From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSouth American Steel Surges: Green Initiatives Fuel Production Growth Despite COP30 Uncertainty

South America’s steel market displays a very positive sentiment, fueled by ambitious decarbonization targets. News articles like “Brazil miners eye cutting emissions by 90pc by 2050” signal a shift towards low-carbon steel production. While activity levels at some specific plants declined in October 2025, the initiative aligns with Brazil’s broader environmental agenda at the upcoming COP30 summit, reflected in articles such as “Cop 30 presidency looking to ‘advance negotiations’” and “COP presidency advances action agenda“. However, no direct causal relationship between these news articles and specific steel plant activity changes can be conclusively established based solely on the data provided.

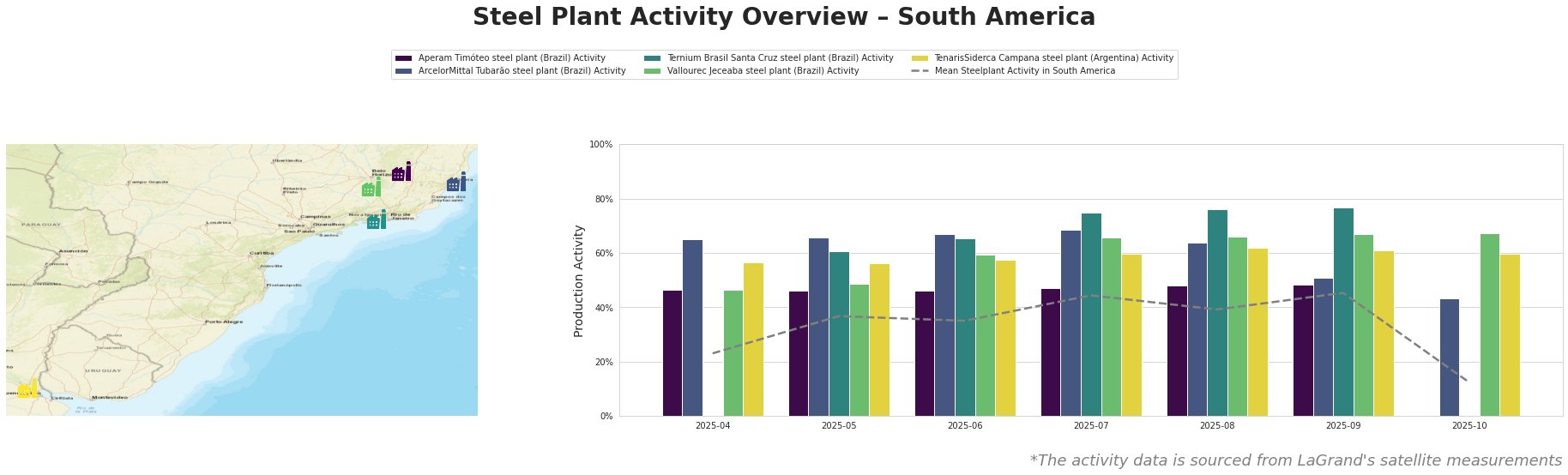

The mean steel plant activity in South America experienced an increase between April and September 2025, from 23.0% to 45.0%, before a significant drop to 12.0% in October. ArcelorMittal Tubarão’s activity consistently remained high, peaking at 68.0% in July before decreasing to 43.0% in October. Ternium Brasil Santa Cruz showed significant growth reaching a peak of 77.0% in September. Vallourec Jeceaba steel plant also maintained a generally increasing trend with a peak activity of 67.0% in October. TenarisSiderca Campana steel plant had relatively stable activity levels around 60% throughout the period.

Aperam Timóteo steel plant: An integrated (BF) plant in Minas Gerais, Brazil, with a crude steel capacity of 900 ttpa. While the plant activity remained fairly consistent between 46% and 48% from April to September, no data is available for October. Aperam Timóteo uses charcoal from cultivated eucalyptus forests, as a substitute for coke. This aligns with the sentiment of the news article “Brazil miners eye cutting emissions by 90pc by 2050“, as using charcoal contributes to lower emissions, but no explicit connection can be established to the October reading.

ArcelorMittal Tubarão steel plant: This integrated (BF) plant in Espírito Santo, Brazil, with a large crude steel capacity of 7,500 ttpa, showed high activity levels, peaking at 68.0% in July. However, there was a significant drop to 43.0% in October. Given the scale of this plant, a significant drop in activity could impact slab availability. While aiming to generate 115% of its energy from gases in the production process, which speaks to commitments made at COP 28 as highlighted in “Fossil fuels in Cop 30 action agenda spotlight“, no explicit relationship can be established between the environmental news and plant activity.

Ternium Brasil Santa Cruz steel plant: This integrated (BF) plant in Rio de Janeiro, Brazil, with a crude steel capacity of 5,200 ttpa, demonstrated a steady increase in activity, reaching 77.0% in September. This high activity may be linked to increased demand for slabs, although activity data is missing for October. The plant generates all of its own energy using gases from the production process, but no connection can be established between its activity and any specific COP-related news.

Vallourec Jeceaba steel plant: An integrated (BF) plant in Minas Gerais, Brazil, producing seamless steel pipes with a crude steel capacity of 1,000 ttpa. The activity showed a general upward trend with a peak activity of 67.0% in October. This increase could be related to the demand for pipes in the energy sector. The plant sources iron ore locally, including from the Pau Branco mine. No explicit link can be established between observed plant activity changes and the provided news articles.

TenarisSiderca Campana steel plant: An integrated (DRI) plant in Buenos Aires, Argentina, producing seamless steel pipes, with a crude steel capacity of 1,300 ttpa. The plant demonstrated relatively stable activity levels. TenarisSiderca’s use of DRI technology may reflect broader environmental concerns discussed in the news, but no specific link to reported activity can be established.

Evaluated Market Implications:

The observed activity drop in October at ArcelorMittal Tubarão, a major slab producer, presents a potential supply disruption risk, especially for customers relying on slabs. While the causes for this drop are not explicitly stated, it warrants close monitoring.

Recommended Procurement Actions:

- Slab Buyers: Closely monitor ArcelorMittal Tubarão’s production updates. Diversify slab sourcing to mitigate potential disruptions caused by the observed activity decrease.

- Seamless Pipe Buyers (Energy Sector): Given the stable and recently increased activity at Vallourec Jeceaba and TenarisSiderca Campana, ensure contract security and explore potential volume increases.