From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSurge in Steel Production and Sustainability Investments Drive Positive Market Outlook in Europe

Swedish steel producer SSAB has reported a 6.3% year-on-year increase in rolled steel production for Q1 2025, as highlighted in the news article “SSAB increased rolled steel production by 6.3% y/y in Q1“. This growth is mirrored in recent satellite-observed plant activity levels, indicating a robust recovery trajectory for the steel industry in Europe.

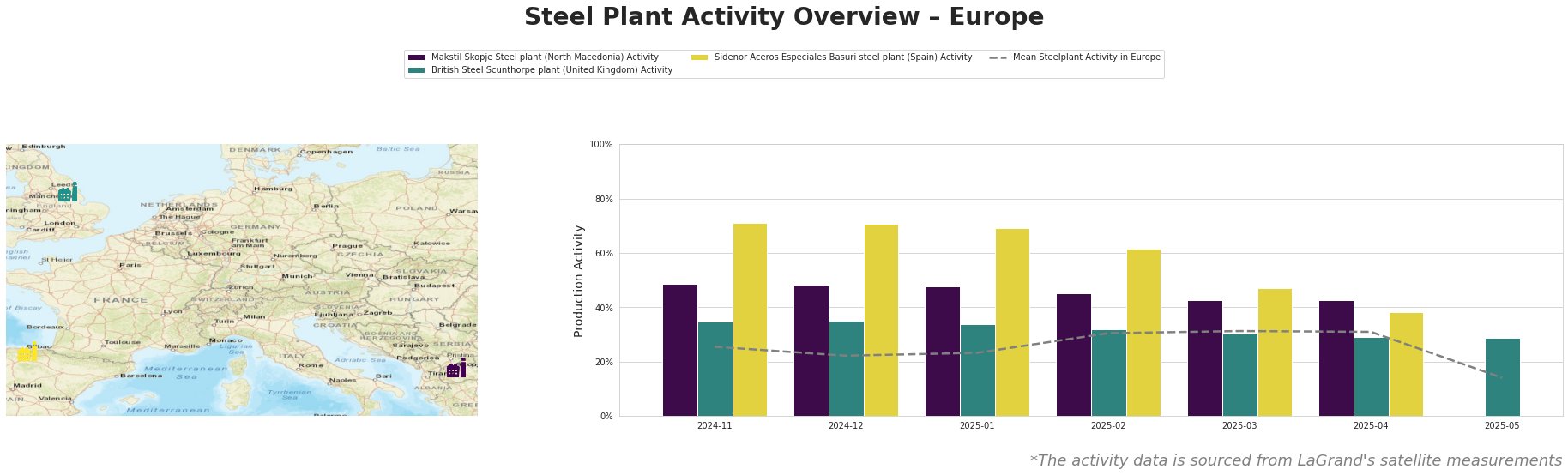

In April, the overall mean steelplant activity in Europe remained stable at 31.0%, but notable deviations were observed among specific plants. The Makstil Skopje Steel plant maintained a high activity level of 43.0%, indicating resilience amid broader trends. Conversely, the British Steel Scunthorpe plant fell to 29.0%; however, its preceding consistent activity trends (30.0% in March) highlight potential supply chain pressures related to planned maintenance or strategic shifts.

Each plant can be examined more closely, with Makstil Skopje’s EAF technology maintaining activity, which aligns with sustainable production trends. On the other hand, Sidenor Aceros Especiales Basuri has shown a significant drop to 38.0% in April despite historically higher activity, potentially indicating demand challenges in sectors like automotive, where upward trends were previously expected following SSAB’s announcements and production increases.

The critical development for SSAB involves the €2.3 billion financing for the Luleå mill, aimed at transitioning to fossil-free production methods, reinforcing supply reliability and sustainability initiatives within the Baltic region. Increased financing and production signify SSAB’s robust position in a transforming market; however, no direct correlation was established between SSAB’s financial announcements and the immediate activity levels of the analyzed plants.

Market implications for steel buyers should focus on:

-

Potential Supply Disruptions: Monitor patterns in the British Steel Scunthorpe plant, given the drop to 29.0% activity, which could result in reduced product availability, particularly in finished rolled goods.

-

Recommended Procurement Actions: Given SSAB’s production increase and investments, procurement strategies should align with SSAB’s output capacity expansions in forthcoming quarters, favoring their output where possible, and strategically planning for sourcing locks to mitigate expected demand against the backdrop of the automotive sector’s uncertain recovery.

Steel procurement professionals must enhance their agility in decision-making processes, appreciating both regional production variances and larger investment shifts underway in the European steel market.