From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSteel Market Dynamics in Asia: Positive Growth Ahead as Plant Activities Surge

Investors and buyers in Asia’s steel market can expect a very positive outlook as observed satellite activity data show significant improvements across various steel plants. Notably, amid heightened trade tensions reflected in articles such as “Stock market today: Dow, S&P 500, Nasdaq rise to kick off big week of Big Tech earnings, Fed meeting”, recent trends indicate robust activity levels that correlate with increasing demand.

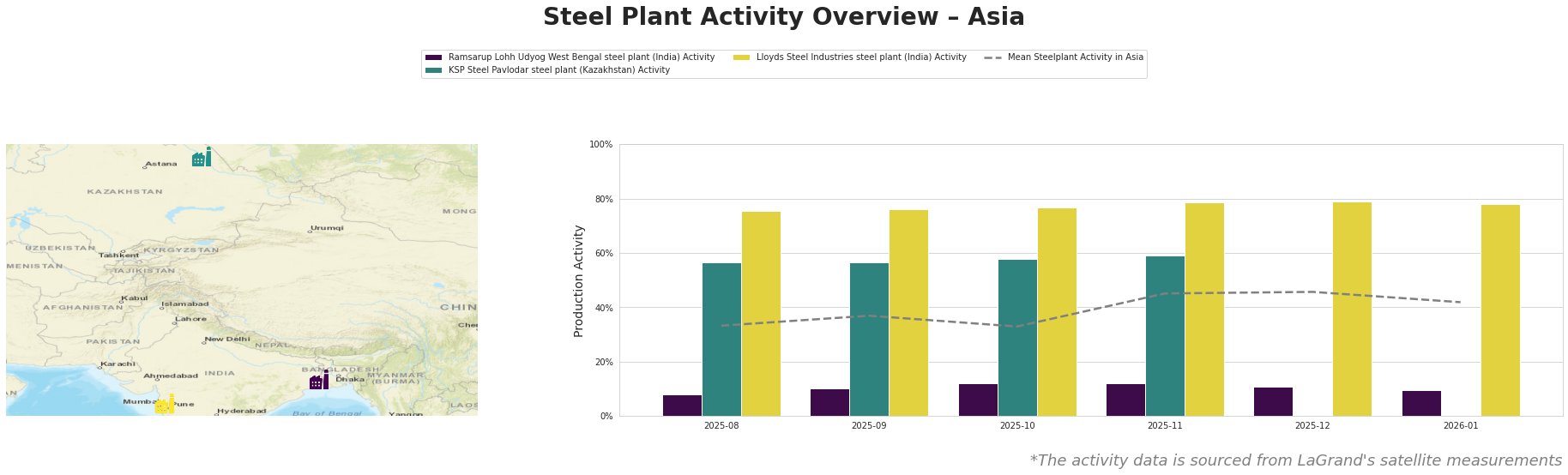

Recent months showcase a marked correlation between increased steel production activities and market dynamics. For instance, KSP Steel Pavlodar demonstrated a peak activity level of 59% in November 2025, aligning with regional demand surges noted in the stock market developments surrounding AI advancements in the same timeframe. Conversely, Ramsarup Lohh Udyog has shown lower activity levels, consistently below the mean at 10%, with no identifiable connections to recent news outcomes.

Lloyds Steel Industries remains a strong player, reaching an activity of 79% by the end of December 2025, which indicates stable demand and operational efficiency, paralleling bullish sentiments across technology-driven sectors as highlighted in “Stock market today: S&P 500 breaches 7,000 mark Wall Street braces for Fed decision, Big Tech earnings.” In contrast, the cessation of activity data for KSP Steel in late December could signal operational adjustments or planned downtime, which remains unevaluated against market trends.

Recommended actions for steel buyers include focusing on sourcing from Lloyds Steel Industries due to their solid activity levels and responsiveness to market demands. Additionally, monitoring KSP Steel’s performance could present opportunities for procurement at fluctuating activity levels. Conversely, contemplating partnerships or enhanced engagement with Ramsarup Lohh Udyog may yield competitive pricing, given their currently subdued operational capacity and potential for expansion.

Steel market participants should remain vigilant to these developments and strategically align their purchasing strategies to capitalize on expanding production capacities and fluctuating market dynamics.