From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSpanish Steel Market Resilient: Car Registrations Surge Drives Positive Outlook Despite Activity Fluctuations

Spain’s steel market shows a very positive outlook, primarily driven by the automotive sector’s strong performance. This is reflected in the news article “The number of new cars registered in the EU increased by 0.9% in January-September 2025“, which highlights a significant 14.8% increase in Spanish car registrations during this period. “New car registrations in EU up 0.9 percent in Jan-Sept 2025” reinforces this positive trend. While a direct and immediate correlation between increased car production and real time steel plant activity levels is difficult to establish with these news reports, the overall positive sentiment suggests sustained demand for steel products.

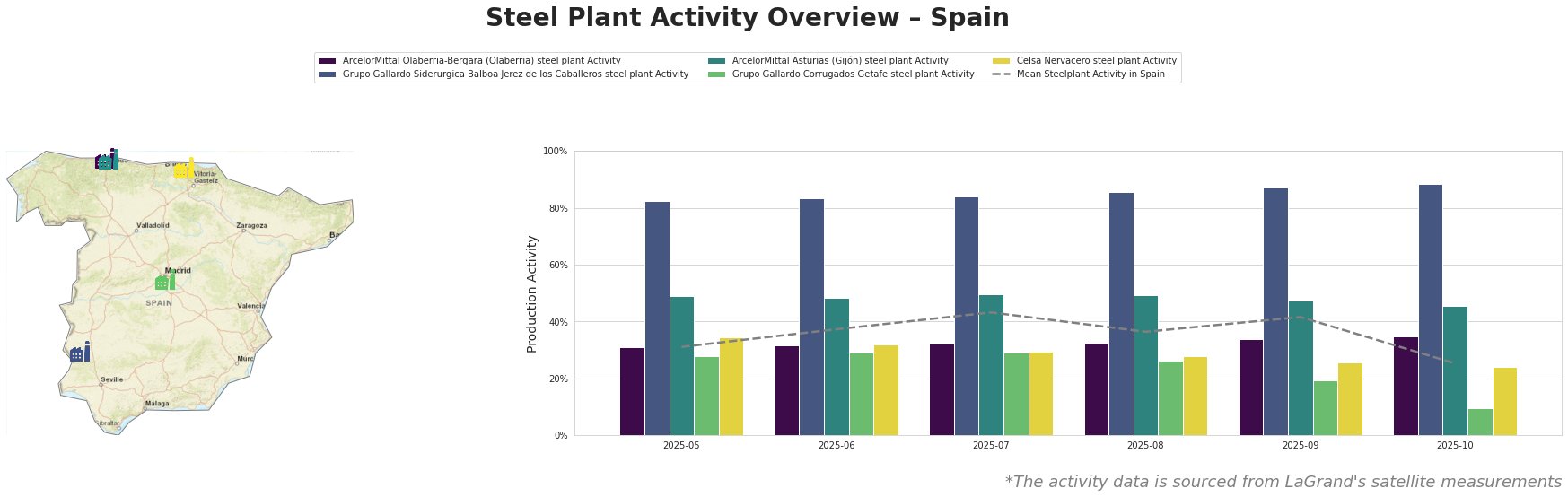

The mean steel plant activity in Spain fluctuated from May to October 2025, peaking at 43% in July and then dropping significantly to 25% in October. Grupo Gallardo Siderurgica Balboa Jerez de los Caballeros consistently operated at a high level, reaching 88% in October, significantly above the national average. ArcelorMittal Olaberria-Bergara shows a modest increase, while ArcelorMittal Asturias fluctuates around the mean. Notably, Grupo Gallardo Corrugados Getafe experienced a sharp decline from 28% in May to 10% in October. Celsa Nervacero shows a gradual decrease.

ArcelorMittal Olaberria-Bergara (Olaberria) steel plant, with a BOF capacity of 4200 ttpa, primarily produces semi-finished and finished rolled flat products, galvanized coil, and tin plate. The plant’s activity has seen a slight increase over the observed period, rising from 31% in May to 35% in October. While this increase is positive, its limited magnitude means no direct link can be immediately established with the increased car registrations reported in “The number of new cars registered in the EU increased by 0.9% in January-September 2025”.

Grupo Gallardo Siderurgica Balboa Jerez de los Caballeros steel plant, an EAF-based plant with a 1300 ttpa crude steel capacity, specializes in round bars, profiles, and wire. This plant has consistently demonstrated very high activity levels, increasing from 82% in May to 88% in October. The strong and steady output may be indirectly related to demand from the automotive sector indicated in “The number of new cars registered in the EU increased by 0.9% in January-September 2025”, however no direct causal relationship can be derived from the available information.

ArcelorMittal Asturias (Gijón) steel plant, an integrated BF-BOF plant with a 1200 ttpa crude steel and 4200 ttpa iron capacity, produces long plate, wire rod, and rail. Its activity has remained relatively stable, fluctuating between 45% and 50%. The lack of significant growth despite overall market positivity and car registration increases, as reported in “New car registrations in EU up 0.9 percent in Jan-Sept 2025”, suggests that its product mix might be less directly impacted by automotive demand.

Grupo Gallardo Corrugados Getafe steel plant, an EAF-based plant with a 600 ttpa crude steel capacity, produces billet, rebar, and coil. This plant has experienced a sharp decline in activity, dropping from 28% in May to 10% in October. No direct connection with news articles can be established. This warrants close monitoring, as the decline could indicate localized challenges or strategic production adjustments unrelated to broad market trends.

Celsa Nervacero steel plant, an EAF-based plant with a 1000 ttpa crude steel capacity, produces billet, rebar, bars, tube and coils. The activity has seen a gradual decrease from 34% in May to 24% in October. No direct connection with news articles can be established.

Given the overall positive market sentiment driven by increased car registrations in Spain, steel buyers should:

- Prioritize securing supply from Grupo Gallardo Siderurgica Balboa: This plant consistently operates at high activity levels, suggesting a reliable supply source. Given the rise to 88% in October, they appear well-positioned to meet increased demand.

- Closely monitor Grupo Gallardo Corrugados Getafe: The significant drop in activity warrants caution. Diversify supply sources for products typically sourced from this plant to mitigate potential disruptions.

- Factor in potential price increases: Increased demand, as indicated by car registration growth, could exert upward pressure on steel prices. Negotiate contracts with built-in flexibility to adjust for market fluctuations.

- Monitor ArcelorMittal Asturias (Gijón): While production is stable, monitor for potential shifts related to overall market trends, even if it doesn’t show an immediate correlation.