From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSouth American Steel Market Optimistic Amid COP30 Preparations: Simec Pindamonhangaba Faces Production Dip

South America’s steel market exhibits a positive outlook, fueled by Brazil’s COP30 presidency and ambitious decarbonization goals. This report analyzes recent activity trends in Brazilian steel plants in light of these developments, referencing news articles like “Brazil miners eye cutting emissions by 90pc by 2050,” “Cop 30 presidency looking to ‘advance negotiations,” and “COP presidency advances action agenda“. The satellite-observed plant activity is used to supplement these reports.

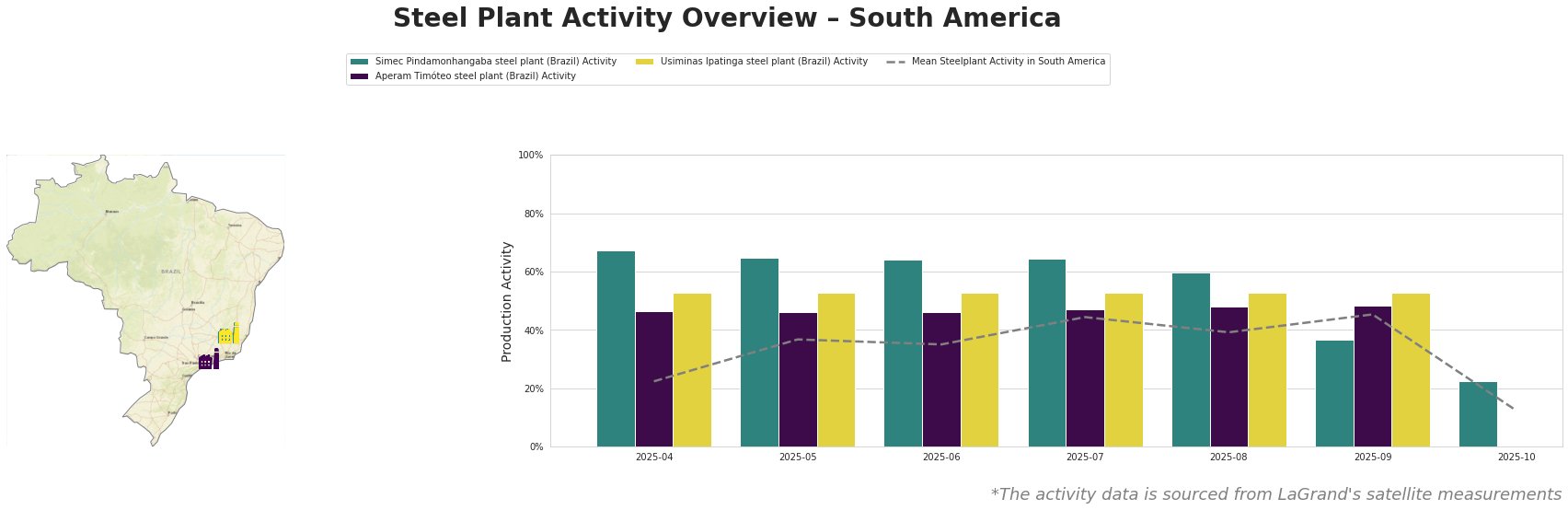

Recent steel plant activity shows fluctuations across the region, as presented in the table below:

The mean steel plant activity in South America varied significantly from April to October, peaking in September at 45% and dropping sharply to 12% in October. Simec Pindamonhangaba showed consistently high activity until September, followed by a sharp decline in October. Aperam Timóteo steel plant activity remained relatively stable. Usiminas Ipatinga steel plant exhibited constant activity throughout the observed period.

Simec Pindamonhangaba, a 500 ttpa EAF-based plant in São Paulo focused on finished rolled products like wire rod and rebar for the building and infrastructure sector, experienced a notable activity decrease from 60% in August to 23% in October. This represents a substantial reduction. While the news reports highlight broader decarbonization efforts like “Brazil miners eye cutting emissions by 90pc by 2050,” no direct connection to Simec’s specific activity drop can be explicitly established from the provided information.

Aperam Timóteo, an integrated BF/BOF/EAF plant in Minas Gerais with a 900 ttpa crude steel capacity, produces stainless steel and special carbon steels for diverse sectors, including automotive and energy. Its activity remained stable around 46-48% throughout the period. The plant’s use of charcoal from cultivated eucalyptus forests as a substitute for coke aligns with Brazil’s broader sustainability goals, but no direct impact on its recent activity is evident from the available news or activity data.

Usiminas Ipatinga, another Minas Gerais-based integrated BF/BOF plant with a 5000 ttpa crude steel capacity, maintained a constant activity level of 53% during the observed period. The plant produces semi-finished and finished rolled products for various sectors. While the COP30 discussions around fossil fuel transition (“Fossil fuels in Cop 30 action agenda spotlight“) might eventually impact Usiminas, there is no explicit indication of this in the current activity levels.

The COP30 presidency’s focus on climate action and potential financial incentives for deforestation reduction (“TFFF, REDD+ can generate $9bn/yr for deforestation“) create a favorable environment for sustainable steel production. However, the recent surge in global deforestation (“Deforestation spike in 2024 risks 2030 goal“) underscores the urgency for concrete actions.

The significant activity drop at Simec Pindamonhangaba warrants close monitoring. While no explicit connection to COP30 preparations or specific decarbonization initiatives can be established from the provided news, steel buyers should:

- Diversify suppliers in the short term to mitigate potential supply disruptions from Simec Pindamonhangaba.

- Prioritize steel from producers with verifiable sustainable practices (e.g., ResponsibleSteel certification), as highlighted by Brazil’s commitment to emission reductions and the certifications held by all three plants.

- Closely track further announcements and outcomes from COP30, particularly regarding funding for low-carbon steel production and the implementation of the action agenda (“COP presidency advances action agenda“). This will help anticipate potential shifts in steel production costs and availability in the region.