From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSouth America’s Steel Market Faces Challenges Amid Political Tensions

Recent developments in South America, particularly in Venezuela, have led to a negative sentiment in the steel market, as reported in articles like “Here’s what the smartest people in foreign policy, business, and economics are saying about Trump’s raid on Venezuela“ and “Reviving Venezuela’s oil industry no easy feat: Update“. The political unrest and U.S. military involvement might disrupt regional trade and supply chains, potentially affecting future steel production and prices.

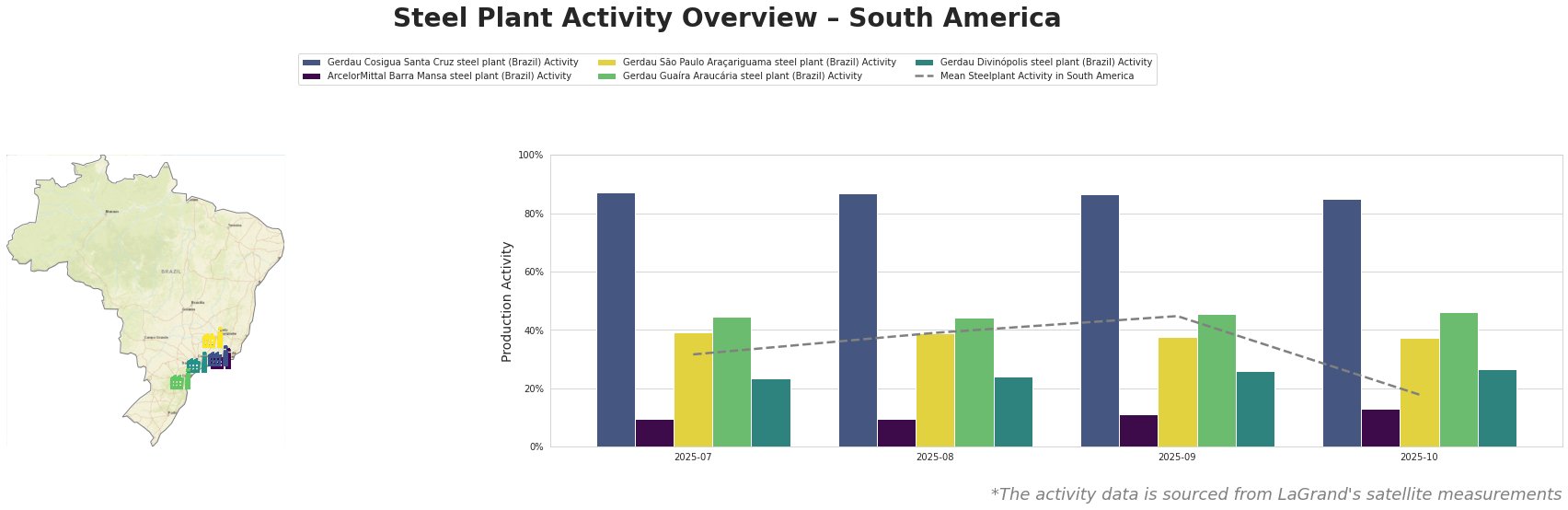

In July 2025, the Gerdau Cosigua Santa Cruz plant maintained high activity at 87%, consistent through August, reflecting its robust operational status amidst market uncertainty. Meanwhile, ArcelorMittal Barra Mansa remained notably low, peaking at just 13% in October, suggesting vulnerability in production capabilities. The average activity across all plants saw a significant drop from 45% in September to 18% in October. The overall trend aligns with concerns raised in the news articles regarding potential disruptions caused by geopolitical instability, although specific connections to individual plant performance were not established.

Gerdau Cosigua Santa Cruz, located in Rio de Janeiro and producing mainly finished rolled products, has demonstrated stability with its electric arc furnace technology. Its consistency contrasts sharply with the ArcelorMittal Barra Mansa steel plant, which reported a significant dip in activity levels from 11% in September to 13% in October. While the geopolitical uncertainties suggest potential ramifications on supply and operational stability, the lack of direct correlation with specific news articles means that broader impacts remain speculative.

The Gerdau São Paulo Araçariguama plant, with a 38% activity rate in October, reflects similar challenges. Despite its operational capacity for both semi-finished and finished products, the regional market dynamics highlighted in the articles suggest that rising political tensions could complicate supply chains, particularly for key input materials.

Given the current market conditions marked by instability, buyers are advised to secure steel supplies promptly before potential sanctions or operational interruptions create scarcity. Close monitoring of the geopolitical situation and its implications on trade is essential to mitigate risks. The events in Venezuela could signal larger shifts that may impact regional manufacturers’ capacities, making immediate procurement engagements prudent for steel buyers.