From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSteel Market Report: Positive Momentum in Europe Amid New Safeguards

Recent activity in the European steel market exhibits a notably positive trajectory, particularly following the announcement of New EU protective measures for steel will come into force on July 1 and EU’s new steel safeguard regime to come into effect on July 1, 2026. These developments align with satellite-observed increases in activity across major steel plants.

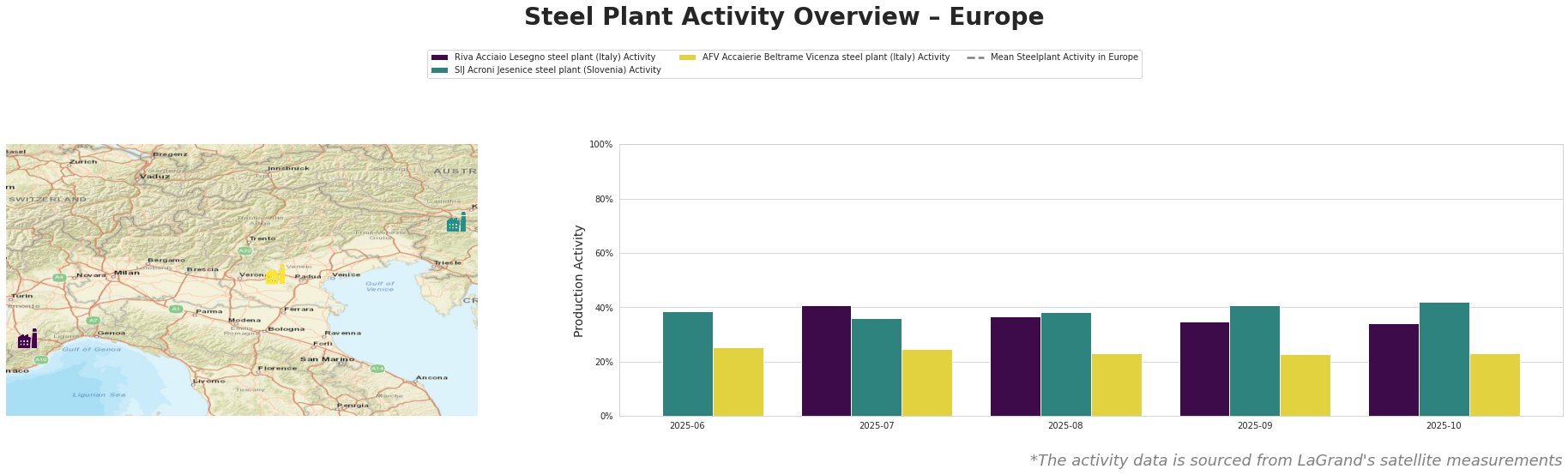

Observations indicate fluctuations in activity levels, with the Riva Acciaio Lesegno plant showing slight increases, from 39% in June to 41% in July, before settling to 34% by October. SIJ Acroni Jesenice registered peaks of 42% in October, significantly exceeding both the mean activity and the levels of Riva, suggesting strong production responses to market conditions potentially related to new safeguard measures. However, no direct relationship between the activity spikes and the news articles could be established for Riva.

Riva Acciaio Lesegno, based in the Province of Cuneo with an annual capacity of 600,000 tons, showcases a steady reliance on electric arc furnace (EAF) technology to produce semi-finished and rolled products. Its recent fluctuations may reflect adjustments to the evolving regulatory landscape highlighted in the articles, although no explicit link to the news was identified.

SIJ Acroni Jesenice, located in Slovenia, with a capacity of 726,000 tons and also utilizing EAF methods, has seen consistent output increases. The upward trend to 42% aligns well with the optimism regarding the EU’s new steel regulations, indicating that preparations for complying with the future safeguard regime may bolster productivity.

Meanwhile, AFV Accaierie Beltrame Vicenza, with a capacity of 1.2 million tons, has not publicly available activity measurements, making it challenging to draw similar connections, although its focus on infrastructure and machinery sectors remains vital.

Given the anticipated regulations effective July 1, 2026, steel buyers should consider proactive procurement strategies, as rising activity rates could lead to potential supply constraints. In particular, securing contracts early with plants such as SIJ Acroni Jesenice that demonstrated increased activity may mitigate risk. Additionally, monitoring the activity patterns of Riva and its peers will be crucial, with particular emphasis on changes post-July 2026 as new measures come into full effect.