From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSouth Korea’s Anti-Dumping Duties & Asian Steel Plant Activity Downtrend Signal Procurement Challenges

South Korea’s imposition of anti-dumping duties on HRC imports from China and Japan, as reported in “S. Korea imposes provisional AD on HRC from China and Japan,” follows earlier news of potential duties in “South Korea considers anti-dumping duties on hot-rolled steel from China and Japan” and “South Korea reacts to dumping of steel from Asia-duties are possible as early as August“. These developments coincide with a notable decrease in mean steel plant activity across Asia, suggesting potential supply chain disruptions. However, a direct connection between the anti-dumping duties and the specific observed plant activities cannot be definitively established from the provided data.

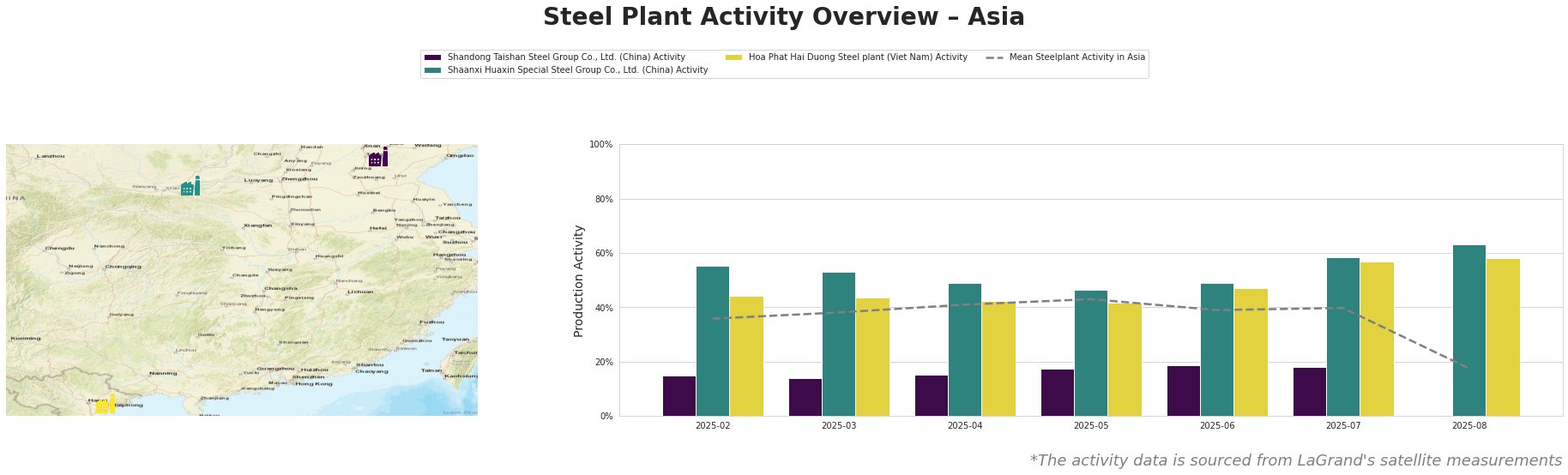

The mean steel plant activity in Asia shows a significant drop in August to 18.0%, a large decrease from 40.0% in July.

Shandong Taishan Steel Group Co., Ltd., an integrated BF-based steel plant producing finished rolled products, including hot rolled coil, operated consistently below the Asian average. Its activity levels remained relatively stable between February and July, ranging from 14.0% to 19.0%. Data for August is not available. Given the anti-dumping duties imposed by South Korea as described in “S. Korea imposes provisional AD on HRC from China and Japan“, and that Shandong Taishan Steel Group produces hot rolled coil, it is possible, although not confirmed by the data, that production is being altered in response to the new duties.

Shaanxi Huaxin Special Steel Group Co., Ltd., an electric arc furnace (EAF) based plant producing rolled round steel plate, hot rolled steel, and hot-rolled ribbed rebar, initially displayed activity levels above the Asian mean. However, activity decreased from 55.0% in February to 46.0% in May, before rising significantly to 63.0% in August. There is no direct news connection to explain this rise.

Hoa Phat Hai Duong Steel plant in Vietnam, an integrated BF-BOF plant producing construction steel, hot rolled coil, and other products, also operated above the Asian average. Plant activity rose from 44.0% in February and March to 58.0% in August. There is no direct news connection to explain this rise.

Given the imposition of anti-dumping duties in South Korea and the significant drop in overall steel plant activity in Asia, steel buyers should:

- Diversify HRC supply sources: As South Korea imposes duties on Chinese and Japanese HRC, buyers reliant on these sources should actively seek alternative suppliers in other regions to mitigate potential price increases and supply constraints.

- Monitor Vietnam HRC pricing: Given the recent anti-dumping duties implemented by Vietnam on certain Chinese HRC products, and the increased plant activity at Hoa Phat Hai Duong Steel plant, Vietnamese-sourced HRC may become a more attractive and potentially less volatile supply option for buyers in the region.