From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSteel Market in South America: Negative Sentiment Amid Political Uncertainties

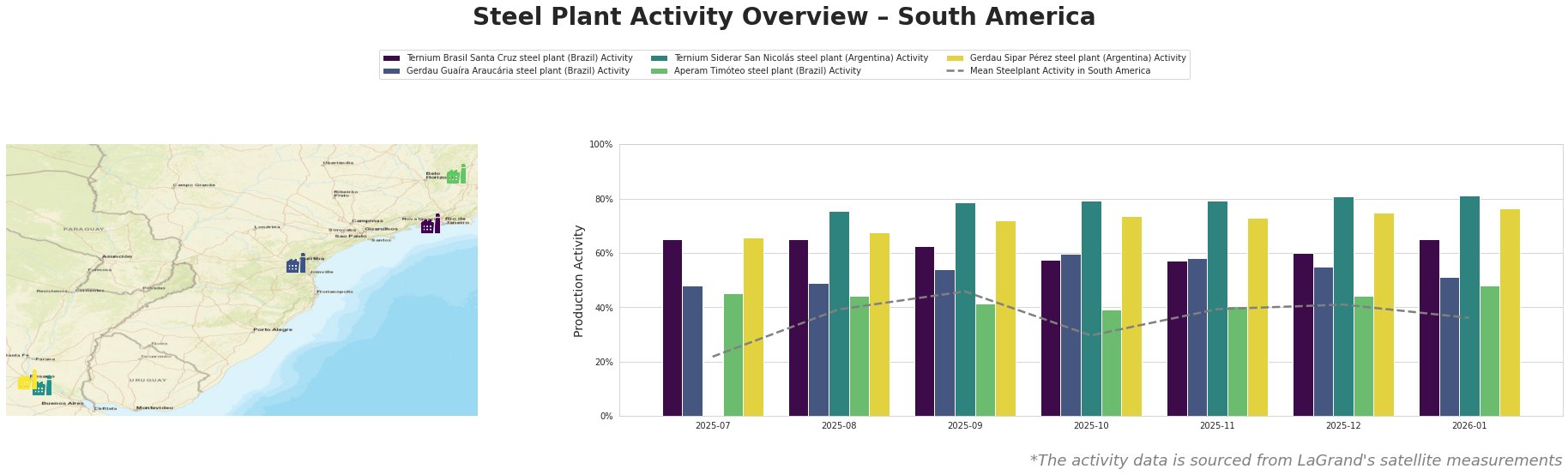

Recent observations indicate a decline in steel plant activity across South America, primarily influenced by ongoing political instability and economic uncertainty. The article “Opec+ waiting for Venezuela clarity“ discusses the challenges surrounding Venezuela’s oil sector, reflecting broader regional tensions that disrupt steel supply dynamics. Concurrently, we note fluctuating activity at steel plants, as evidenced by satellite data, indicating a negative trend.

The Ternium Brasil Santa Cruz plant shows a stable high activity of 65% but faces increasing operational risks due to the regional instability discussed in “Opec+ waiting for Venezuela clarity,” which could impact raw material supplies in the future.

Gerdau Guaíra Araucária displays a recent increase to 51% but remains lower than its historical activity of 54%; the ongoing political crisis could affect this plant’s incoming materials, echoing concerns raised in “Venezuela defies US call to end aid for Cuba: Update.”

Contrarily, the Ternium Siderar San Nicolás plant has maintained a robust activity level of 81%, reflecting consistency in its output, although this may not be sustainable if regional supply issues worsen.

The Aperam Timóteo steel plant witnessed a recent boost to 44%, linked to the resumed flows outlined in “Naphtha flows to Venezuela via traders resume,” which are vital for its operations but depend on political developments in Venezuela.

Gerdau Sipar Pérez’s operation remains relatively stable at 76%, but similar uncertainty around inputs could generate future risk.

Given the current landscape, we recommend steel buyers to consider:

1. Advance Procurement: Secure contracts immediately as political unrest could further destabilize supply channels.

2. Diversification of Suppliers: Explore sourcing from alternative markets outside South America to mitigate dependency on fluctuating local operations.

3. Monitor Political Developments: Closely watch Venezuela’s political situation, as it is critical to anticipate potential disruptions in supply, particularly concerning raw materials essential for operations.

Engagement with plants currently operating at reduced capacity may be beneficial to bolster inventory ahead of possible future shortages.