From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSteel Market Report: Neutral Sentiment Amid Policy Changes in Ukraine’s Steel Industry

Recent government actions and market activity indicate a cautious approach in Ukraine’s steel sector, particularly following policies limiting raw material exports. The article “The Cabinet of Ministers of Ukraine has extended the ban on the export of timber and scrap metal until the end of 2026” and “The government has set zero quotas for scrap exports from Ukraine for 2026“ highlight efforts to boost domestic processing and mitigate losses from scrap metal exports. These developments correlate with satellite observations of lower activity levels at Ukrainian steel plants.

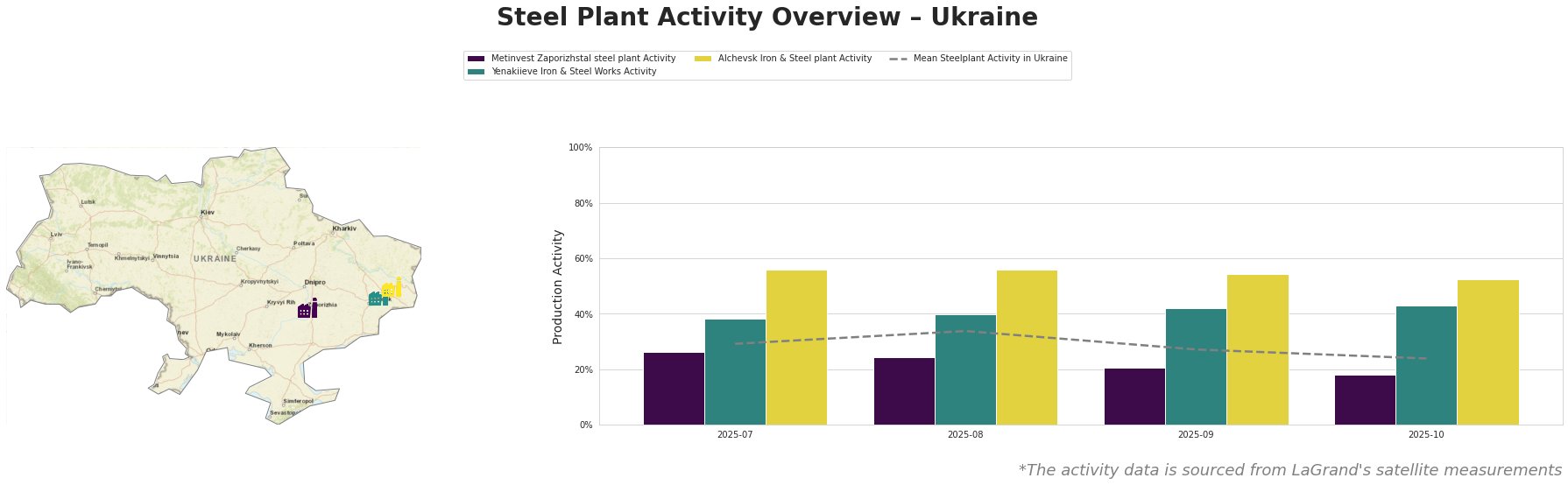

The Metinvest Zaporizhstal steel plant has seen a declining activity trend, from 26.0% in July to 18.0% in October 2025, which suggests underperformance in alignment with the import bans potentially restricting access to essential raw materials. Conversely, Yenakiieve Iron & Steel Works and Alchevsk Iron & Steel Plant showed relatively stable activity levels, although they still highlighted fluctuations with a peak of 56.0% at Alchevsk in July. Notably, a direct correlation is not established between the observed activity levels and the cited news articles, indicating that broader industry dynamics may also influence operations.

The observed increases in scrap collection, reported in “The government has set zero quotas for scrap exports from Ukraine for 2026,” are anticipated to improve domestic supply chains, possibly stabilizing future activity levels at plants like Alchevsk that service these needs. The total export ban on scrap might mitigate pressures from lower-cost imports, such as Turkish steel which constituted 59.4% of Ukraine’s rolled steel imports in 2025, as highlighted in “Turkey accounts for up to 60% of Ukraine’s rolled steel import market in 2025.”

Steel buyers should prepare for potential supply disruptions particularly from Metinvest and consider sourcing more from domestic producers like Alchevsk, which are well-positioned to benefit from the government’s new policy landscape favoring local resource utilization. To enhance procurement strategies, stakeholders should monitor scrap collection trends closely, anticipating better raw material availability which aligns with domestic processing capacities under the new export restrictions.