From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSouth American Steel Sector Poised for Growth Amidst Climate Initiatives: Monitor Argentina’s TenarisSiderca

South America’s steel market shows positive momentum as Brazil commits to climate goals. Observed changes in steel plant activity relate to news such as “Brazil, GCF to draw $1bn to climate fund” as Brazil seeks to attract private investment for sustainable development, and are likely to lead to more sustainable steel production.

Brazil’s commitment to reducing GHG emissions, highlighted in “Brazil’s 2024 GHG emissions reach 6-year low“, aims to reduce emissions by 59-67% by 2035. This aligns with the upcoming UN Cop 30, as referenced in “Cop 30 success hinges on GHG cuts, finance response“, where climate targets will be discussed.

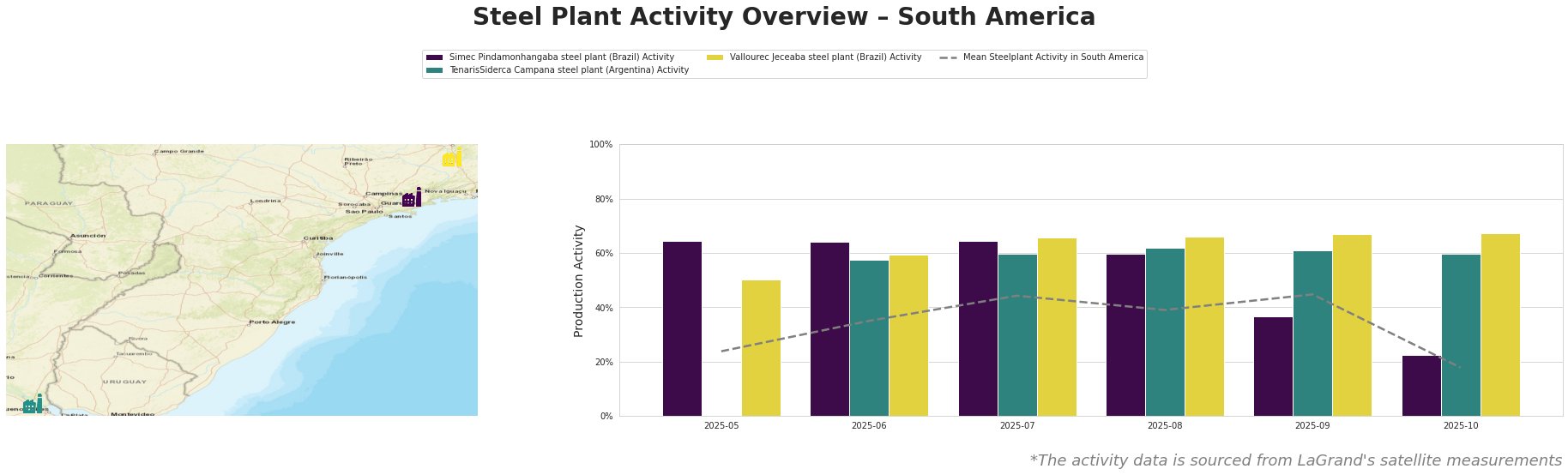

The mean steel plant activity in South America fluctuated, peaking at 45% in September 2025 before dropping to 18% in October 2025.

The Simec Pindamonhangaba steel plant in São Paulo, Brazil, which primarily produces finished rolled products like wire rod and rebar for the building and infrastructure sector using EAF technology, experienced a significant drop in activity from 64% in July 2025 to 23% in October 2025. While the plant has ResponsibleSteelCertification, no direct connection could be established with the news articles.

The TenarisSiderca Campana steel plant in Buenos Aires, Argentina, produces seamless steel pipes for the energy sector using integrated DRI and EAF processes. It showed relatively stable activity around 60% between June and October 2025. Its certifications include ISO14001 and ResponsibleSteelCertification. Given TenarisSiderca’s energy-sector focus, its stable activity may be linked to potential investments in sustainable energy projects, as facilitated by the “Brazil, GCF to draw $1bn to climate fund” article and could provide procurement opportunities.

Vallourec Jeceaba steel plant in Minas Gerais, Brazil, which produces seamless steel pipes for the energy sector using integrated BF and EAF processes, shows a consistent increase in activity, reaching 67% in September and October 2025. While certified by ResponsibleSteelCertification, there is no explicit evidence in the news articles to fully explain the consistently high activity level.

Based on the news and activity data, steel buyers should:

- Prioritize securing supply from TenarisSiderca (Argentina): The stable activity at the TenarisSiderca Campana plant, coupled with Brazil’s increased investments in sustainability, suggests a reliable supply of seamless steel pipes for the energy sector.

- Monitor Simec Pindamonhangaba (Brazil) for potential supply disruptions: The significant drop in activity at the Simec Pindamonhangaba plant warrants close monitoring. Buyers relying on wire rod and rebar from this plant should consider diversifying their supply base to mitigate potential disruptions.