From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSouth America Steel Market Report: Activity Declines Amid Regulatory Uncertainty

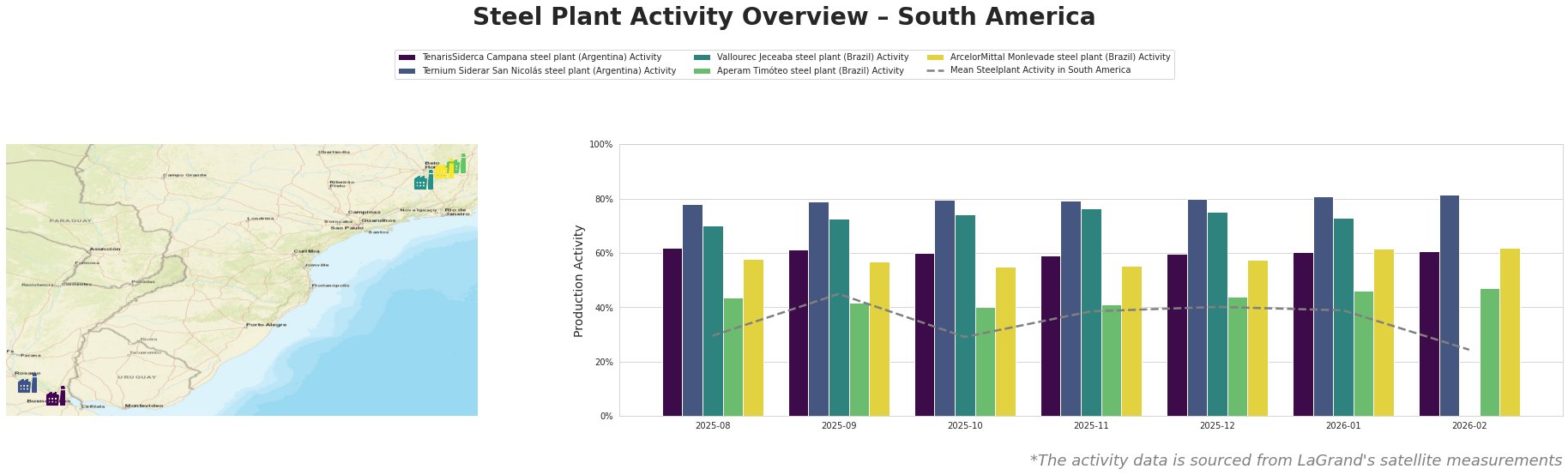

In South America, the steel market sentiment is very negative due to significant declines in production activity, primarily linked to regulatory pressures surrounding emissions trading. The articles “Was hinter dem Preissturz der CO2-Zertifikate steckt – was wird aus dem Emissionshandel?” and “Gezerre um den europäischen Emissionshandel” highlight the political discussions that have influenced these trends. Specifically, the ongoing uncertainty around the CO₂ emissions trading system (ETS) has led to reduced plant activities observed through satellite data.

The TenarisSiderca Campana plant in Buenos Aires exhibited relatively stable activity (61% in February) despite an overall declining trend. This stability, however, is juxtaposed against the market’s pessimistic outlook regarding emissions regulations as noted in “Was hinter dem Preissturz der CO2-Zertifikate steckt – was wird aus dem Emissionshandel?”.

In contrast, the Ternium Siderar San Nicolás site demonstrated slight increases peaking at 82% in February, but external pressures hinted at possible operational constraints linked to emissions cost concerns raised in the same articles. Vallourec Jeceaba’s activity remained low and speculative links to the emissions discussions hint at broader supply chain impacts. The other plants, particularly Aperam Timóteo and ArcelorMittal Monlevade, displayed inconsistent activity levels, with significant drops noted in January and February, reflecting greater caution in ramping up production given the market instability.

Marked reductions in mean activity to 24% in February signal potential supply constraints affecting all regions in South America, notably linked to regulatory discussions around carbon emissions. As forecasted changes to emissions trading could further upset pricing structures, buyers should prioritize securing contracts with plants displaying stable output, like TenarisSiderca Campana and Ternium Siderar San Nicolás, while being cautious of fluctuating prices influenced by the EU’s emissions policy.

To mitigate risks, steel buyers are advised to establish flexible procurement strategies, focusing on securing volume commitments with producers ready to adapt to the unpredictable regulatory environment impacting supply chains in the short term.