From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineStrong Growth in Finland’s Steel Market: SSAB Expansion and Rising Activity Levels

Recent developments in the Finnish steel market reflect a very positive sentiment, particularly noted in the acquisition of Ovako Metals Oy by Tibnor, as highlighted in the news articles “Tibnor to acquire Finnish steel distributor“ and “Tibnor to acquire Ovako Metals Oy to strengthen presence in Finnish steel distribution market.” This strategic acquisition aligns with a notable increase in activity levels at selected steel plants, indicating a significant market shift.

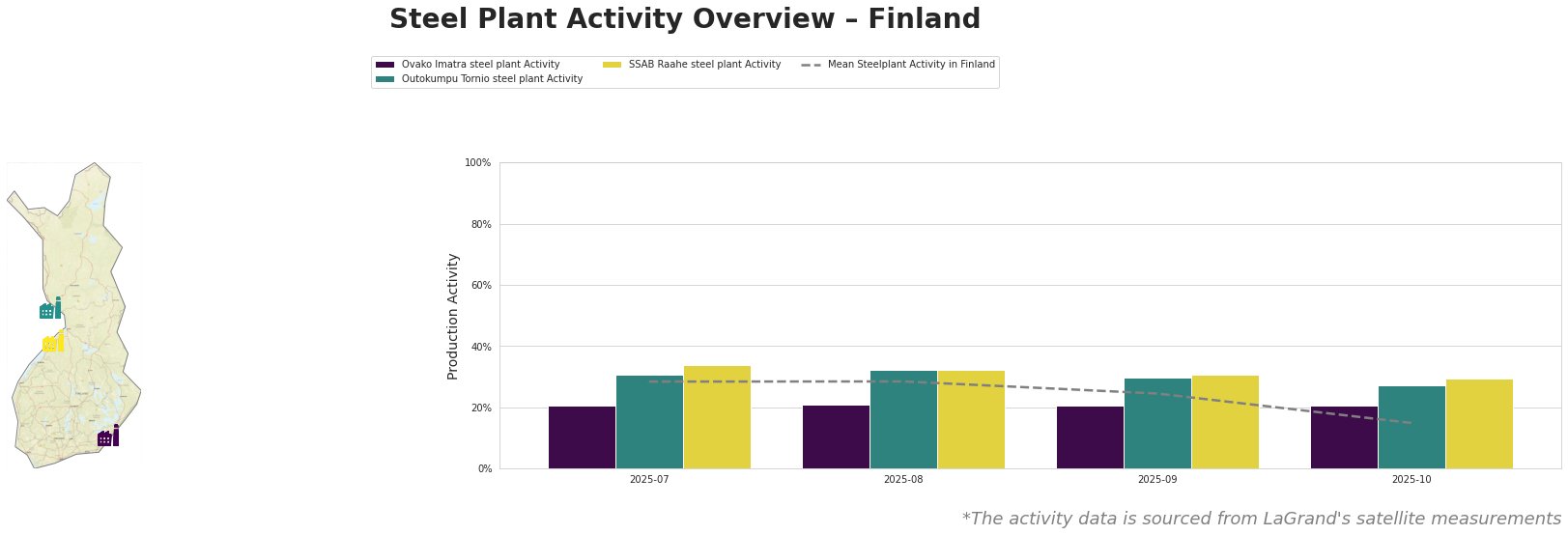

Recent satellite-observed activity data show varied activity levels from key steel plants in Finland for the months leading up to October 2025:

The overall mean activity level has declined from 28% in July to 15% by October 2025. The Ovako Imatra plant remained stable at 21%, while the Outokumpu Tornio plant saw a decrease from 31% to 27%, and SSAB Raahe decreased from 34% to 29%. Notably, the consistent activity level at Ovako may reflect the plant’s resilience amid market consolidations, reinforcing Tibnor’s strategic direction to enhance service offerings in Finland.

The Ovako Imatra steel plant operates with an electric arc furnace (EAF) and produces semi-finished and finished rolled products for various sectors, including automotive and infrastructure. Given its stable 21% activity level, no direct impact from Tibnor’s acquisition discussions is observed here.

Conversely, Outokumpu Tornio, employing a similar electric production process, shows a gradual decline in activity which can be possibly attributed to market adjustments as consolidation and strategies emerge from acquisitions nearby. The plant produces a diverse range of products, including cold and hot rolled coils, making it significant in major end-user markets.

Meanwhile, the SSAB Raahe plant, being an integrated facility with a capacity of 2,600 tonnes of crude steel, demonstrated a considerable activity peak of 34% in July. The slight decrease by October to 29% may indicate rapid feedback to market repositioning but remains high compared to the mean.

Given these nuances in activity trends, potential supply disruptions may arise, particularly for Outokumpu Tornio, highlighting the need for buyers within the automotive and energy sectors to consider alternative supply sources or adjust procurement requirements in anticipation of further market fluctuations.

Steel buyers should actively pursue procurement in light of the recent acquisition of Ovako by Tibnor, which indicated increased capacity and network expansion in the region. Engaging with Tibnor post-acquisition will likely facilitate improved service levels and product availability tailored to buyers’ needs. Proper timing and strategic sourcing around these developments will be essential to leverage the strengthened presence in the Finnish steel market.