From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSteel Market Report: South America Faces Severe Disruptions Amidst Political Turmoil

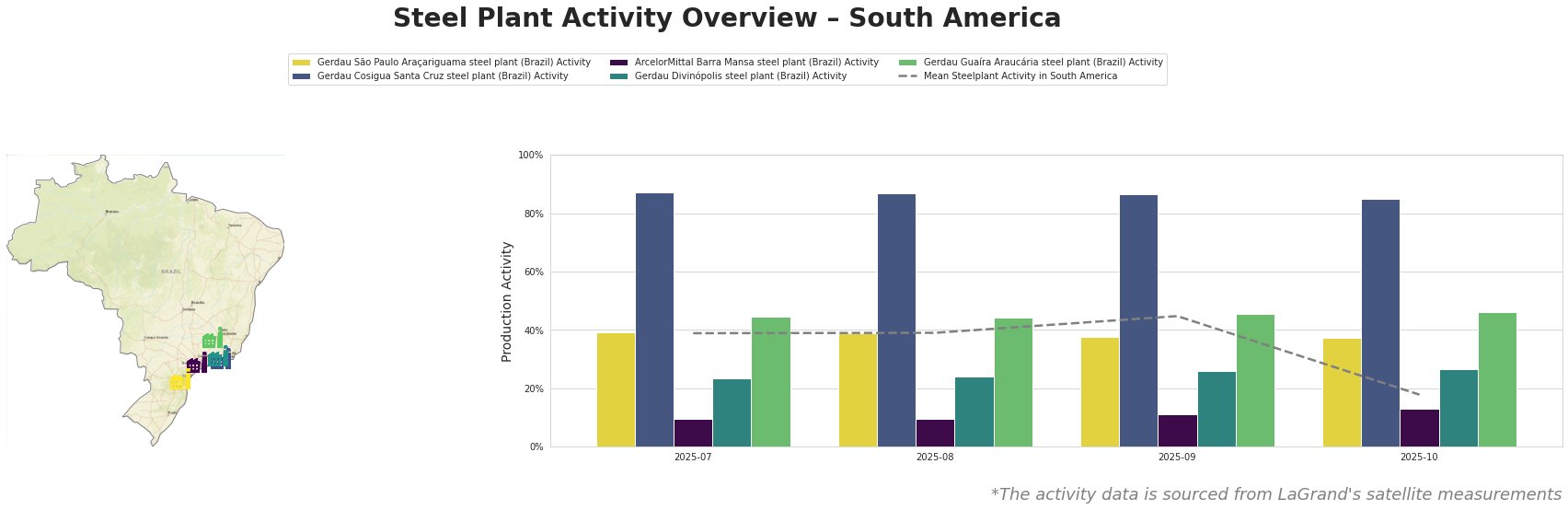

The steel market in South America is experiencing very negative sentiment as recent geopolitical events, notably U.S. military actions in Venezuela, have led to uncertain supply conditions. Articles such as “Here’s what the smartest people in foreign policy, business, and economics are saying about Trump’s raid on Venezuela“ and “Trump sees role in Venezuela after military strike“ reflect concerns from analysts that regional instability could negatively affect steel production and supply chains. Satellite activity data show an alarming decline in operational levels across various steel plants over the past few months.

Gerdau São Paulo Araçariguama recorded a moderate activity of 39% in July and August 2025, but it declined to 37% in October. This decrease reflects underlying market anxieties that may be directly related to the escalating crisis in Venezuela discussed in “Trump sees role in Venezuela after military strike.” The plant operates EAF systems, producing semi-finished products primarily for construction, which could become less available if political tensions disrupt supply channels.

Gerdau Cosigua Santa Cruz, maintaining a relatively stronger position at 87% in July, faced a decline to 85% by October. Despite being a significant player with capacity for finished rolled products, uncertainty about raw material supply may be contributing to a less optimistic outlook, as noted by analysts in “Here’s what the smartest people in foreign policy…”

ArcelorMittal Barra Mansa reported extremely low activity levels, dropping drastically from 9% in July to 13% in October. This volatility may indicate a complete reevaluation of operations given the tumultuous political environment. The connection to recent geopolitical developments suggests that market and operational adjustments are in response to external pressures.

Gerdau Divinópolis and Gerdau Guaíra Araucária have seen slight fluctuations but generally follow a downward trend with decreases from 24% to 27% and 45% respectively. Analysts’ commentary in “Reviving Venezuela’s oil industry no easy feat: Update“ may highlight the anticipated complications in obtaining supplies and labor amidst ongoing uncertainty.

Potential supply disruptions are becoming evident in South America, with steel plants, particularly those in Brazil, struggling to maintain stable output amid declining activity levels. Steel procurement professionals should consider immediate actions such as securing contracts for required material quantities and potentially exploring alternative suppliers or regions to avoid geopolitical supply failure.

In summary, the interconnectedness of local steel production capabilities with regional political changes necessitates a proactive approach for steel buyers to safeguard their supply chains against anticipated disruptions.