From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSouth America Steel Market Report: Surge in Production Activity Amid Optimistic Demand Growth

Brazil’s steel market is experiencing a notable uptick in production activity, positively influenced by recent developments. The article “Viewpoint: Brazil seeks gas growth and price cuts“ highlights Brazil’s strategy to expand its gas market, which could indirectly benefit steel producers through enhanced energy availability and pricing. Activity data from satellite observations further corroborate this with increases in output at key steel plants.

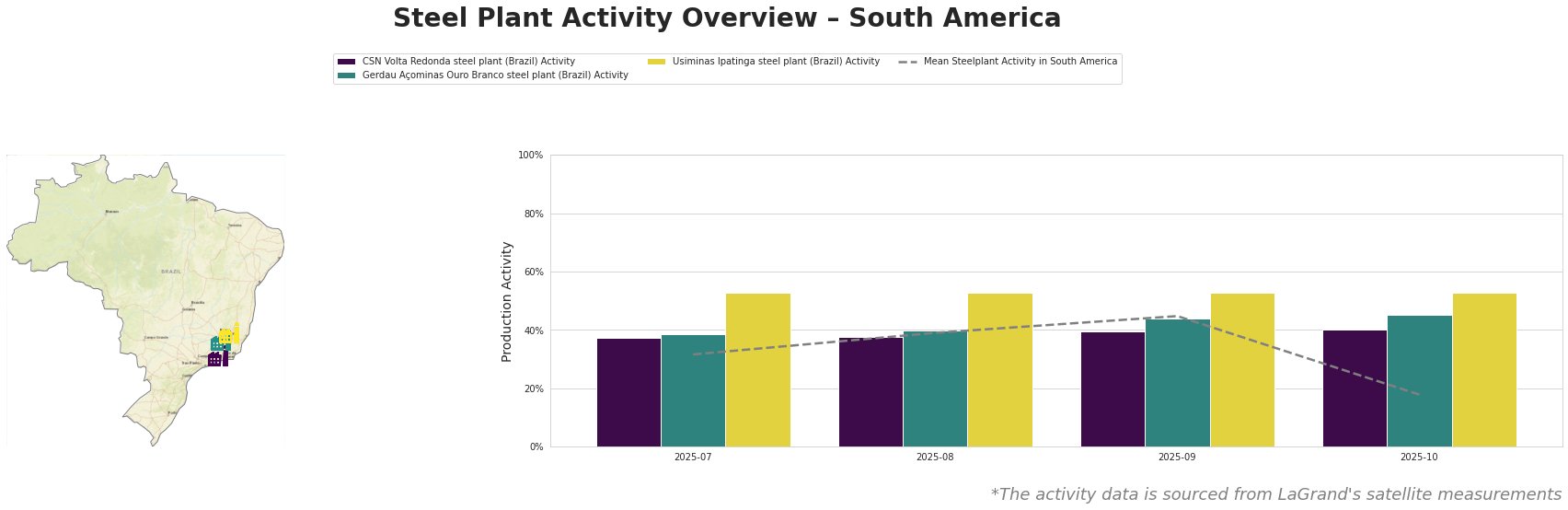

Over the observed months, the mean activity level across steel plants in South America has fluctuated, peaking at 45% in September. The CSN Volta Redonda plant demonstrated stability, maintaining around 39%-40% but experienced a drop to 32% in October. Gerdau Açominas showed a consistent activity range, with an increase to 45% by October, indicating robust demand dynamics. Notably, Usiminas Ipatinga maintained a solid focus with stable output around 53%, aligning with the optimistic sentiment in industrial sectors as highlighted in the aforementioned news article.

The CSN Volta Redonda steel plant, located in Rio de Janeiro, shows a steady growth trajectory with its operational capacity at 6,250 tons of crude steel. Activity has varied, with a peak at 40% in October that may connect to increased expectations from domestic energy supplies. However, no explicit connection to the “Viewpoint: Brazil seeks gas growth and price cuts” article could be established.

The Gerdau Açominas Ouro Branco steel plant in Minas Gerais reported improved activity aligning with a growth strategy benefiting from projected demand for steel products in the automotive and infrastructure sectors. This plant’s observed increase to 45% ties into the optimistic growth framework provided in the news articles.

Usiminas Ipatinga, also in Minas Gerais, sustained a strong output at 53%, indicating resilience against shorter-term market fluctuations, although no direct links to specific news events were noted.

With the backdrop of increasing natural gas output and favorable economic conditions, steel buyers in South America should strategically align their procurement actions to leverage on the increasing production capacity observed. Buyers should consider securing contracts promptly as demand is likely to grow and further pressure existing supply chains. Delays in infrastructure developments as mentioned in the gas market article may lead to localized supply constraints, particularly if domestic production does not meet rising industrial demands. Conducting thorough assessments of individual plant capacities and likely performance trends remains crucial in this market environment to optimize procurement strategies effectively.