From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSteel Market Insights: Austria’s Activity Trends and Supply Landscape Amid Ongoing Pressures

In Austria, the steel market sentiment remains neutral as recent satellite observations reveal fluctuating activity levels across key plants amid external pressures. Notably, “Australia’s QCoal to keep producing after mine closure“ has pointed to continuing operational challenges in the coal sector, influencing pricing and availability variables closely linked to the steel industry.

Measured Activity Overview

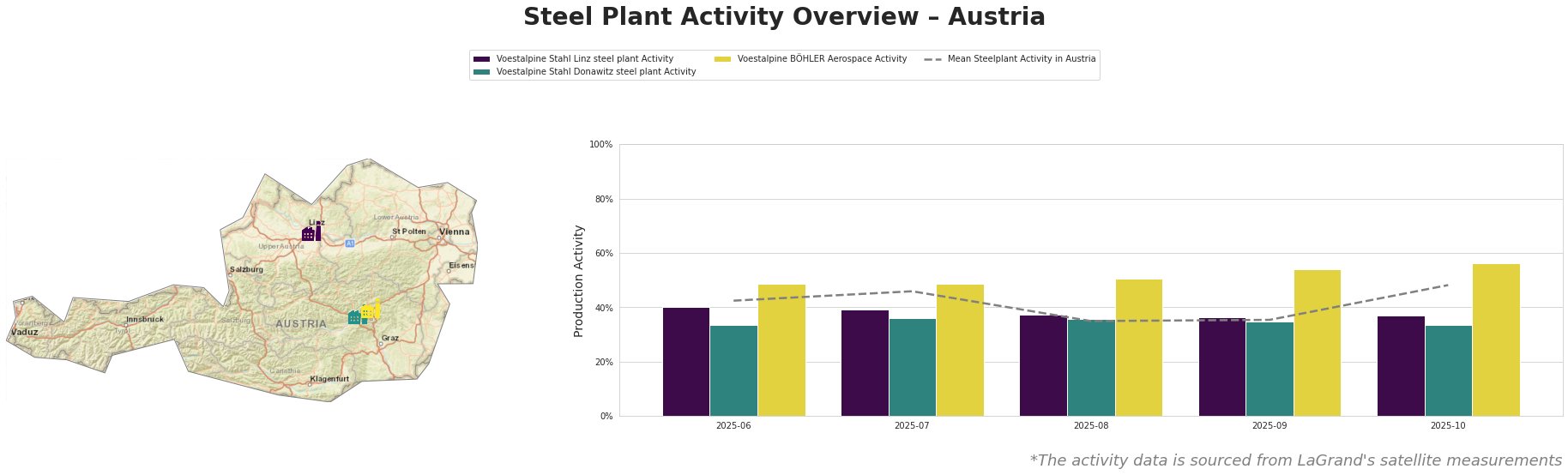

Over the observed months, the mean activity level across steel plants in Austria peaked at 48.0% in October after dipping to its lowest at 35.0% through August and September. The Voestalpine BÖHLER Aerospace steel plant has consistently outperformed, reaching 56.0% activity in October, while both Voestalpine Stahl Linz and Donawitz showed less stability with declines back to 37.0% and 34.0%, respectively. The increases and decreases in activity do not appear to correlate with the developments highlighted in the news articles pertaining to coal production in Australia, leaving their direct impact on Austrian steel production levels unclear.

Voestalpine Stahl Linz steel plant

The Voestalpine Stahl Linz plant, with a crude steel capacity of 6 million tonnes, is significant for producing semi-finished and finished rolled steel using a blast furnace and basic oxygen furnace (BOF) technologies. Activity dropped notably to 40.0% in June, followed by a modest recovery to 46.0% in July, yet fell again to 37.0% in October. These swings in activity do not correlate with specific news events; hence, the reasons behind these fluctuations remain tied to market conditions rather than the external pressures reported in the coal industry.

Voestalpine Stahl Donawitz steel plant

The Voestalpine Stahl Donawitz plant has a crude steel capacity of 1.57 million tonnes, utilizing similar processes. Its observed activity also declined, stabilizing around 36.0% to 35.0% from July to September, ultimately dropping to 34.0% by October. Like its Linz counterpart, Donawitz’s performance does not show a direct link to the external Australian coal developments, which complicates pinpointing external impacts on local production activities.

Voestalpine BÖHLER Aerospace

With no crude steel but specialized in aerospace applications, Voestalpine BÖHLER Aerospace has shown consistent activity peaks, hitting 56.0% in October, reflecting its robust niche market position. This performance could signal increased demand in specialized sectors despite broader market pressures documented in the news.

Evaluated Market Implications

Given the fluctuations in observed activities with no direct link to the Australian coal supply disruptions, steel buyers should closely monitor the performance and activity levels of Voestalpine’s production facilities. With the potential for continued volatility, especially at the Linz and Donawitz plants, procurement strategies must focus on establishing firm contracts with suppliers to hedge against unexpected supply interruptions. Increased prices stemming from demand and external influences may necessitate proactive stocking and diversifying supply channels in light of the broader coal market dynamics as indicated in “Queensland coal mining in Australia is declining for the fifth time.”