From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSteel Market Analysis: Negative Sentiment Prevails in Asia Amidst Geopolitical Tensions

In Asia, the sentiment in the steel market has shifted to negative, driven primarily by geopolitical tensions impacting supply chains. Recent news articles, such as “US captures Maduro after strikes in Venezuela: Update” and “US sanctions more oil tankers tied to Venezuela”, highlight significant disturbances in the region, which correlate with declining satellite-observed activity levels across key steel plants.

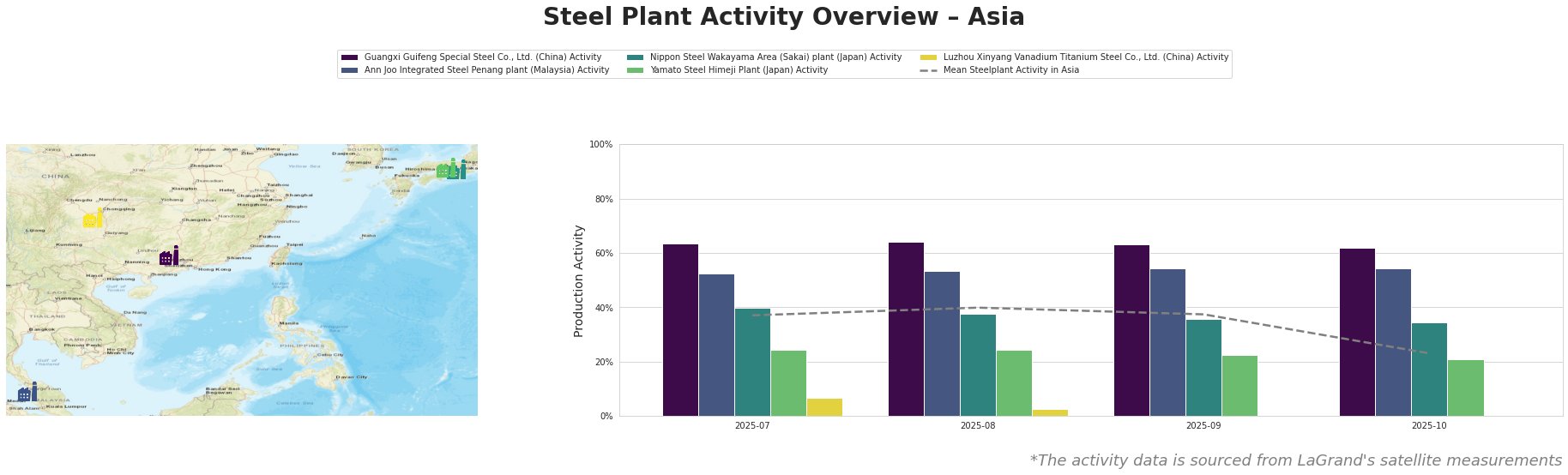

The observed data illustrates a downward trend in overall activity, with the mean steelplant activity dropping from 40.0% in August to a low of 23.0% by October. Guangxi Guifeng maintained relatively high activity levels, yet saw a minor decrease from 64.0% to 62.0%. In contrast, Luzhou Xinyang exhibited a catastrophic plummet from 7.0% in July to 0.0% by September, indicating a complete halt. Notably, the actions described in “US sanctions more oil tankers tied to Venezuela” correlate indirectly as supply constraints from Venezuela may ripple into the Asian steel market due to increased global oil prices.

Guangxi Guifeng Special Steel Co., Ltd. operates primarily with EAF technology and serves the building and infrastructure sectors. While activity remained relatively robust, the reported slippage in performance (from 64.0% to 62.0%) may reflect broader market uncertainties stemming from geopolitical events, particularly the developments surrounding Venezuelan oil sanctions.

The Ann Joo Integrated Steel Penang plant, which produces both crude and semi-finished steel products, maintained an activity level of 54.0% through late October. This stability may indicate resilience against current tensions, though the potential for supply disruptions remains—particularly as international sanctions impact raw material availability.

Nippon Steel’s Wakayama facility also encountered decreased levels, highlighting a slightly lower robustness; its activity dipped from 40.0% to 34.0%. The overarching uncertainties in oil supply due to the “US captures Maduro after strikes in Venezuela: Update” may pose future risks to operational continuity for such plants.

Yamato Steel’s performance mirrored a decline with activity falling to 21.0%, signifying ongoing challenges. Meanwhile, Luzhou Xinyang’s operations ceased entirely, severely impacting their capability to service demand.

Given the outlined market dynamics and observed data, steel procurement professionals should shift focus to securing inventories immediately to hedge against anticipated disruptions from geopolitical tensions linked to Venezuela’s oil exports affecting input costs. Maintaining a diversified supplier network will be crucial to mitigate risks arising from sudden supply chain interruptions across Asia.