From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSouth Korea Steel: Rising EU Exports Despite Production Fluctuations – Procurement Strategies

South Korea’s steel market is seeing increased exports to the EU, as highlighted in multiple EUROFER reports, including “EUROFER: EU’s finished steel imports decrease in Q1” and “EUROFER: Imports of finished steel products from the EU decreased in the first quarter“, despite some fluctuations in domestic steel plant activity. While these reports highlight South Korea as a key exporter to the EU, accounting for 13.5% of finished steel imports in Q1 2025, direct links between increased exports and observed plant activity levels are not explicitly established by the news articles.

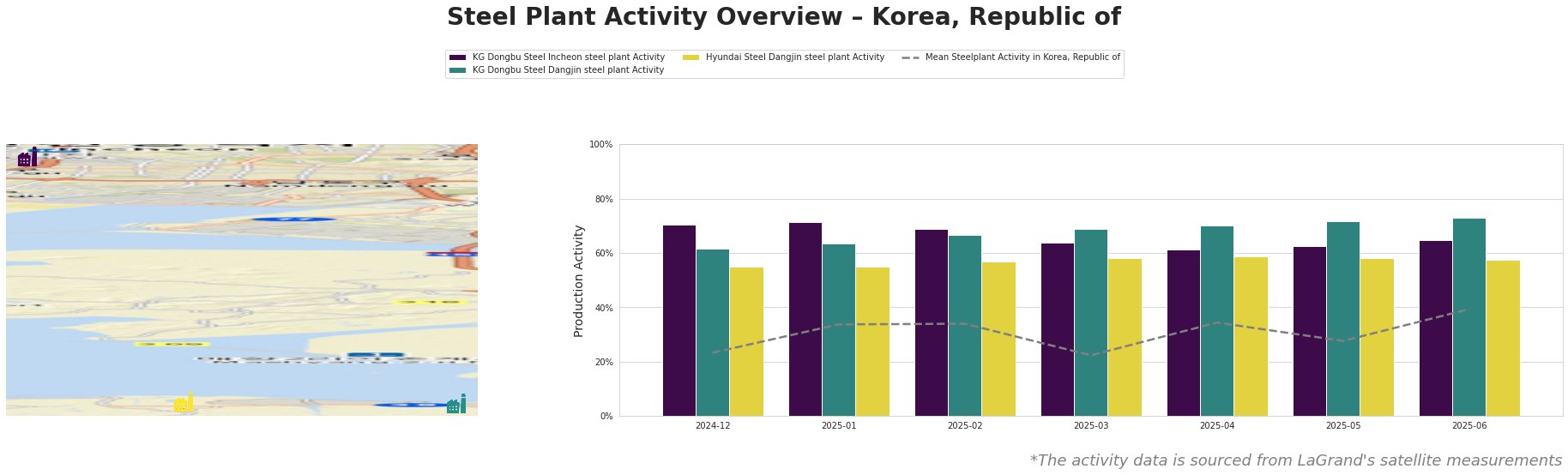

Overall, the mean steel plant activity in Korea, Republic of shows an upward trend towards the end of the observed period, reaching 39.0% in June 2025, a significant increase from 23.0% in December 2024. Individual plant activity varies. KG Dongbu Steel’s Incheon plant shows relatively high activity compared to the national mean, ranging from 61.0% to 72.0% but ending the period at 65.0%. KG Dongbu Steel’s Dangjin plant exhibits consistent growth, peaking at 73.0% in June 2025. Hyundai Steel’s Dangjin plant activity remains relatively stable, fluctuating between 55.0% and 59.0%.

KG Dongbu Steel’s Incheon plant, an EAF-based facility with a 700ktpa crude steel capacity focusing on semi-finished and finished rolled products like bars and cold-rolled strips, has shown activity between 61% and 72% over the last seven months. There is no direct correlation between activity changes at this plant and the EUROFER reports.

KG Dongbu Steel’s Dangjin plant, another EAF-based facility but with a larger 3000ktpa crude steel capacity and similar product portfolio to its Incheon counterpart, showcased steady increase in activity over the observation period, ending at 73% in June. This increase does not show a correlation with specific events mentioned in the EUROFER reports.

Hyundai Steel’s Dangjin plant, an integrated BF/BOF/EAF facility with a substantial 16,600ktpa crude steel capacity that produces hot/cold rolled sheet, heavy plate, galvanized steel, and rebar, maintained stable activity, ranging from 55% to 59% over the observed months. This plant’s flat activity levels are not directly linked to the EU export trends noted in the EUROFER reports.

Despite the EUROFER reports indicating increased exports from South Korea to the EU, the satellite-observed plant activity data does not provide a direct, verifiable correlation. Given the steady, and in some cases, increasing activity at key steel plants like KG Dongbu Steel Dangjin, there are no immediate indications of supply disruptions stemming directly from domestic production issues. However, procurement professionals should note the increased export volume to the EU could potentially impact domestic availability and pricing.

Recommended Procurement Actions:

- Monitor Domestic Pricing: Closely track domestic steel prices in Korea, Republic of to detect any upward pressure due to increased export demand to the EU, as highlighted in the “EUROFER: EU’s finished steel imports decrease in Q1” and related reports.

- Diversify Supply Options: While KG Dongbu Steel Dangjin plant is operating at a high activity level, indicating stable supply, explore alternative domestic and international suppliers to mitigate potential price increases and ensure supply security.

- Negotiate Long-Term Contracts: Secure long-term contracts with favorable pricing to buffer against potential market fluctuations driven by export demand.