From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineTurkey’s Steel Imports Surge Amidst Fluctuating Activity in Chinese Steel Plants, Signaling Procurement Opportunities

Turkey’s steel market is experiencing significant shifts in import and export dynamics. Recent news articles, namely “Turkey’s HRC imports up ten percent in Jan-Sept 2025” and “Turkey’s billet imports up 50.8 percent in Jan-Sept 2025“, reveal substantial increases in HRC and billet imports, primarily driven by suppliers like China, Russia and Malaysia. While these reports focus on Turkey, observed activity in select Chinese steel plants shows fluctuating activity levels which may relate to supply dynamics. There is no direct, explicit link in the news to these plants.

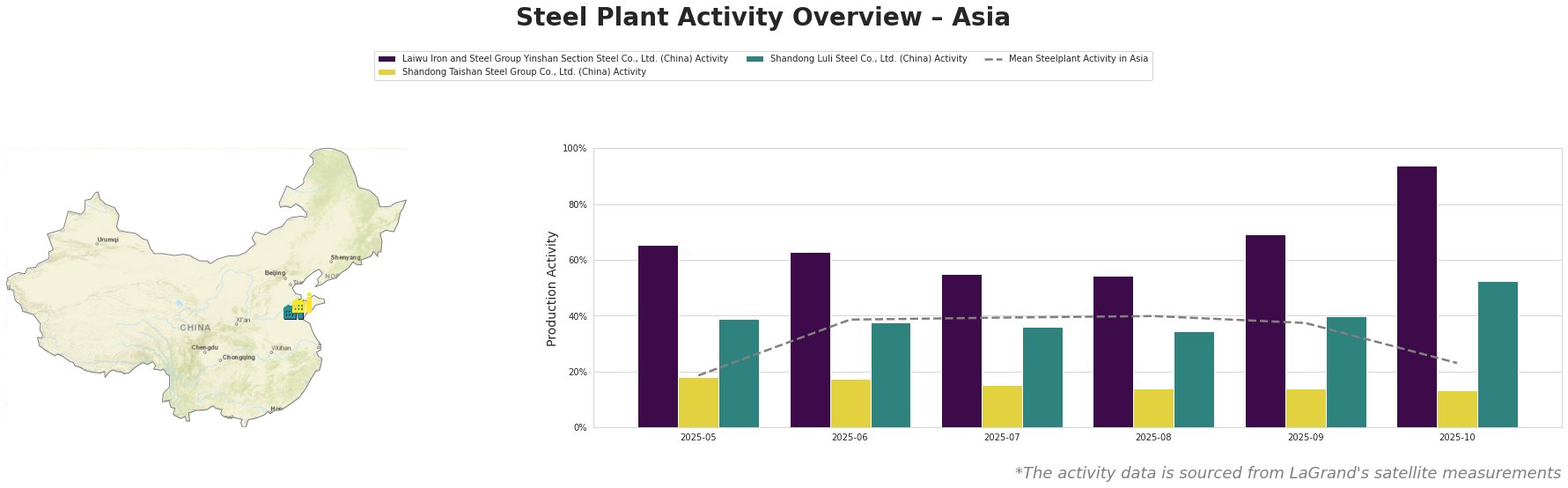

The mean steel plant activity in Asia fluctuated, peaking in August 2025 at 40.0% and then dropping significantly to 23.0% in October 2025. Laiwu Iron and Steel Group Yinshan Section Steel Co., Ltd. shows consistently higher activity than the mean, reaching a peak of 94.0% in October 2025. Shandong Taishan Steel Group Co., Ltd. shows consistently lower activity, remaining below 20% throughout the observed period. Shandong Luli Steel Co., Ltd.’s activity is generally around the mean but shows a notable rise to 53.0% in October 2025.

Laiwu Iron and Steel Group Yinshan Section Steel Co., Ltd., an integrated (BF) steel plant with a crude steel capacity of 5.4 million tons, primarily produces semi-finished and finished rolled products like section steel and billets. Its activity has been consistently above the Asian mean, peaking at 94.0% in October 2025, indicating strong production. There is no direct connection established through the provided news articles to explain this surge.

Shandong Taishan Steel Group Co., Ltd., another integrated (BF) steel plant with a crude steel capacity of 5 million tons, produces finished rolled products including hot rolled coil and cold rolled coil. Its activity has remained consistently low, around 14-18%, throughout the observed period, significantly below the Asian mean. The observed low activity levels cannot be directly linked to any specific event or development described in the provided news articles.

Shandong Luli Steel Co., Ltd., an integrated (BF) steel plant producing hot rolled ribbed steel bars and billets, has a crude steel capacity of 1.4 million tons. Its activity increased to 53.0% in October 2025. There is no direct connection established through the provided news articles to explain this surge.

The “Turkey exported over 16 million tons of steel in January-October” article highlights Turkey’s increasing exports, particularly in flat-rolled products and hot-rolled sheets. Given the increased HRC imports reported in “Turkey’s HRC imports up ten percent in Jan-Sept 2025“, steel buyers should monitor potential price fluctuations influenced by supply and demand dynamics.

The rise in Turkish billet imports, as described in “Turkey’s billet imports up 50.8 percent in Jan-Sept 2025“, coupled with fluctuating activity in Chinese plants, requires procurement professionals to closely monitor supply chain vulnerabilities.

* Recommended Procurement Action: Given Turkey’s increased reliance on billet and HRC imports, as highlighted in the news articles, buyers should diversify their supplier base to mitigate risks associated with relying heavily on specific countries like China, Russia and Malaysia. Seek alternative sources in regions with more stable steel production.

* Recommended Procurement Action: Given the increased HRC imports reported in “Turkey’s HRC imports up ten percent in Jan-Sept 2025“, steel buyers should monitor potential price fluctuations influenced by supply and demand dynamics, potentially using derivative instruments to hedge price risks, or consider shorter-term contracts to adapt to market variability.