From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSouth Korea Steel Market Reacts Positively to US-China Trade Deal; POSCO Gwangyang Ramps Up Production

South Korea’s steel market sentiment is very positive. Recent developments include a trade agreement between the U.S. and China, as highlighted in “Gipfel in Südkorea: Trump senkt die Zölle und China die Exportrestriktionen,” which is likely influencing the observed production increases at key steel plants. While “Trump arrives in South Korea for key talks ahead of APEC summit, Xi meeting — no Kim Jong Un reunion” and “Trump and Xi set for first face-to-face meeting in 6 years as major trade war looms over both nations” set the stage for potential trade improvements, a direct connection to immediate steel plant activity is not explicitly evident.

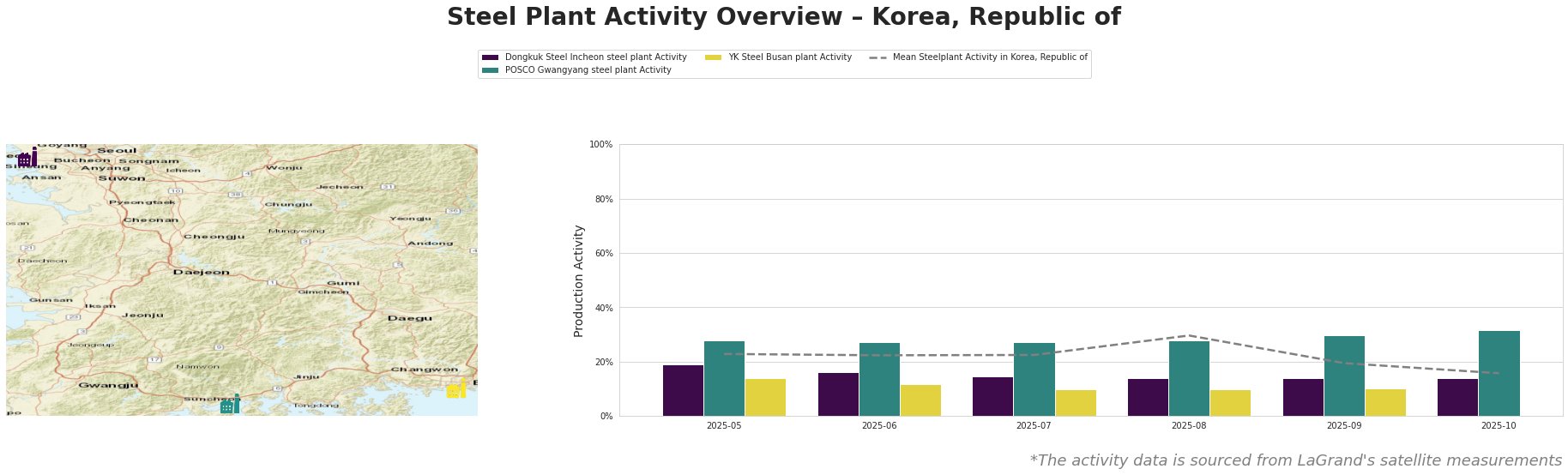

Overall, the mean steel plant activity in Korea, Republic of has fluctuated, reaching a peak of 30.0 in August before declining to 16.0 in October. Dongkuk Steel Incheon steel plant Activity has remained consistently low at 14.0 throughout the observed period. POSCO Gwangyang steel plant Activity has shown an upward trend, reaching 32.0 in October, significantly above the mean. YK Steel Busan plant Activity has been consistently low at 10.0.

Dongkuk Steel Incheon steel plant, an EAF-based facility in the Seoul National Capital Area with a crude steel capacity of 2,200 ttpa, has consistently shown the lowest activity level, remaining at 14.0%. Specializing in rebar for the automotive, building, and infrastructure sectors, its stable, low activity doesn’t directly correlate with the provided news articles, indicating plant-specific factors may be at play.

POSCO Gwangyang steel plant, a major integrated steel producer in South Jeolla with a crude steel capacity of 23,000 ttpa, utilizes BF and BOF technologies. The plant’s activity has steadily increased, culminating in a high of 32.0% in October. This upward trend may reflect the positive trade developments mentioned in “Gipfel in Südkorea: Trump senkt die Zölle und China die Exportrestriktionen,” allowing POSCO to capitalize on reduced tariffs and eased export restrictions to increase production of its diverse product range, including hot rolled steel, plate, and stainless steel.

YK Steel Busan plant, an EAF-based facility in South Gyeongsang with a crude steel capacity of 2,110 ttpa, primarily produces rebar and billets for the building and infrastructure sectors. Its activity has remained consistently low at 10.0%, with no apparent link to the provided news articles, indicating localized or company-specific operational factors may be responsible.

Evaluated Market Implications:

The increasing activity at POSCO Gwangyang, potentially driven by the U.S.-China trade deal (“Gipfel in Südkorea: Trump senkt die Zölle und China die Exportrestriktionen“), suggests a potential shift in supply dynamics.

-

Recommended Procurement Action for Steel Buyers and Analysts: Given POSCO Gwangyang’s increased production, steel buyers should prioritize negotiating contracts with POSCO for products like hot rolled steel, plate, and stainless steel to capitalize on potentially more favorable pricing due to increased supply.

-

Recommended Procurement Action for Steel Buyers and Analysts: Diversification of suppliers is recommended. Steel Buyers should cautiously monitor the market developments and consider diversifying procurement to mitigate potential risks from relying too heavily on a single supplier, in this case POSCO Gwangyang.