From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSouth Korean Steel Faces EU Export Pressure Amidst Production Fluctuations

South Korea’s steel market faces growing challenges due to tightening EU import quotas and fluctuating domestic production. The articles “Most EU steel import quotas nearly exhausted as Q2 ends” and “Most EU steel import quotas are almost exhausted by the end of the second quarter” highlight that South Korea has already exhausted its quotas for HRC and organic coated sheets, potentially impacting future exports. Satellite data shows a recent decline in overall steel plant activity, but no direct relationship with these news articles can be definitively established.

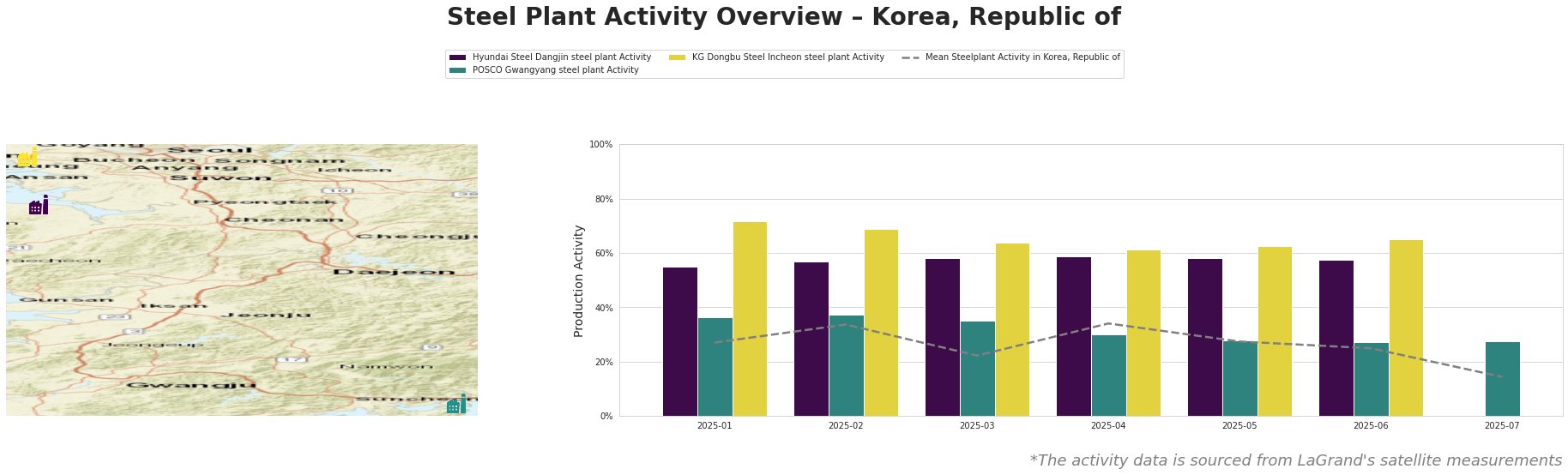

Monthly Steel Plant Activity in Korea, Republic of

The mean steel plant activity in Korea, Republic of has shown volatility. While the activity peaked in February and April at 34%, there was a significant drop to 14% in July.

Hyundai Steel Dangjin steel plant: This integrated BF/BOF plant, with a crude steel capacity of 16.6 million tonnes per annum (mtpa), has shown relatively stable activity, fluctuating between 55% and 59% from January to June. This activity does not immediately reflect the challenges posed by the EU quota exhaustion described in the news articles.

POSCO Gwangyang steel plant: A major integrated steel producer with 23 mtpa crude steel capacity. POSCO Gwangyang steel plant activity has been consistently below the Hyundai Steel Dangjin steel plant and KG Dongbu Steel Incheon steel plant and the mean activity level across all observed plants in Korea. Activity declined from 36% in January to 27% in June and remained at 27% in July. This downward trend might reflect broader market pressures, but no direct correlation with the news articles on EU quotas can be established.

KG Dongbu Steel Incheon steel plant: This EAF-based plant, with a relatively smaller capacity of 0.7 mtpa, has shown the highest activity levels among the observed plants, ranging from 61% to 72%. This comparatively high activity could be due to its focus on different product segments than those affected by EU quotas or stronger domestic demand. There is no directly apparent link to the EU quota news.

Evaluated Market Implications

The exhaustion of EU import quotas for HRC and organic coated sheets from South Korea, as reported in “Most EU steel import quotas nearly exhausted as Q2 ends” and “Most EU steel import quotas are almost exhausted by the end of the second quarter,” creates potential supply disruption for European buyers of these specific products.

Recommended Procurement Actions:

- For European Steel Buyers relying on South Korean HRC and Organic Coated Sheets: Immediately diversify supply sources to mitigate potential shortages due to quota limitations. Consider alternative suppliers from countries with remaining quota availability or explore domestic options, accepting potential price adjustments.

- For Analysts: Closely monitor the activity of Hyundai Steel Dangjin steel plant, a major HRC producer, in the coming months. Any significant drop in activity combined with further restrictions on EU quotas would signal increased pressure on European HRC supply, as Hyundai Steel Dangjin steel plant’s activity hasn’t yet responded. Continuously analyzing potential changes is crucial.