Electric Steel Works in Germany, a 1,000 ttpa EAF-based plant producing steel billets and rebar, showed an increase in activity from February (39%) to March (34%) followed by a consistent decrease until June (31%). The UK’s investment in clean energy and electricity cost reductions, as highlighted in “The UK will reduce electricity costs for industry,” are not directly correlated with these observed changes. This plant primarily serves the automotive industry.

ABS Sisak in Croatia, with a 350 ttpa capacity and EAF technology, showed a continuous increase in activity from January (34%) to June (47%). While the UK’s broader clean energy initiatives are encouraging for the European steel industry, there is no specific evidence to link them directly to the increased activity at the ABS Sisak plant. The plant produces billets for the automotive, energy, and transport sectors.

Based on the news articles and observed trends, procurement professionals should consider the following:

- Monitor UK steel imports: The UK’s reduced electricity costs, detailed in “The UK will reduce electricity costs for industry,” starting in 2027 could potentially increase the competitiveness of UK steel production. Procurement analysts and buyers should analyze import volumes.

- Assess long-term contracts: The news from “UK set to boost clean energy investments by £30bn/yr” and “The UK will increase investment in clean energy to over £30 billion per year” suggest a long-term supportive environment for steel production in Europe. This may influence the negotiation of long-term contracts, favoring suppliers who can demonstrate sustainable production practices aligned with clean energy initiatives.