From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUK CBAM in 2027: What it Means for European Steel Supply and Procurement

The European steel market faces potential shifts due to the UK’s upcoming Carbon Border Adjustment Mechanism (CBAM). The UK is set to implement a CBAM in 2027, according to several news articles titled “UK to implement a CBAM in 2027 to prevent carbon leakage,” with slightly varying publication dates. This mechanism, designed to prevent carbon leakage, may indirectly impact steel production and trade flows within Europe. While these policy shifts are significant, no immediate correlation could be established between the CBAM announcements and the satellite-observed plant activity levels.

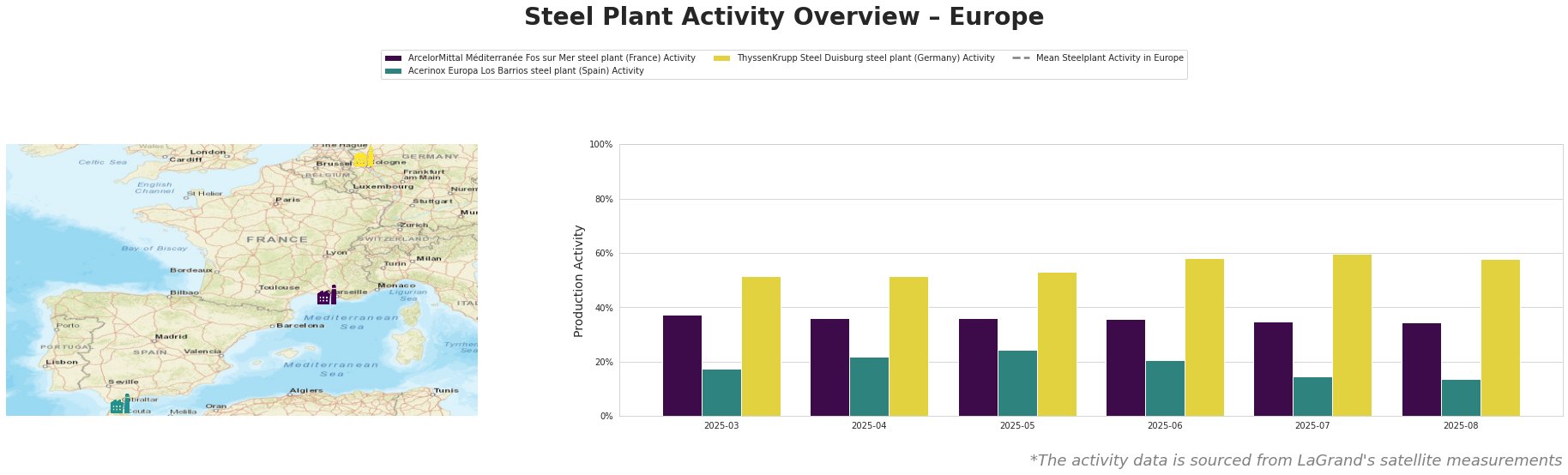

Observed monthly activity levels show a gradual decline at ArcelorMittal Méditerranée Fos sur Mer from 37% in March to 34% in August. Acerinox Europa Los Barrios saw more fluctuations, with a peak of 24% in May and a drop to 14% in August. ThyssenKrupp Steel Duisburg shows a generally increasing activity from 52% in March to 60% in July, followed by a slight decrease to 58% in August. No direct connection could be established between these fluctuations and the news articles regarding the UK CBAM. The mean steel plant activity is not analyzed as the provided values are negative and thus considered corrupt.

ArcelorMittal Méditerranée Fos sur Mer, located in France, is an integrated steel plant with a crude steel capacity of 4 million tonnes per annum (ttpa), relying on basic oxygen furnace (BOF) technology integrated with blast furnaces (BF). The observed activity decline of 3% over the monitored period (from 37% in March to 34% in August) does not have a clearly identifiable connection to the announced UK CBAM implementation. The plant focuses on semi-finished and finished rolled products, targeting sectors like automotive and construction.

Acerinox Europa Los Barrios in Spain operates with electric arc furnace (EAF) technology, producing 1.2 million ttpa of crude steel. The plant focuses on stainless steel production. The fluctuation and ultimate decline in activity from 24% in May to 14% in August do not show any explicit correlation with the UK CBAM news.

ThyssenKrupp Steel Duisburg, a major integrated steel producer in Germany, utilizes BOF technology and has a crude steel capacity of 13 million ttpa. Activity at the plant peaked at 60% in July, before falling back to 58% in August. Again, no clear link to the UK CBAM could be identified.

The UK CBAM, as outlined in the news articles titled “UK to implement a CBAM in 2027 to prevent carbon leakage,” may incentivize European steel producers to reduce their carbon footprint to remain competitive in the UK market. Given this, potential supply disruptions may arise from facilities that struggle to meet new carbon intensity standards.

Procurement Action Recommendations:

- For steel buyers focusing on the UK market: Prepare for potential price adjustments reflecting carbon intensity. Prioritize suppliers with transparent and independently verified carbon emissions data. Begin auditing your supply chains for embedded carbon in steel products.

- For market analysts: Closely monitor policy developments related to carbon pricing and border adjustment mechanisms in both the UK and EU. Analyze trade flows and production shifts in response to these regulations. While no direct link can be established yet, focus on plants with integrated (BF/BOF) processes that may face the biggest challenges in decarbonization, making them more vulnerable to CBAM implications.