From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSteel Market Report for Europe: Activity Declines Amid Pricing Pressures

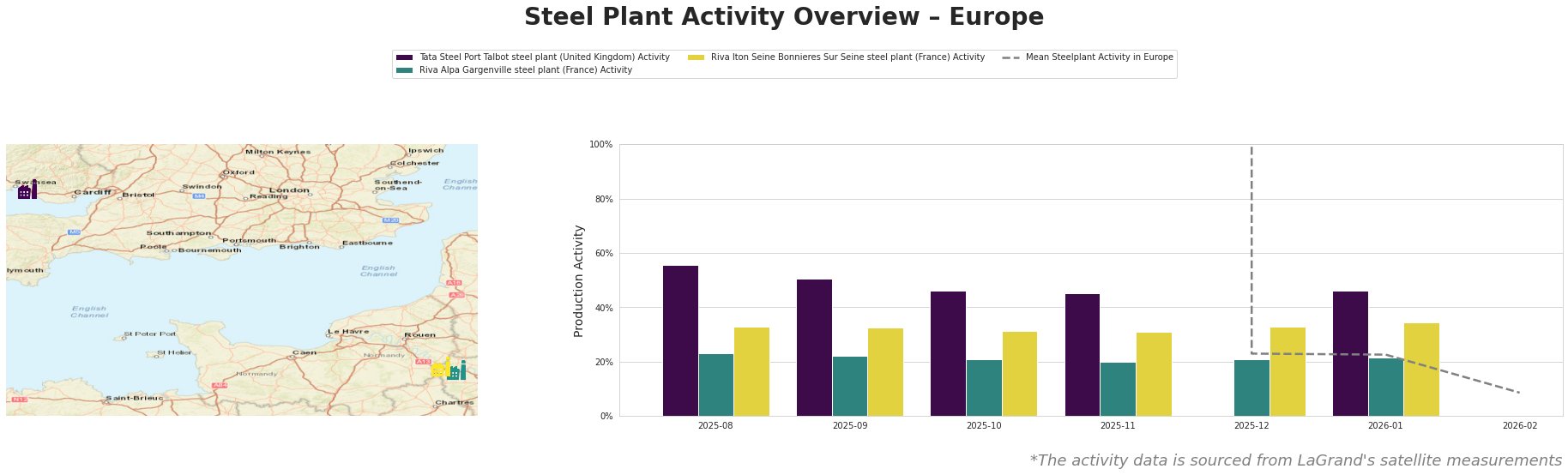

In Europe, recent developments in steel production reflect a neutral market sentiment amid fluctuating prices and varying activity levels across key steel plants. The news articles “France reduced steel production by 8.7% y/y in 2025,” and “European longs prices tick up, market resistance remains“ illustrate ongoing challenges, with satellite data from selected plants confirming these trends.

The satellite-observed activity levels indicate that the mean activity across European steel plants has seen significant fluctuations. Particularly, the Tata Steel Port Talbot plant experienced a considerable drop from 56% in August 2025 to 45% in November, before slightly recovering to 46% in January 2026. This decline aligns with the broader trends noted in the article “France reduced steel production by 8.7% y/y in 2025,” indicating a regional contraction in output.

Conversely, the Riva Alpa Gargenville plant recorded a drop to 20% by November, suggesting a potential tie to “French longs prices edge higher despite weak demand,” where weak market conditions may have limited its ability to ramp up production amidst rising costs for raw materials. However, it managed to stabilize around 22% in January.

Riva Iton Seine had a slightly positive trajectory, maintaining activity levels around 33%, which indicates a consistent performance in a challenging environment. This stability can inform procurement strategies, especially as Europe grapples with pricing pressures as highlighted in “Downstream flat steel prices in Europe steady while CBAM, AD probe limit import options.”

Specific procurement recommendations include:

– Tata Steel Port Talbot: Monitor the plant’s output closely and consider securing orders promptly, given its recent volatility. The slight uptick in January might offer a narrow window for securing steel before potential supply issues arise due to broader market uncertainty.

– Riva Alpa Gargenville: Engage cautiously with suppliers here, as drops in activity correlate with price resistance despite rising costs. Emphasize negotiations for securing better pricing conditions.

– Riva Iton Seine: Given its steadiness, it may serve as a reliable supply source in the near term, particularly as demand stabilizes while competitors adjust pricing strategies in relation to market signals.

In summary, buyers and analysts should be proactive in supply chain discussions, focusing on both current production capabilities and price fluctuations driven by external pressures such as CBAM and raw material costs.