From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSouth America Steel Market Outlook: Negative Sentiment Amid Crude Oil Transition

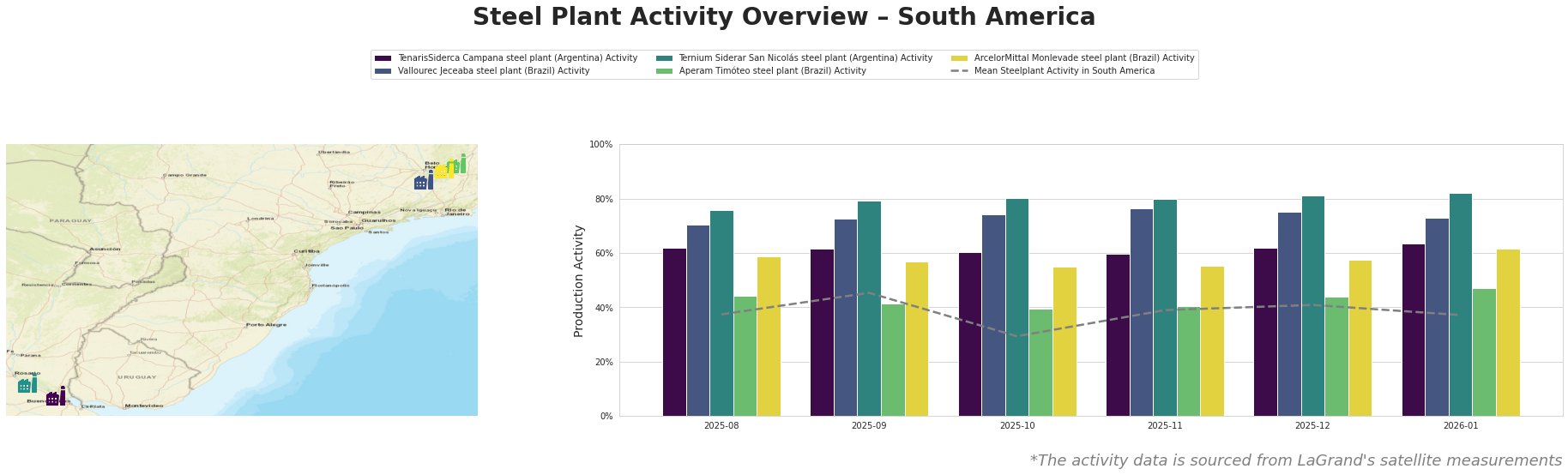

Recent developments in South America’s steel market suggest a negative sentiment, driven by notable activity changes in local steel plants. Reported in Venezuela’s crude revival makes slow start (January 24, 2026), and Venezuela gets back to its old business (January 25, 2026), the shift toward increasing foreign investment in crude oil operations impacts downstream sectors, including steel. Recent satellite data reveal activity fluctuations among key steel plants in Argentina and Brazil amid these dynamics.

Measured Activity Overview:

The data indicates a mean activity level of 37% in January 2026, down slightly from December’s 41%. Vallourec Jeceaba’s activity fell to 73%, down from 75% in December, even as Ternium Siderar and ArcelorMittal Monlevade saw minor increases (82% and 61%, respectively). The TenarisSiderca plant experienced a stable increase to 64%, indicating robust performance relative to the overall declining trend. The observed activity changes do not directly correlate with the crude oil investment news but signal systemic challenges impacting the steel sector.

Plant Narratives:

The TenarisSiderca Campana steel plant operates through a DRI and EAF process, producing seamless steel pipes primarily for the energy sector. Its activity increased from 62% in December to 64% in January, suggesting resilience amidst market pressures. This may correlate indirectly with increasing oil trade, as noted in Venezuela gets back to its old business.

At the Vallourec Jeceaba steel plant, although activity levels remained high at 73%, a decrease from previous months suggests external market pressures may affect output. This reduction could be linked to overall uncertainty in the oil sector’s revival, as highlighted in Venezuela’s crude revival makes slow start.

The Ternium Siderar San Nicolás plant, with a January activity peak of 82%, demonstrates relative strength and effective management despite a challenging marketplace. The increased efficiency in operations could aid in weathering broader sectoral downturns prompted by volatility in crude oil investments.

Evaluated Market Implications:

The ongoing shifts in Venezuela’s oil investment strategy might disrupt local steel supply chains, particularly for plants heavily reliant on energy sector demand. Steel buyers should closely monitor activity levels in production facilities such as Vallourec Jeceaba and ArcelorMittal Monlevade, which exhibit declining trends amid volatile oil market conditions.

Procurement actions should focus on consolidating relationships with suppliers who are demonstrating stability, such as TenarisSiderca and Ternium Siderar, which have shown relative resilience. Steel buyers are advised to anticipate potential delays or increased costs linked to supply chain disruptions resulting from geopolitical and investment-related instability in crude oil operations.