From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineTangshan Cuts Pressure Asia Steel: CISA Output Up, Inventories High, Procurement Risks Rise

Asia’s steel market faces a complex scenario as production cuts in China clash with rising CISA output and inventory levels. The market sentiment is negative. Stricter production cuts in Tangshan, as reported in “Output cuts in Tangshan in August to be much bigger than in July” and “Метallurgists in Tangshan will suspend production in August–September,” aim to improve air quality but could disrupt supply. However, these cuts occur while “CISA mills’ daily crude steel output up 4.7% in early August, stocks also up,” suggesting a potential buffer against immediate shortages. Satellite data provides supporting evidence for these developments.

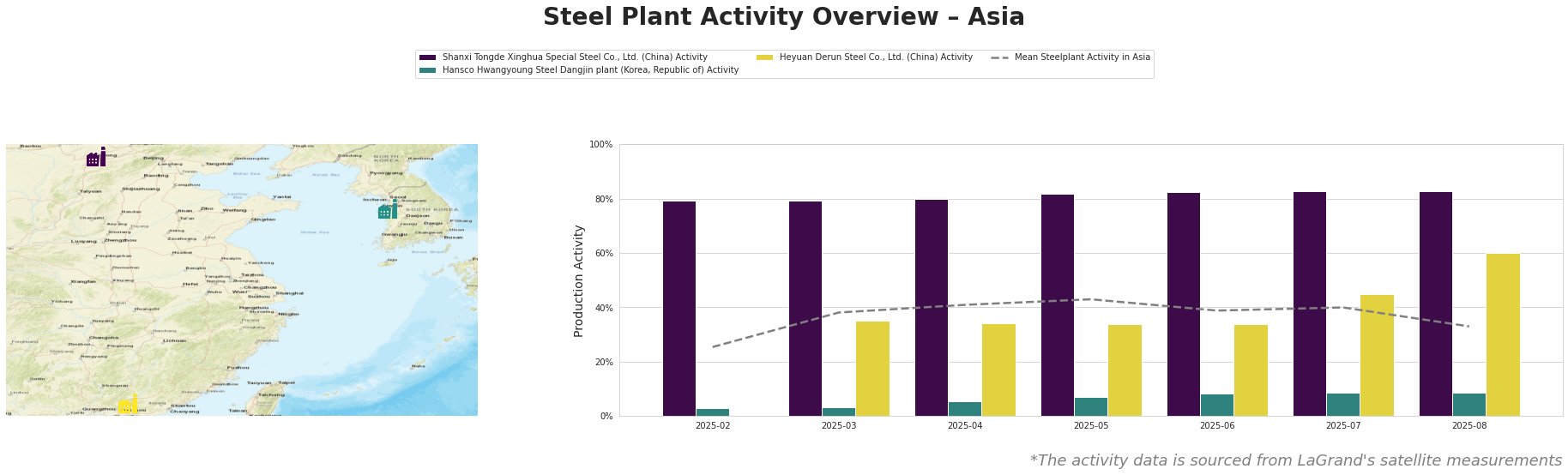

The monthly aggregated activity levels of selected steel plants are shown in the following table:

Overall, the mean steel plant activity in Asia declined significantly in August, dropping to 33% from a stable 39-43% between March and July.

Shanxi Tongde Xinghua Special Steel Co., Ltd., an integrated BF steel plant with a crude steel capacity of 2.5 million tons, focuses on semi-finished and finished rolled products like billet and rebar. Its activity remained consistently high between February and August 2025, at around 80%, far exceeding the mean activity level across Asia. Despite the reported production cuts in Tangshan, there is no indication of reduced activity at Shanxi Tongde Xinghua Special Steel Co., Ltd. based on satellite observations. No direct connection can be established between this activity and the provided news articles, given this plant’s location outside the immediate Tangshan area.

Hansco Hwangyoung Steel Dangjin plant, an EAF-based steel plant in South Korea with a crude steel capacity of 800,000 tons specializing in billet and rebar, exhibited very low activity levels from February to August 2025, ranging from 3% to 9%. These levels are significantly below the Asian mean, suggesting potential operational issues or a focus on higher-value production. No direct link can be established between these low activity levels and the Chinese production cuts described in the news articles.

Heyuan Derun Steel Co., Ltd., an EAF-based plant in Guangdong, China, with a crude steel capacity of 1.2 million tons focusing on rebar and billet production, showed increasing activity levels. Starting at 35% in March, its activity rose significantly to 60% by August, markedly exceeding the Asian mean. While “China’s Crude Steel Output Falls Below 80 Million mt in July, down 3.1% in Jan-July” highlights an overall output decrease in China, Heyuan Derun Steel’s increased activity indicates a possible shift in production focus or regional advantages.

Despite the rise in CISA mills’ daily output reported in “CISA mills’ daily crude steel output up 4.7% in early August, stocks also up,” the Tangshan production cuts detailed in “Output cuts in Tangshan in August to be much bigger than in July” and satellite-observed overall decline in mean activity levels across Asian steel plants point to potential supply disruptions, particularly in section steel. The drop in overall output also aligns with “China reduces steel output for the third month in a row“. Steel buyers should:

- Prioritize securing section steel supply from regions outside Tangshan: Given the mandatory production halts in Tangshan between August 25th and September 3rd, and potential halts from August 16th, buyers dependent on section steel should diversify their sourcing to mitigate potential delays or price increases.

- Monitor inventory levels closely: While “CISA mills’ daily crude steel output up 4.7% in early August, stocks also up” suggests a buffer, the impact of Tangshan cuts on overall inventory needs continuous monitoring. Increased export levels as referred to in “Метallurgists in Tangshan will suspend production in August–September” further decrease this buffer.

- Assess alternative material options: For projects allowing material flexibility, evaluate the feasibility of using alternative materials to steel in case supply chain disruptions become more pronounced, to reduce procurement risk.