From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSwiss Steel Forges Ahead: Solar Steel Production Ramps Up Amidst Stable EAF Activity

Switzerland’s steel sector exhibits a very positive outlook, driven by advancements in sustainable steel production and relatively stable electric arc furnace (EAF) activity. The Panatere inaugurates world’s first solar furnaces to produce recycled steel in Switzerland news articles (three articles with identical titles) signal a move towards decarbonized steel, aiming to reduce import dependence and stimulate local industry. While these developments are groundbreaking, no direct correlation can yet be established between the news and the recent satellite-observed activity levels at existing steel plants.

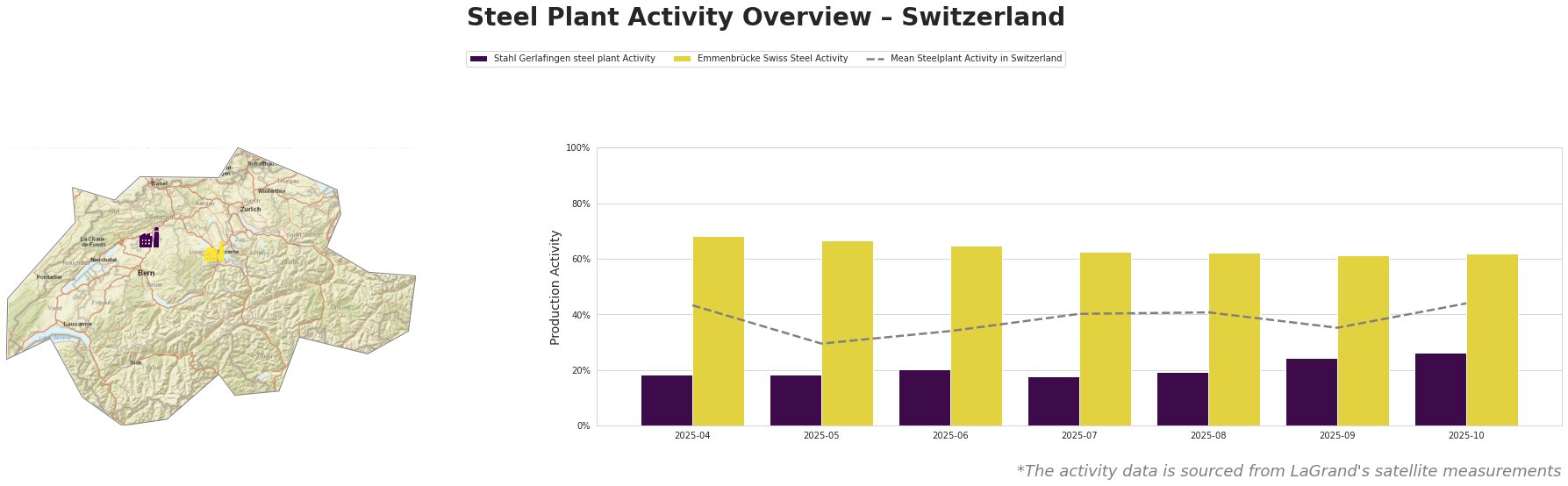

Recent monthly activity trends across the observed steel plants are as follows:

The mean steel plant activity in Switzerland saw a low of 30.0% in May and a peak of 44.0% in October. Stahl Gerlafingen steel plant consistently operated below the national average, exhibiting a slight increase in activity from 18.0% in July to 26.0% in October. Emmenbrücke Swiss Steel, in contrast, showed significantly higher activity levels than both the national average and Stahl Gerlafingen, remaining relatively stable between 61.0% and 68.0%. No direct connection could be established between the opening of the solar furnaces in La Chaux-de-Fonds and observed activity changes at these specific plants.

Stahl Gerlafingen, located in Solothurn, is a steel plant with a crude steel production capacity of 687 ttpa, relying exclusively on EAF technology. Their product range includes semi-finished and finished rolled products like rebar and profiles. The observed activity at Stahl Gerlafingen has remained consistently below the national average, though it shows an increase from 18% in July to 26% in October. Despite this slight increase, the recent news regarding solar furnace steel production, as reported in “Panatere inaugurates world’s first solar furnaces to produce recycled steel in Switzerland” articles, does not appear to have directly influenced activity at this EAF-based facility.

Emmenbrücke Swiss Steel, situated in Luzern, also utilizes EAF technology, albeit with unspecified production capacity. Its activity levels consistently surpass the national average, exhibiting a stable performance around 60%. As with Stahl Gerlafingen, there’s no discernible correlation between the launch of Panatere’s solar furnaces and the operational activity at Emmenbrücke Swiss Steel.

The launch of the solar furnaces, as detailed in the Panatere inaugurates world’s first solar furnaces to produce recycled steel in Switzerland articles, represents a long-term shift in Switzerland’s steel industry, aiming to localize production and reduce reliance on imported stainless steel. While no immediate impact is apparent on the activity levels of Stahl Gerlafingen and Emmenbrücke Swiss Steel, the development introduces new supply chain dynamics, specifically impacting stainless steel markets in the future. Considering the increased activity at Stahl Gerlafingen combined with the long-term implications of solar steel, steel buyers and market analysts should:

- Monitor stainless steel import trends closely: Track import volumes and pricing for stainless steel to identify potential shifts as solar steel production scales up by 2028, as it is the explicit target.

- Engage with Panatere: Establish communication channels with Panatere to understand the availability, specifications, and pricing of solar steel as it becomes commercially available.

- Assess potential supply chain vulnerabilities: Evaluate current stainless steel supply chains for reliance on specific import sources and develop contingency plans to mitigate potential disruptions from increased domestic solar steel production. Although the existing EAF plants have exhibited stable activity and are not directly impacted, a shift of end-user sectors towards solar steel will eventually impact demand for their products.