From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineTrump’s UN Attacks and European Steel: Activity Declines Signal Market Instability

Europe’s steel market faces increasing uncertainty as political tensions, specifically Donald Trump’s criticisms at the UN General Assembly, coincide with observed decreases in steel plant activity. The geopolitical climate, as reflected in articles such as “Trump attackiert UNO und warnt Europa vor Ruin,” “UN-Generaldebatte im Liveticker: ++ Trump kritisiert europäische Migrationspolitik – danach setzt Baerbock eine Spitze ++“, and “UN-Generaldebatte: ++ Trump nennt Russland einen „Papiertiger“ – Selenskyj ist überrascht von „großer Kehrtwende“ ++ Liveticker“, introduces instability that might impact future trade relationships and energy policies, especially for Europe. While there is a potentially disruptive political and economical climate in place, no explicit relationship between the political tensions reported in these articles and observed steel plant activity levels can be established.

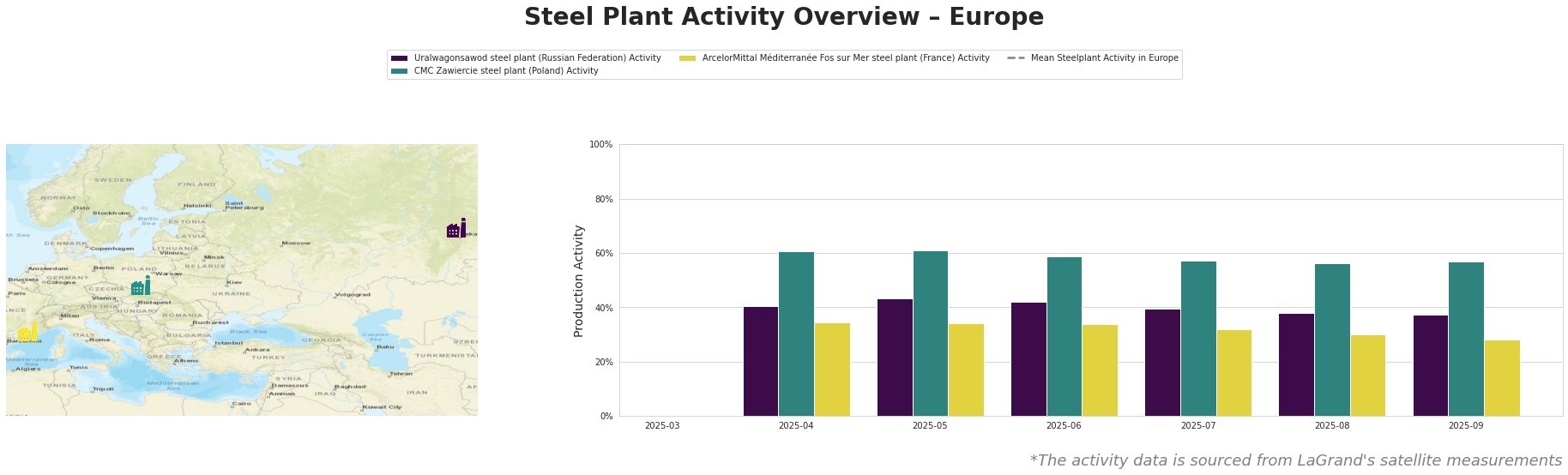

Observed plant activity shows a fluctuating mean activity level across all European steel plants. Individually, Uralwagonsawod steel plant shows a consistent decline from 40% in April to 37% in September. CMC Zawiercie steel plant decreased from 61% in April/May to 56% in August, followed by a slight increase to 57% in September. ArcelorMittal Méditerranée Fos sur Mer steel plant exhibits the most pronounced continuous decrease, from 35% in April to 28% in September. No direct connection between these activity trends and the provided news articles can be established.

Uralwagonsawod, a steel plant in the Rostov region of Russia focused on defense sector products, has seen a gradual decrease in activity from 40% in April to 37% in September. Given the plant’s focus on the defense sector, this decline could indicate adjustments related to the ongoing geopolitical climate. However, no explicit causal link to articles like “UN-Generaldebatte: ++ Russland ist weder „Papiertiger“ noch „Papierbär“, spottet der Kreml über Trump ++ Liveticker,” which discusses Trump’s evolving stance on Russia, can be established based on the provided data.

CMC Zawiercie, a Polish EAF steel plant with a 1.7 million tonne crude steel capacity catering to automotive, construction, and energy sectors, saw its activity decrease from 61% in April to 56% in August, before slightly recovering to 57% in September. As a ResponsibleSteel certified producer relying on electric arc furnaces, CMC Zawiercie’s operations are sensitive to energy market fluctuations. There is no clear correlation between the plant’s activity and the geopolitical discussions presented in the provided news articles.

ArcelorMittal Méditerranée Fos sur Mer, a French integrated steel plant with a 4 million tonne crude steel capacity mainly producing slabs and hot rolled coil, has shown a continuous decline in activity from 35% in April to 28% in September. Given Trump’s criticism of European green energy policies in “Trump attackiert UNO und warnt Europa vor Ruin,” the decline at ArcelorMittal Méditerranée, which uses a BF-BOF process, potentially reflects a cautious approach to production in light of evolving environmental regulations and trade uncertainties. However, a direct link cannot be definitively established. Note that the plant will shutdown its BOF by 2030.

Given the observed decline in activity at ArcelorMittal Méditerranée Fos sur Mer, steel buyers should consider diversifying their sources of hot rolled coil and slabs. Specifically, explore supply options outside of Europe to mitigate potential disruptions caused by policy shifts or further activity reductions at the French plant. Furthermore, given the political uncertainty, buyers should closely monitor energy prices in Poland and the effect on CMC Zawiercie.