From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSteel Market Report: South America Sees Neutral Sentiment Amid Regulatory Changes and Plant Activity Fluctuations

Brazil’s steel market faces fluctuations in activity levels intertwined with significant regulatory developments. Notably, the articles “Brazil to allow UCO imports for SAF production“ and “Brazil groups seek fossil fuel phase-out: Update“ indicate an evolving landscape impacting the steel industry, but no direct relationships could be established with satellite-observed plant activity changes at this time.

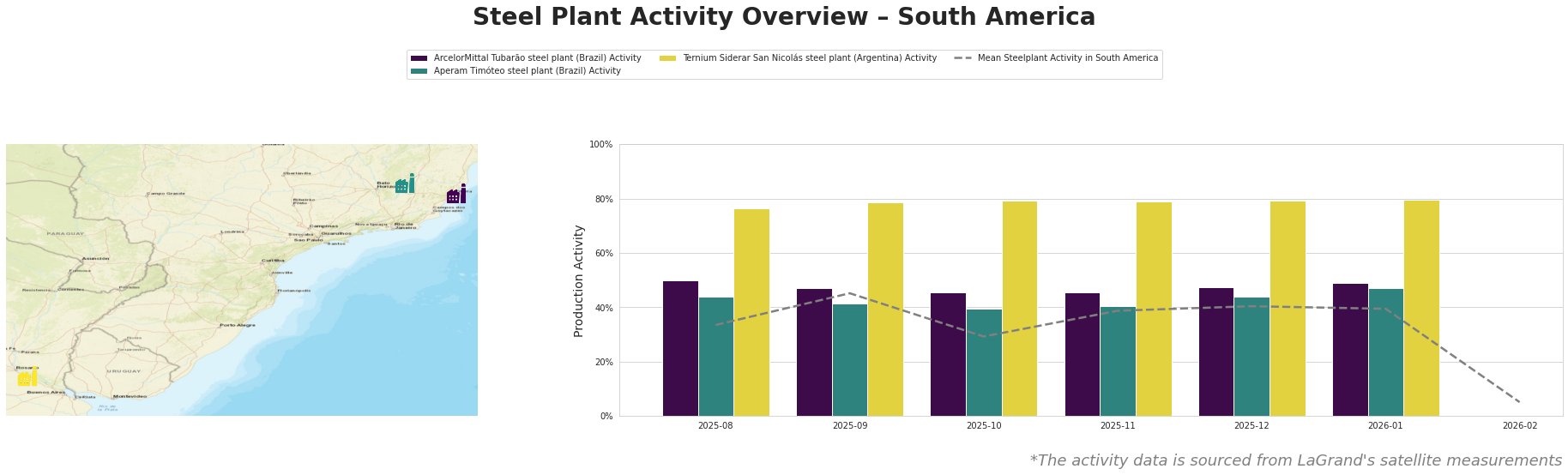

ArcelorMittal Tubarão experienced a slight increase in activity, reaching 49% in January 2026, following a drop to 45% in preceding months. This increase could reflect adaptive responses to domestic and international market fluctuations, though it does not directly connect to recent news.

The Aperam Timóteo plant’s output remains relatively stable, rising to 47% in January from a previous 41%, displaying resilience amidst market shifts. Comparatively, Ternium Siderar San Nicolás has shown peak activity at 80%, indicating solid demand for its products, particularly in the automotive and infrastructure sectors.

Both “Brazil groups seek fossil fuel phase-out: Update” articles point to a potential regulatory push affecting energy sources that could influence plant operations moving forward, though how this plays out in terms of upstream raw material availability remains unclear.

Evaluating potential supply disruptions, should the proposed energy transition lead to rigorous fossil fuel phase-outs, facilities relying heavily on conventional energy sources may face challenges. Steel buyers should prepare for potential volatility in supply from plants like ArcelorMittal Tubarão, where activity levels could be more susceptible to policy changes.

Recommendations for procurement professionals:

1. Monitor Regulatory Developments: Stay informed on the progress of Brazil’s fossil fuel phase-out roadmap, as it could reshape energy costs and availability.

2. Assess Supplier Risk: Evaluate the sustainability strategies of key suppliers like ArcelorMittal and Aperam, which may impact their long-term viability and pricing strategies.

3. Diversify Sources: Consider alternative suppliers in regions less affected by regulatory changes, ensuring supply chain resilience.

These actionable insights are crucial for navigating the current neutral sentiment in the South American steel market effectively.