From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSouth American Steel Market Strengthens Amidst COP30 Focus on Climate Action

South America’s steel market shows positive momentum, although no direct links between steel plant activity and climate goals can be explicitly established from the provided news articles. The market sentiment appears largely unaffected by the ongoing COP30 summit in Brazil, which, according to “Cop 30 braces for first test on divisive issues,” is grappling with contentious issues like climate finance. However, the focus on implementation of climate action plans as described in “COP30: Was Brasilien an Klimakonferenzen ändern will” could indirectly impact long-term investment strategies in the steel sector, although the satellite data does not reflect this currently.

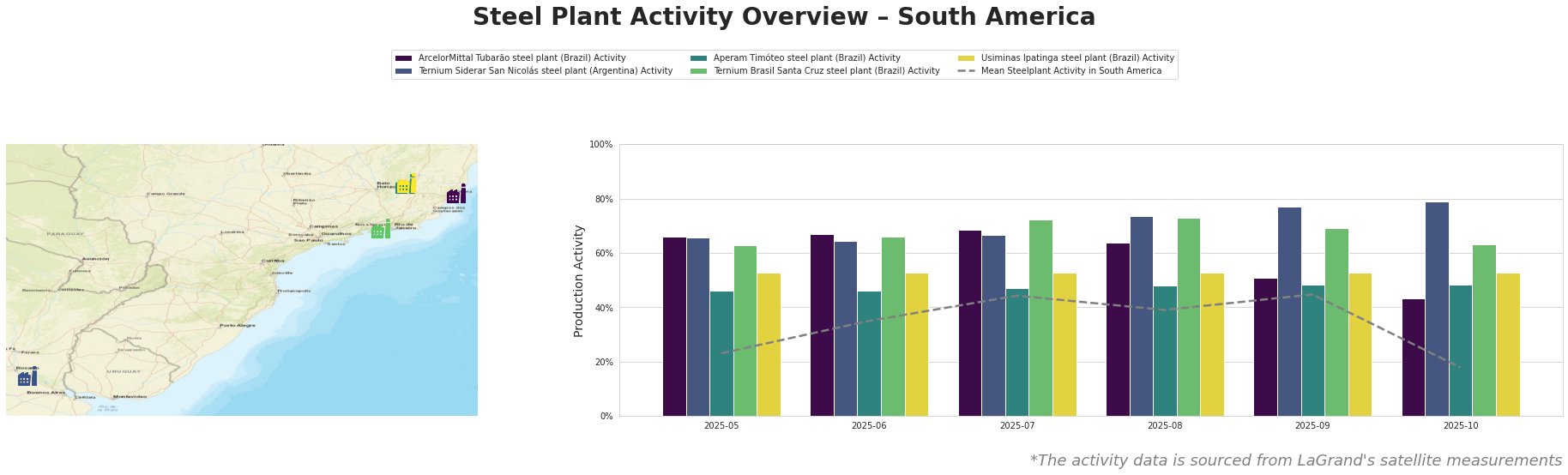

The average steel plant activity across South America fluctuated, peaking at 45% in September 2025 and then dropping significantly to 18% in October. All plants except Ternium Siderar San Nicolás followed this downward trend in October.

ArcelorMittal Tubarão, an integrated BF/BOF plant in Espírito Santo, Brazil, producing 7500 ttpa of crude steel, showed consistently high activity from May to July (66-68%), then gradually declined to 43% in October. This drop coincides with the COP30 conference, however, given that “Cop 30 braces for first test on divisive issues,” highlights potentially unstable situations, no direct connection between the climate talks and plant activity can be explicitly established.

Ternium Siderar San Nicolás, an integrated BF/BOF plant in Buenos Aires, Argentina, producing 3200 ttpa of crude steel, exhibited a steady increase in activity levels, reaching a peak of 79% in October. This contrasts with the overall regional trend and the situation at COP30 reported in “Cop 30 braces for first test on divisive issues” and could indicate local demand increases or supply shifts within Argentina, but no direct cause can be determined from the provided news.

Aperam Timóteo, an integrated BF/BOF/EAF plant in Minas Gerais, Brazil, producing 900 ttpa of crude steel including stainless and electrical steels, maintained a relatively stable activity level around 46-48% throughout the observed period. The consistency of Aperam Timóteo contrasts against the claims of the article “COP30 in Brasilien: Indigene Aktivisten stürmen Gelände der Klimakonferenz – Verletzte bei Zusammenstößen” which states that climate policies have had a negative impact.

Ternium Brasil Santa Cruz, an integrated BF/BOF plant in Rio de Janeiro, Brazil, producing 5200 ttpa of crude steel (slabs), showed strong activity in July and August (72-73%) but experienced a decrease to 63% in October, coinciding with the drop in mean steelplant activity across South America. There is no explicit connection to be made between this shift and any of the provided news articles.

Usiminas Ipatinga, an integrated BF/BOF plant in Minas Gerais, Brazil, producing 5000 ttpa of crude steel, showed a stable level of activity at 53% across the whole observed period, diverging from the average trend. No information regarding the plant from the news articles can be extracted from the provided information to derive any conclusion.

The consistent rise in activity observed at Ternium Siderar San Nicolás, while the regional average declined, suggests potential localized supply constraints or increased demand in Argentina. Steel buyers should:

- Prioritize securing supply from Ternium Siderar San Nicolás to capitalize on the increased output.

- Diversify sourcing beyond the Argentinian market.

- Closely monitor local Argentinian market dynamics for any further changes impacting price or supply.

The drop in activity at ArcelorMittal Tubarão and Ternium Brasil Santa Cruz, coupled with the stable output at Usiminas Ipatinga, suggests potential oversupply in certain product categories. Steel buyers should: - Attempt to negotiate lower prices with ArcelorMittal Tubarão and Ternium Brasil Santa Cruz due to decreased activity.

- Consider increasing spot purchases from Usiminas Ipatinga to offset against the reduced activity, and secure a constant, reliable supply.