From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSteel Market Analysis: South America Faces Neutral Sentiment Amid Political and Economic Challenges

In South America, the recent political shifts in Venezuela, particularly the developments surrounding President Trump’s push for US oil investment following the capture of Nicolas Maduro, have led to fluctuating market conditions for steel. Articles titled “Reviving Venezuela’s oil industry no easy feat: Update“ and “Rebuilding Venezuela’s oil industry no easy feat“ highlight potential struggles in revitalizing the Venezuelan oil sector, which may indirectly influence steel price dynamics due to increased competition for resources and workforce. However, no direct correlation can be made between these articles and recent satellite data activity levels from steel plants.

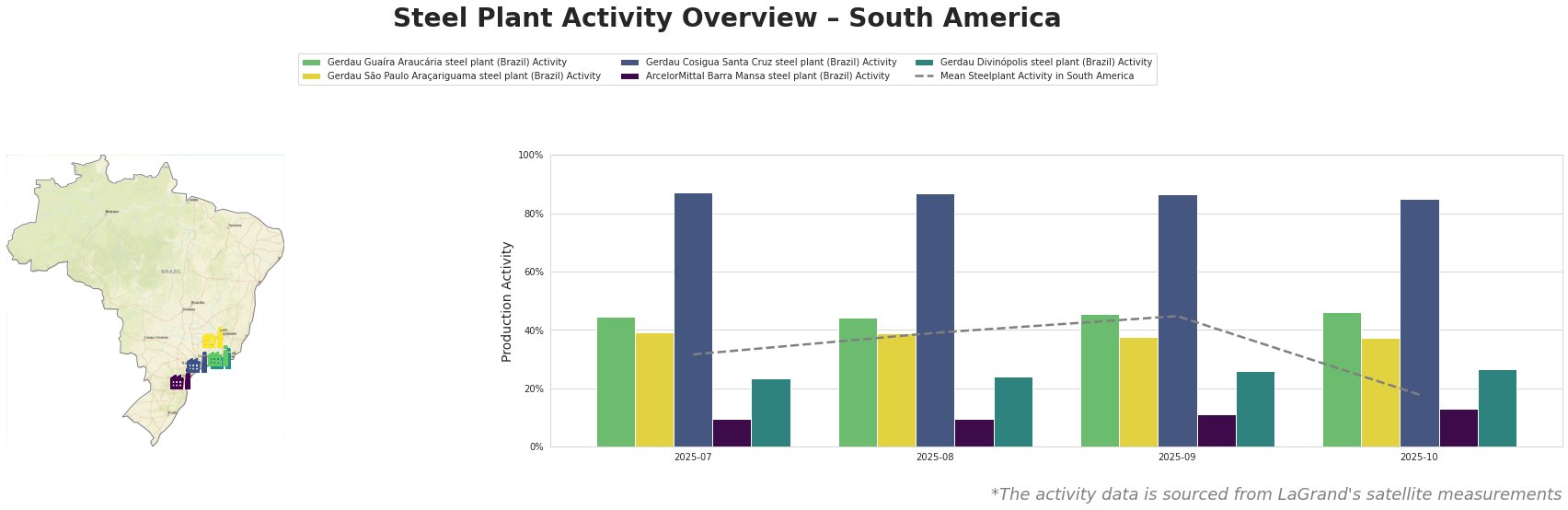

Activity across the steel plants observed revealed significant fluctuation, especially marked by a notable drop in mean activity in October to 18%, down from a high of 45% in September. Specifically, the Gerdau Cosigua Santa Cruz plant maintained relatively high activity levels (86-87%) in the previous months but showed a slight decrease in October. Conversely, Gerdau Guaíra Araucária’s activity remained stable at 46% without a defined downward trend, which indicates potential resilience amid shifting market conditions.

The Gerdau Guaíra Araucária plant, located in Paraná, has shown an ongoing activity rate of around 45% to 46%, with a capacity of 540,000 tons and focusing on electric arc furnace production, critical for semi-finished goods. This stability may be influenced by the lack of direct market competition due to external political factors affecting the energy sector, as discussed in the articles.

Across the board, Gerdau São Paulo Araçariguama, although slightly fluctuating with a drop to 37%, remains a key player with a higher capacity (950,000 tons) producing rebar and other finished goods. Its proximity to São Paulo’s urban market emphasizes its strategic advantage, though its slight decrease could reflect broader macroeconomic uncertainties tied to the oil sector as highlighted by “Trump touts oil meetings after Venezuela ouster.”

Given the overall neutral market sentiment alongside observed fluctuations, buyers and analysts are advised to closely monitor the steel plants, particularly Gerdau Cosigua Santa Cruz, which remains a crucial supplier within the region despite slight dips. Ensuring procurement strategies account for local market volatility, contingent upon external political developments in Venezuela, is essential as this could affect supply continuity and pricing strategies.

No direct links have been established between observed plant activity and the fluctuating oil and political dynamics in Venezuela, emphasizing the importance of staying informed on both local and global landscapes for effective procurement decision-making.