From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSteel Market Outlook for Italy: ArcelorMittal Disputes Claims Amid Declining Operations – A Very Negative Sentiment

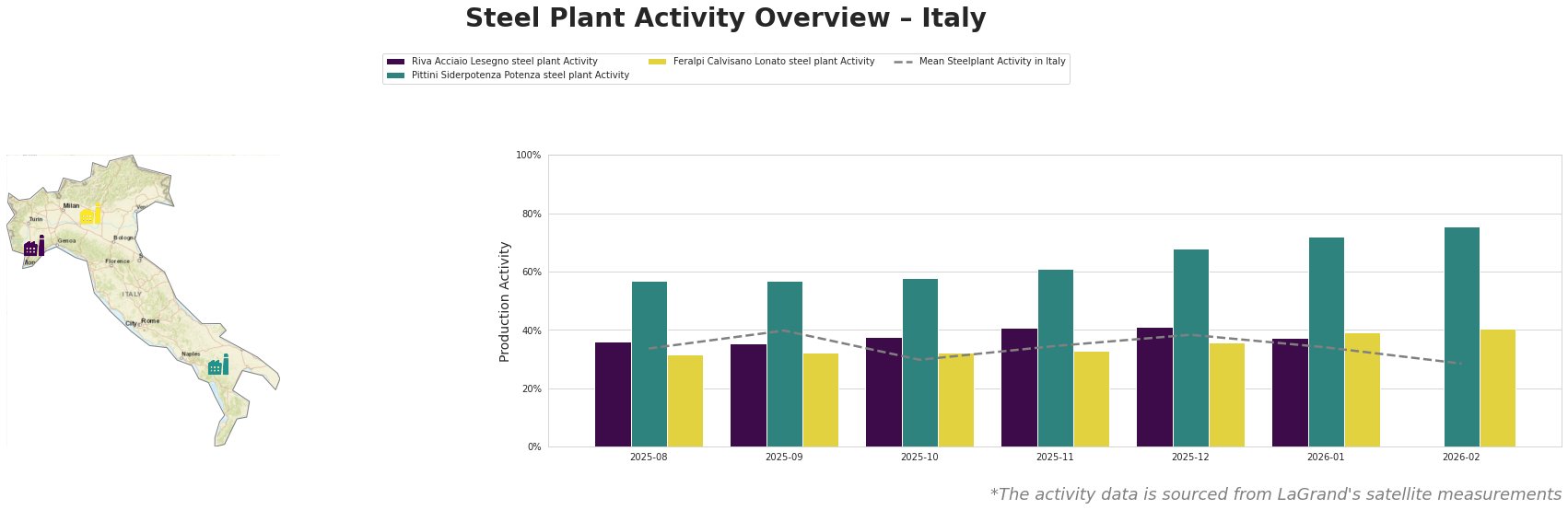

The Italian steel market currently faces significant turmoil, notably stemming from ArcelorMittal’s rejection of Italy’s claims regarding Acciaierie d’Italia (ADI), as detailed in “ArcelorMittal rejects Italy’s claims regarding Acciaierie d’Italia.” Coupled with ongoing management challenges at the Taranto plant, recent satellite data reflects a decline in operational activity across several steel plants, notably aligning with negative market sentiments.

The Riva Acciaio Lesegno steel plant has demonstrated a slight reduction in activity from 41% in November 2025 to 37% in January 2026, reflecting a dip consistent with the negative outlook associated with ongoing disputes involving ArcelorMittal. Meanwhile, more resilience is noted at the Pittini Siderpotenza Potenza plant, which peaked at 76% in February 2026, despite the overall mean activity level declining to 28%. In contrast, the Feralpi Calvisano Lonato plant’s activity remained relatively stable, fluctuating between 32% and 39% over recent months.

The Pittini Siderpotenza Potenza plant, located in the Province of Potenza and using EAF technology, saw a gradual increase from 68% in December to 76% in February 2026. This notable gain suggests operational resilience amidst market despair, possibly linked to specific contracts or effective management strategies. On the other hand, the stagnation at Riva Acciaio Lesegno is troubling, given alignment with the legal void and disputes surrounding ADI’s operation, highlighted in “ArcelorMittal denied all allegations in the case related to its Ilva plants in Italy.”

Market analysts should be wary of the potential supply disruptions particularly from Riva Acciaio and Feralpi Calvisano plants, where consistent operational fluctuations could lead to erratic supply availability. Furthermore, there is a heightened risk of complete operational halts or significant output reductions stemming from uncertainties over management claims and plant oversight, particularly in light of the sustained court cases against ArcelorMittal.

Recommendations for Procurement Professionals:

– Prioritize sourcing from the Pittini Siderpotenza Potenza plant as it demonstrates ongoing strength in production levels, ensuring a more stable supply amidst the broader market decline.

– Consider diversifying suppliers to mitigate risks associated with the potential fallout from ongoing legal situations impacting ADI and other ArcelorMittal-related operations.

– Stay informed on legal proceedings, specifically around ArcelorMittal’s international arbitration against Italy, as this may have direct repercussions on supply chains and market pricing strategies moving forward.

In conclusion, a careful and proactive procurement strategy is essential in these turbulent times, with a keen focus on plants demonstrating resilience and stability amidst a very negative market sentiment.