From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSouth America Steel Market Sentiment Turns Negative Amidst Declining Production and Rising Imports

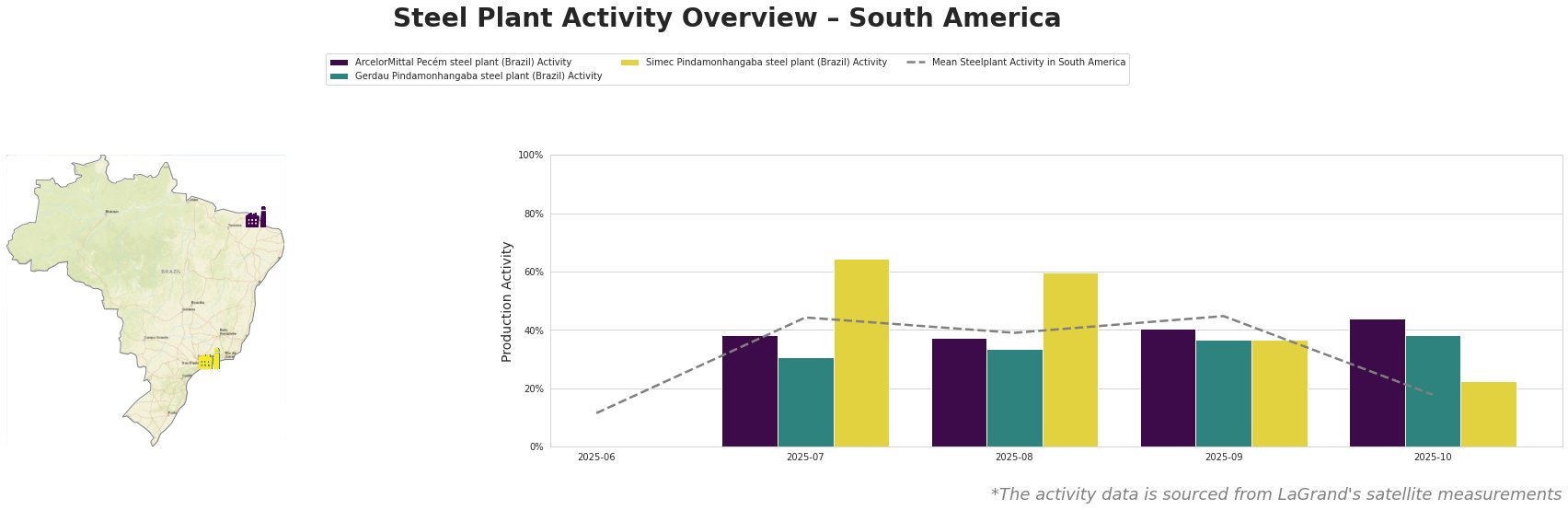

Brazil’s steel market faces a bleak outlook as domestic production declines, influenced by increasing imports and underutilized capacities. Notably, the article “Brazil steel output may fall in 2026: Aco Brasil“ forecasts a 2.2% drop in output to 32.4 million metric tons by 2026 due to a 10% increase in imports, contributing to a 66% operational capacity at domestic mills. This trend reflects changes captured by satellite data, showing a sharp decrease in plant activity, particularly in the ArcelorMittal Pecém and Gerdau Pindamonhangaba plants.

The ArcelorMittal Pecém steel plant, situated in Ceará, demonstrated fluctuating activity, with observed levels at 44.0% in October, a notable drop from previous months correlating to the concerns raised in “Brazilian crude steel production increased slightly in November“, where domestic sales fell by 6.5%. The factory’s strategic integration of blast furnace (BF) and basic oxygen furnace (BOF) technology appears under pressure as imports escalate.

Gerdau Pindamonhangaba has similarly suffered, largely dependent on its electric arc furnace (EAF) technology. Its usage peaked in July at 31.0%, declining by October. This trend aligns with insights from the “Steel production in Brazil may decrease in 2026: Aco Brasil“, highlighting increased competition from lower-cost imports impacting sales volumes and production viability.

In contrast, Simec Pindamonhangaba saw a higher level of activity at 64.0% in July, dropping to 23.0% by October, indicating significant instability. The report “Brazilian crude steel production increased slightly in November” highlights broader market challenges of falling local demand, directly affecting this facility’s output.

The cumulative data confirms projected supply disruptions in the Brazilian steel sector. Steel buyers should prepare for potential shortages and increased prices from plants like ArcelorMittal Pecém, given operational inefficiencies and incoming anti-dumping duties that may limit pricing flexibility.

Recommended procurement actions include:

- Prioritize sourcing from facilities exhibiting stable activity (notably Gerdau’s EAF capacity) while monitoring import patterns.

- Engage in forward contracts to lock in prices with suppliers ahead of anticipated price volatility from declining local output.

- Diversify supply chains to incorporate imports strategically, contingent on tariff and duty outcomes, as a hedge against domestic supply disruptions.

This stringent environment necessitates proactive strategies for steel procurement professionals to mitigate risks and navigate the evolving market landscape effectively.