From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSouth America Steel Market: Climate Finance & Plant Activity Signal Positive Outlook Despite CBAM Concerns

South America’s steel market shows positive signs despite challenges. The upcoming COP30 in Belem, Brazil, is a major driver, with “Cop 28 outcome must be implemented in full: Cop 30 head” setting an ambitious agenda for renewable energy and climate finance. While “UN Bonn climate talks delayed by agenda disagreements” highlights ongoing debates over climate finance and the EU’s Carbon Border Adjustment Mechanism (CBAM), no direct link can be established to recent plant activity changes.

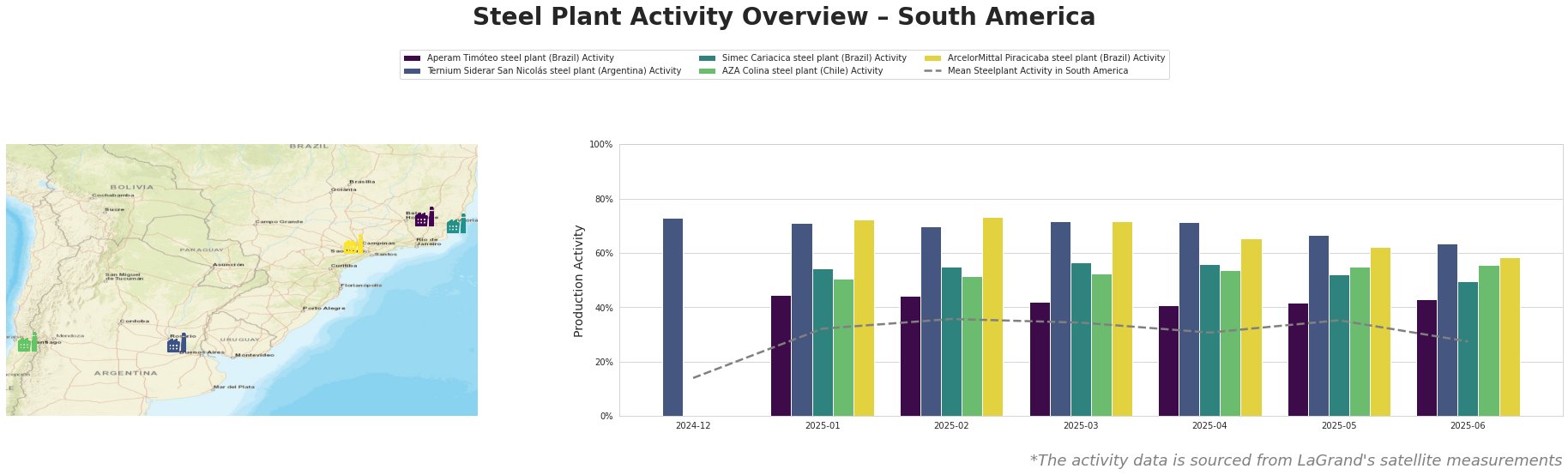

The mean steel plant activity in South America has fluctuated, peaking in February 2025 at 36% and declining to 27% by June 2025. Ternium Siderar San Nicolás in Argentina consistently exhibits the highest activity levels, starting at 73% in December 2024 and gradually decreasing to 63% by June 2025. ArcelorMittal Piracicaba in Brazil showed high activity, peaking at 73% in February 2025, followed by a decline to 58% in June 2025. The other plants (Aperam Timóteo, Simec Cariacica, and AZA Colina) show moderate activity levels, with smaller fluctuations.

Aperam Timóteo, a Brazilian integrated steel plant with both BOF and EAF production, remained relatively stable, fluctuating between 41% and 44% activity, with a slight rise to 43% in June. The plant focuses on specialty steels, including stainless and electrical steel, catering to sectors like automotive and energy. No direct connection can be established between its activity and the news articles.

Ternium Siderar San Nicolás, an Argentinian integrated BF-BOF steel plant with a crude steel capacity of 3.2 million tonnes, showed a gradual decrease in activity from 73% in December 2024 to 63% in June 2025. The plant produces slabs, hot-rolled, cold-rolled, and tinplate coils. This decline may be linked to potential uncertainty surrounding CBAM’s impact, as highlighted in “UN Bonn climate talks delayed by agenda disagreements,” although a direct connection cannot be definitively confirmed.

Simec Cariacica, a Brazilian EAF-based steel plant producing rebar and profiles for the building and infrastructure sectors, experienced activity fluctuations between 50% and 57%. No direct connection can be established between its activity and the news articles.

AZA Colina, a Chilean EAF-based steel plant focusing on long products for construction, saw activity fluctuate between 51% and 56%. No direct connection can be established between its activity and the news articles.

ArcelorMittal Piracicaba, a Brazilian EAF-based plant producing rebar and wire rod for the construction sector, exhibited a decline from 72% in January-March 2025 to 58% in June 2025. This decline does not seem to be directly related to news.

The upcoming COP30 conference in Brazil (“Cop 28 outcome must be implemented in full: Cop 30 head”) signals a strong push towards renewable energy and lower-carbon production methods. Given Aperam Timóteo’s use of charcoal (biomass) as a substitute for coke, this plant is well-positioned to benefit from the increased emphasis on sustainable steel production.

Evaluated Market Implications:

-

Potential Supply Disruptions: The gradual decline in activity at Ternium Siderar San Nicolás in Argentina, although not directly attributable to CBAM concerns, warrants monitoring. Increased costs due to CBAM could lead to decreased production and potential supply chain disruptions, particularly for hot-rolled and cold-rolled coils.

-

Recommended Procurement Actions: Steel buyers should:

- Prioritize securing contracts with steel producers demonstrating commitment to lower-carbon production methods, like Aperam Timóteo, aligning with the COP30 objectives. This is supported by the focus of “Cop 28 outcome must be implemented in full: Cop 30 head” on renewable energy.

- Diversify steel sourcing to mitigate potential supply disruptions from Argentinian producers like Ternium, potentially affected by CBAM, as discussed in “UN Bonn climate talks delayed by agenda disagreements”.

- Monitor Argentinian steel prices closely for potential increases due to CBAM implementation, and factor this into procurement planning.