From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineStrong Recovery in Asia’s Steel Market Amidst CBAM Developments

The steel market in Asia is experiencing a robust recovery driven by increased activity in major plants, buoyed by recent adjustments in carbon regulation strategies. Significant insights arise from the articles “Draft CBAM default values act clarifies revision logic“ and “CBAM clarification raises importers’ cost expectations,” both of which indicate a favorable shift toward higher valuations for local producers while emphasizing heightened operational standards for imports, particularly from carbon-intensive regions.

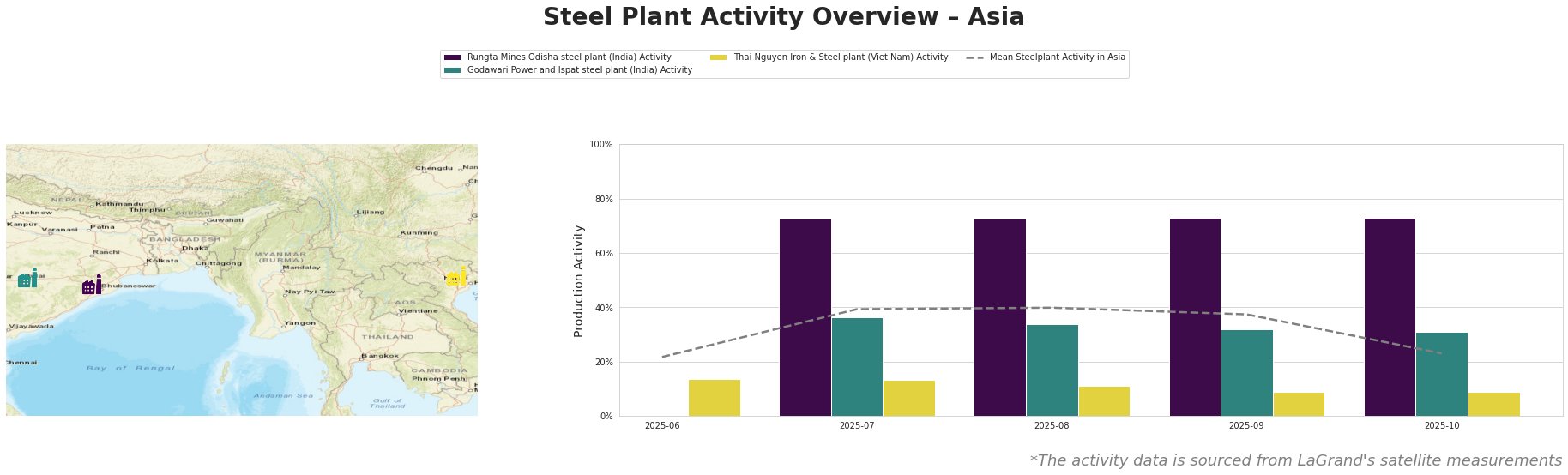

Rungta Mines in Odisha has maintained a high activity level, peaking at 73% throughout the observed months, indicating consistent production capacity in crude steel via integrated processes (BF and DRI). This sustained high output correlates with the positive sentiment outlined in the “CBAM clarification raises importers’ cost expectations,” suggesting that local producers could capitalize on rising market prices as compliance costs escalate for imports.

In contrast, Godawari Power and Ispat Plant has shown a gradual decline in its activity, dropping from 36% to 31% between August and October. The connection to the CBAM adjustments is less clear, but the shifting regulatory environment underscores potential challenges in maintaining competitive production costs, as noted in “Italian rerollers and buyers call CBAM values ‘unworkable’.”

The Thai Nguyen Iron & Steel Plant shows a concerning reduction in activity, from 14% to 9%, reflecting capacity constraints or lower demand. No direct links can be established from the identified articles, but the trends in Asian procurement practices could suggest a general responsiveness to European market pressures stemming from the evolving CBAM framework.

Given the robust performance and relatively stable operations of plants like Rungta Mines, steel buyers should strategically prioritize sourcing from this facility to mitigate exposure to potential disruptions. Moreover, procurement strategies should also focus on diversifying suppliers while considering the shifting costs attributable to compliance with carbon regulations, particularly from plants facing new, higher import costs in nations like China and India, referenced in multiple news articles. The imminent phase-in of CBAM regulations adds urgency in securing favorable terms ahead of full implementation in 2026.