From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSurge in Steel Production Activity in Asia Driven by Strategic Joint Ventures

In Asia, the steel market is witnessing a very positive trend primarily due to the establishment of significant joint ventures, such as JFE Steel to establish joint venture with India’s JSW worth $3.4 billion and Japan’s JFE Steel to invest $1.75 billion in JV with JSW Steel to run BPSL mill. These ventures are associated with an uptick in observed activity levels at steel plants, particularly in Odisha, which aligns closely with increased investment intent.

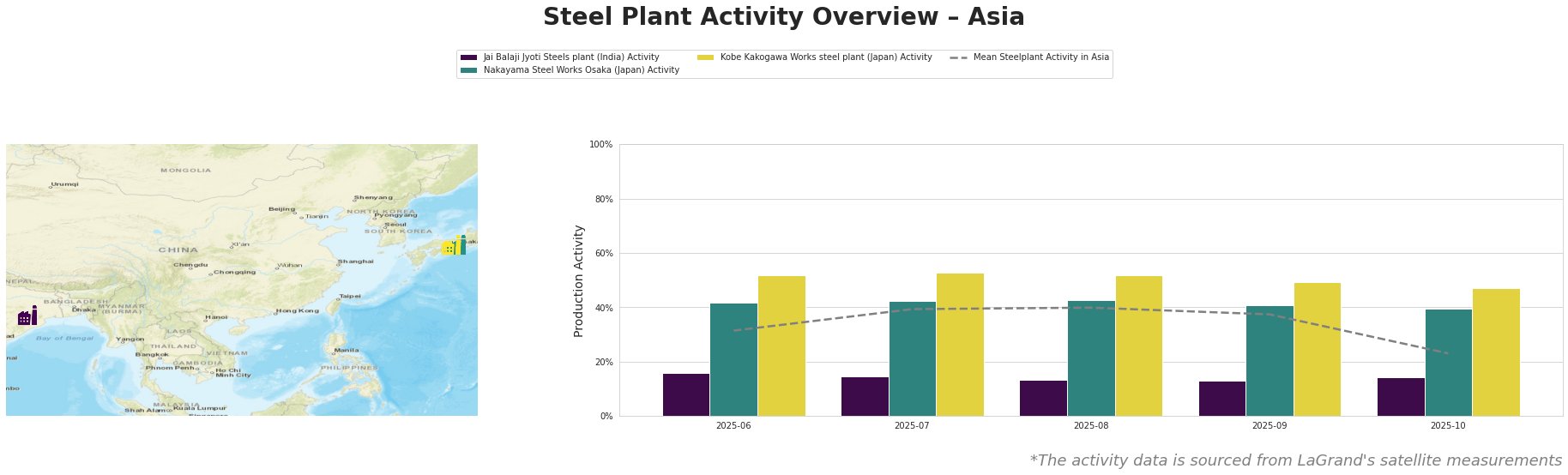

Activity levels across steel plants indicate fluctuations, with the mean activity being highest in July. Notably, the Jai Balaji Jyoti Steels plant in India has seen its activity decline sharply, peaking at 16% but dropping to 14% by October, suggesting operational challenges. Conversely, the Kobe Kakogawa Works has managed to maintain activity levels around 49-53%, reflecting stability perhaps linked to its established market position.

The Jai Balaji Jyoti Steels plant, located in Odisha, operates with a crude steel capacity of 92, primarily utilizing DRI technology. Recent activity fluctuations (16% in June to 14% in October) offer no explicit correlation to the recent news articles; however, the ongoing development of new ventures, particularly those like JFE-JSW integrated steel plant joint venture, suggests an overall industry boost might impact future operational capacity positively.

The Nakayama Steel Works Osaka, with an EAF-based capacity of 660, exhibits consistent activity around 40% but does not show a noticeable increase linked to the recent joint ventures focused on India. Given its established output and product segmentation, it remains poised for greater international diversifications, but without direct correlation yet.

The Kobe Kakogawa Works, demonstrating activity around 47-53%, operates an integrated process with core production utilizing BOF. Although current activity levels don’t show a spike directly linked to new investments, the historical output eases potential supply disruptions through maintained production capability.

Market Implications:

1. Potential Supply Disruptions: The decline in activity at the Jai Balaji Jyoti Steels plant could lead to regional supply challenges if aligned projects do not increase output promptly. The joint ventures may witness delays or operational hurdles impacting supply chains.

- Recommended Procurement Actions: Steel buyers should consider securing contracts with more stable plants like Kobe Kakogawa while mitigating risks by monitoring Jai Balaji developments. Proactive engagement with expanded capacities from the JFE and JSW collaboration might present future opportunities for high-quality steel procurement as production ramps up toward 2030.