From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineThyssenkrupp Modernization Drives Optimistic European Steel Outlook Despite Russian Overhaul

Europe’s steel market sentiment remains very positive, buoyed by modernization efforts despite a significant shutdown in Russia. The activity increase is partly explained by Thyssenkrupp’s recent advancements as reported in “Thyssenkrupp launches a new continuous casting machine“, “Thyssenkrupp starts trial production at new continuous slab caster“, and “The first slabs were poured in Duisburg: a new era of Thyssenkrupp steel production has begun“. At the same time, as reported in “Russia’s Severstal shuts down BF No. 4 for $240 million overhaul“, a major Russian steelmaker, Severstal, has commenced a substantial overhaul that will take a major BF offline for an extended period. The news articles relating to Thyssenkrupp directly relate to the satellite observed increase of activity at European Steel plants.

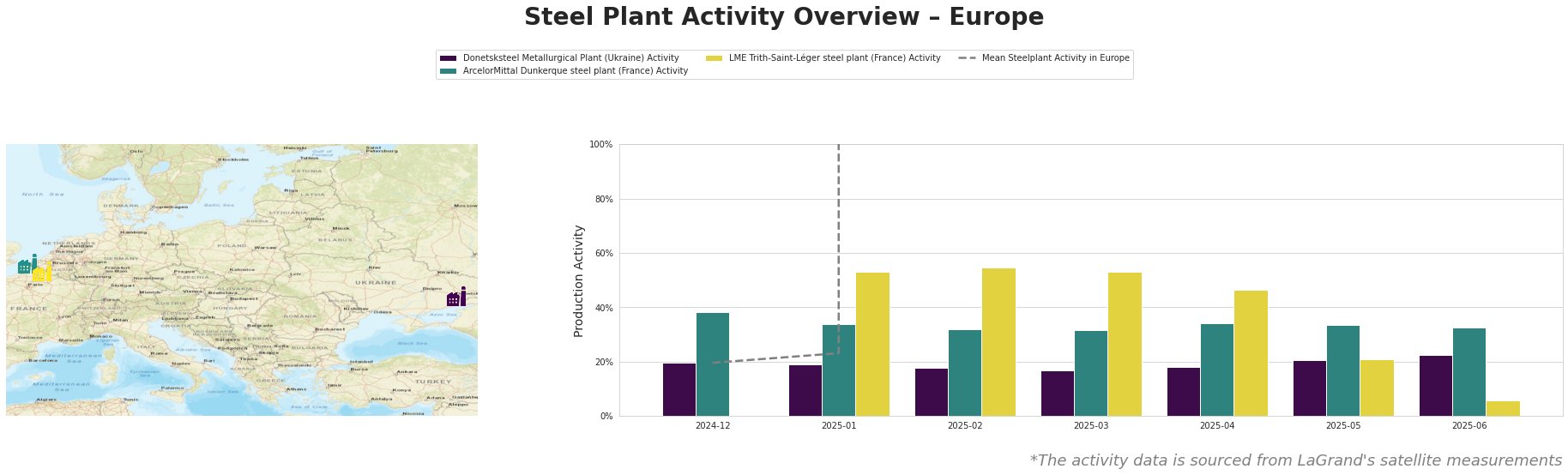

The mean steel plant activity in Europe, according to satellite data, has experienced considerable volatility, peaking in May 2025. Donetsksteel Metallurgical Plant shows a steady increase in activity, reaching 23% in June 2025, up from 20% in December 2024. Activity at ArcelorMittal Dunkerque remains relatively stable around 32-38%. LME Trith-Saint-Léger saw a sharp increase in January and February 2025, followed by a decline to 6% in June 2025. The mean steelplant activity level in Europe is significantly influenced by outliers (especially in March, April, May and June 2025), making comparisons less meaningful. The sharp drop in June 2025 for LME Trith-Saint-Léger does not appear to be directly linked to the provided news articles.

Donetsksteel Metallurgical Plant, an integrated BF-based plant in the Donetsk region of Ukraine with a 1.5 million tonne pig iron capacity, has shown a gradual increase in activity, rising from 20% in December 2024 to 23% in June 2025. While this indicates increased production, no direct connection to the provided news articles can be established. The plant primarily produces pig iron, and the observed activity may reflect adjustments in production levels independent of the modernization efforts highlighted elsewhere.

ArcelorMittal Dunkerque, a major integrated steel plant in France with a 6.75 million tonne crude steel capacity utilizing BF-BOF technology, exhibits a stable activity level, fluctuating between 32% and 38%. This stability suggests consistent operation, with no major disruptions or surges in production observed in the satellite data. While ArcelorMittal is investing in BOF upgrades, there is no direct evidence in the provided news articles or satellite data that these upgrades are related to activity level changes within the observed period. The plant focuses on semi-finished and finished rolled products.

LME Trith-Saint-Léger, an electric arc furnace (EAF) based steel plant in France with a crude steel capacity of 850,000 tonnes, demonstrates a volatile activity pattern. From no recorded value initially, the plant’s activity surged to 55% by February 2025, then sharply declined to 6% in June 2025. This sharp decline is not explained by the provided news articles. The plant specializes in semi-finished and finished rolled products.

Severstal’s blast furnace No. 4 overhaul, as stated in “Russia’s Severstal shuts down BF No. 4 for $240 million overhaul” will remove 2.4 million mt of annual pig iron capacity from the market until Q3 2025. While the shutdown is in Russia, it will likely reduce supply to Europe and put upward pressure on prices. This disruption coincides with increased activity at Thyssenkrupp, as reported in “Thyssenkrupp launches a new continuous casting machine”, “Thyssenkrupp starts trial production at new continuous slab caster”, and “The first slabs were poured in Duisburg: a new era of Thyssenkrupp steel production has begun”, which may partially offset the supply reduction.

Evaluated Market Implications and Procurement Actions:

Given the upcoming outage at Severstal and the increased production efficiency at Thyssenkrupp, steel buyers should:

- Secure Contracts: Prioritize securing medium-term contracts with European steel producers, such as Thyssenkrupp, to mitigate potential price increases due to the Severstal shutdown. The increased efficiency at Thyssenkrupp suggests they may be able to offer competitive rates.

- Monitor EAF Plant Activity: Closely monitor the activity levels of EAF plants like LME Trith-Saint-Léger. The recent drop in activity at LME Trith-Saint-Léger warrants further investigation to understand potential supply disruptions. Diversifying suppliers could mitigate risks.

- Verify certifications: Prioritize and verify certifications to fulfill requirements for sustainable and responsibly produced steel, such as “ResponsibleSteelCertification”.