From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSouth American Steel Market: Fossil Fuel Transition Stalls Amidst Stable Plant Activity

South America’s steel market is showing signs of stability despite global uncertainty regarding fossil fuel transition. While the “Cop: Cop 30 leaves fossil fuels out of final deal” due to disagreements at the UN climate summit in Brazil, the satellite-observed activity data does not show immediate disruptive impact on steel production levels. No direct relationship can be established between the news articles about COP30 climate talks and observed plant activity at this time.

Steel Plant Activity – Recent Trends

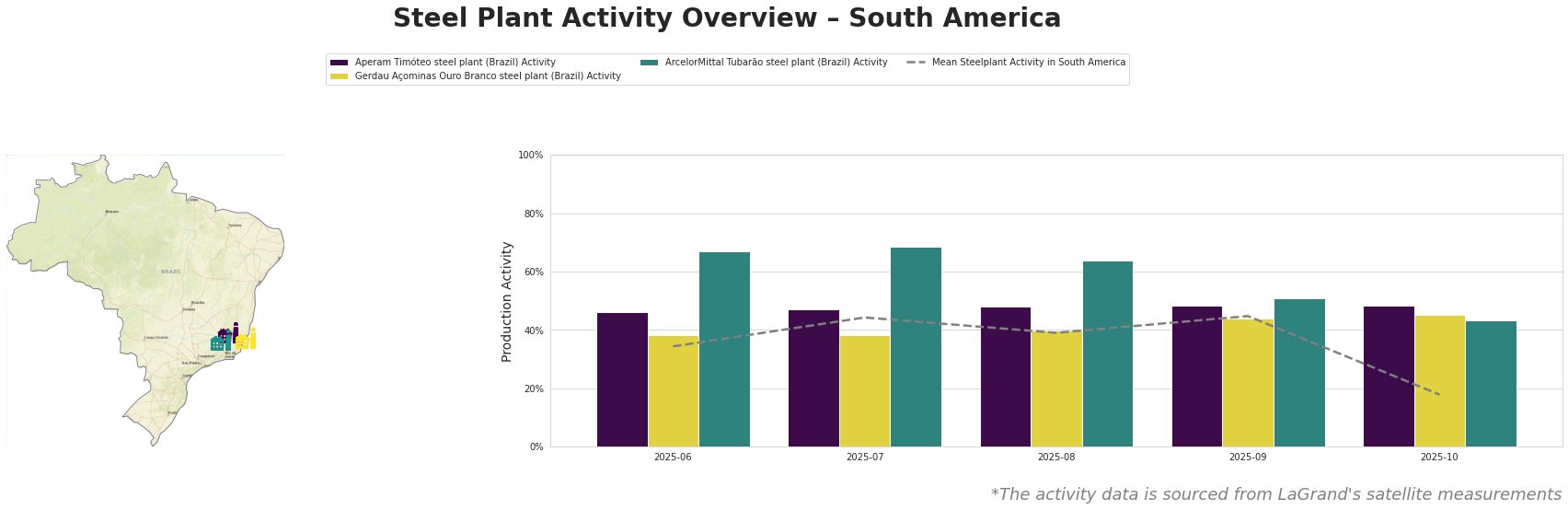

The mean steel plant activity in South America has fluctuated, with a significant drop to 18.0% in October 2025, after a high of 45.0% in September 2025. Aperam Timóteo steel plant (Brazil) maintained a stable activity level around 47% – 48% between June and October 2025, consistently outperforming the regional average. Gerdau Açominas Ouro Branco steel plant (Brazil) showed a slight increase in activity, reaching 45.0% in October 2025. ArcelorMittal Tubarão steel plant (Brazil) exhibited the highest activity levels overall, peaking at 68.0% in July 2025, but experienced a decrease to 43.0% in October 2025.

Plant-Specific Analysis

Aperam Timóteo steel plant: This plant, located in Minas Gerais, Brazil, operates with both BOF and EAF technologies and has a crude steel capacity of 900 ttpa. It is ResponsibleSteel certified and uses charcoal from cultivated eucalyptus forests as a substitute for coke, reducing its reliance on fossil fuels. The plant’s activity remained stable at approximately 47-48% throughout the observed period. No direct connection can be established between its consistent activity and the COP30 news articles.

Gerdau Açominas Ouro Branco steel plant: Also located in Minas Gerais, Brazil, this integrated BF-BOF plant boasts a substantial crude steel capacity of 4500 ttpa. It is also ResponsibleSteel certified and sources iron ore from Gerdau’s own Varzea do Lopes mine. The observed increase in activity to 45% in October might reflect ongoing adjustments to market demands within the region, however, no connection to the mentioned news articles can be directly established.

ArcelorMittal Tubarão steel plant: Situated in Espírito Santo, Brazil, this integrated BF-BOF plant has a large crude steel capacity of 7500 ttpa. The plant generates a significant portion (approximately 115%) of its energy needs from process gases. Despite a peak activity of 68.0% in July, a notable decrease to 43.0% was observed in October 2025. Despite the drop in activity, no direct correlation can be established between this decrease and the COP30 news.

Market Implications and Procurement Actions

The COP30’s failure to reach a binding agreement on phasing out fossil fuels, as reported in “Cop: Cop 30 leaves fossil fuels out of final deal“, does introduce long-term uncertainty. However, in the short term, the observed activity levels suggest stable steel production.

Given the relatively stable activity at Aperam Timóteo (46-48%), which also uses biomass, buyers seeking supply security should consider increasing procurement from this plant. Conversely, given the drop in activity at ArcelorMittal Tubarão in October, procurement professionals may want to temporarily diversify their slab sourcing.