The Challenge of Analyst Forecasts: A Closer Look at ArcelorMittal's Quarterly EBIT

When it comes to corporate financial analysis, even the most trusted names in reporting, like Bloomberg, can face significant challenges in providing accurate forecasts. This is particularly true for industries like steel production, where market volatility, external influences, and unforeseen circumstances often lead to discrepancies between expectations and reality.

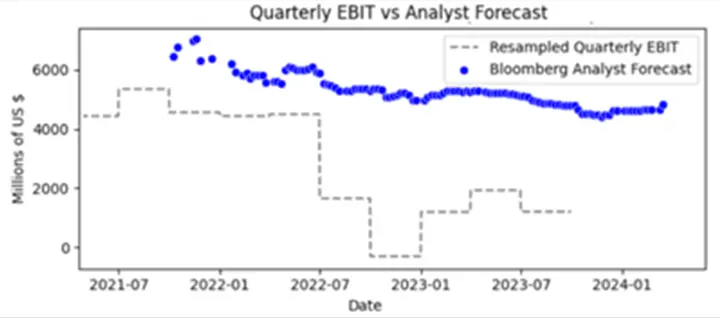

In our latest analysis, we examined the quarterly EBIT (Earnings Before Interest and Taxes) of ArcelorMittal, one of the largest steel producers in the world. Specifically, we compared Bloomberg’s analyst forecasts with the actual reported EBIT figures for each quarter.

The results, as shown in the accompanying chart, reveal a striking trend. The dotted gray line represents ArcelorMittals quarterly EBIT, while the blue points sowcase Bloomberg’s Analyst Estimates. Despite the use of advanced financial models and expert insights, the forecasts often deviate significantly from reality. For example, there are noticeable declines in the accuracy of predictions over several quarters, with actual EBIT figures frequently falling outside the expected range.

Why Do These Discrepancies Occur?

Market Volatility: The steel industry is highly influenced by global economic conditions, changes in raw material costs, and demand fluctuations from key sectors such as construction and automotive. These factors are difficult to predict with precision.

Limited Real-Time Data: Analyst models often rely on past performance and publicly available data, which may not capture real-time changes in production or market conditions.

Complexity of Global Operations: Companies like ArcelorMittal operate in multiple regions, each with its own set of challenges, from geopolitical tensions to currency fluctuations. These complexities add layers of uncertainty to forecasting efforts.

The Implications for Stakeholders

These discrepancies highlight the limitations of traditional forecasting methods, even when conducted by top-tier institutions. For stakeholders—whether procurement managers, investors, or policymakers—this serves as a reminder to approach analyst estimates with caution. While forecasts provide valuable guidance, they should be supplemented with other sources of data and insights for a more comprehensive understanding of market trends.

A Call for Better Tools and Insights

At LaGrand, we believe that real-time data and innovative technologies can bridge the gap between forecasts and reality. By leveraging satellite-based monitoring and integrating real-world production data into decision-making processes, we aim to offer stakeholders more accurate and actionable insights.