From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSouth America Steel Market: Brazilian Wire Rod Exports Surge Amid HRC Import Shifts

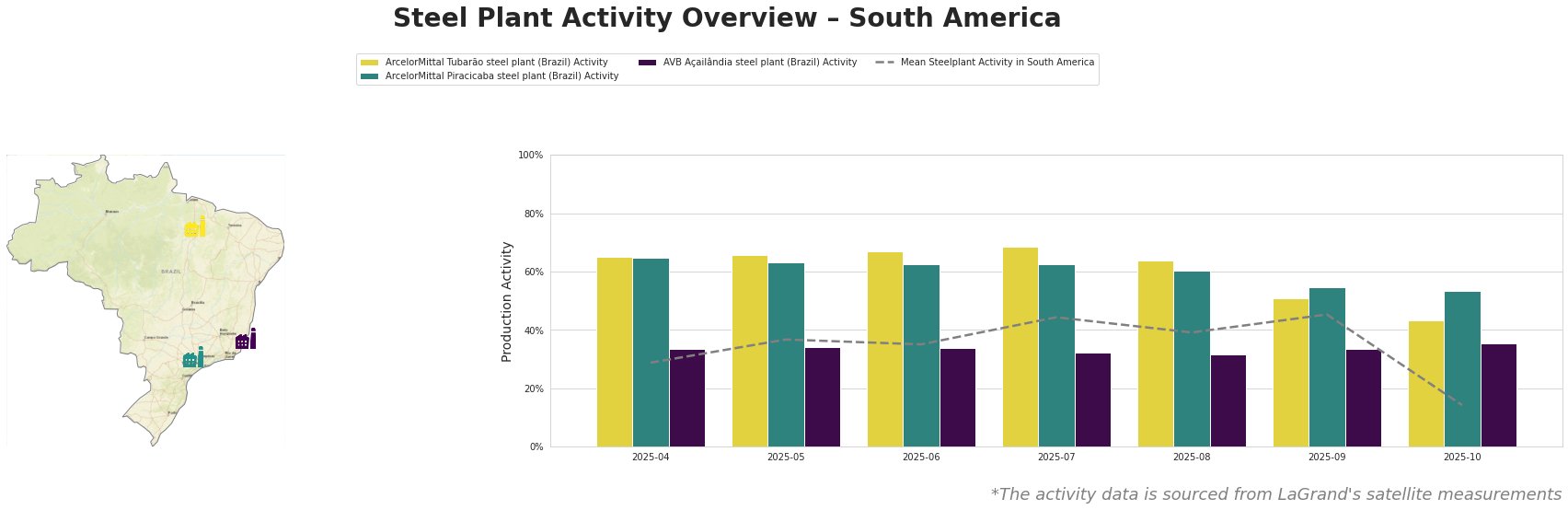

South America’s steel market shows a mixed landscape. The observed activity levels at selected Brazilian steel plants do not obviously correspond to the shifting trade dynamics described in “Brazil’s HRC imports decline in Sep” and “Wire rod exports from Brazil increase in September“. There is no direct evidence in the articles to clearly relate heavy plate export decline to plant activity. The activity overview shows a sharp decline in mean steel plant activity for October, but no obvious relationship can be established.

The mean steel plant activity in South America peaked in September at 45.0, but sharply declined to 14.0 in October. ArcelorMittal Tubarão steel plant consistently operated at higher-than-average activity levels until September, when its activity dropped significantly from 64.0 in August to 51.0. This further decreased to 43.0 in October. ArcelorMittal Piracicaba steel plant showed a more moderate decline. AVB Açailândia steel plant demonstrated relatively stable activity levels throughout the observed period, staying consistently below the mean value.

ArcelorMittal Tubarão, an integrated steel plant in Espírito Santo, Brazil, with a 7.5 million tonne crude steel capacity (BOF-based), primarily produces slabs and hot-rolled coils. The plant’s activity dropped significantly in September and October, from a high of 68.0 in July to 43.0 in October. Although “Brazil’s HRC imports decline in Sep” indicates shifting import patterns, there is no clear evidence to explicitly link these developments to the Tubarão plant’s production levels.

ArcelorMittal Piracicaba, an electric arc furnace (EAF)-based plant in São Paulo, Brazil, focuses on finished rolled products such as rebar and wire rod, with a crude steel capacity of 1.1 million tonnes. Plant activity decreased from 65.0 in April to 53.0 in October, but the decrease was relatively stable. This plant’s output is rebar and wire rod. Given that “Wire rod exports from Brazil increase in September“, the consistent drop is not immediately explained by the export numbers.

AVB Açailândia, an integrated steel plant in Maranhão, Brazil, possesses a 600,000-tonne crude steel capacity (BF/BOF based) and produces semi-finished and finished rolled products, including billets, rebar, and wire rod. The plant showed relatively stable activity levels, slightly below the South American mean, suggesting a consistent operational tempo, but no growth linked to increased wire rod exports.

The significant drop in mean activity observed from September to October across all plants warrants close monitoring of output levels.

Steel buyers should:

– Closely monitor Brazilian wire rod export data and domestic rebar pricing for further signals as “Wire rod exports from Brazil increase in September,” possibly driven by ArcelorMittal Piracicaba, may impact regional supply dynamics.

– Investigate alternative suppliers, particularly from South Korea, Egypt, Italy, and Turkey for HRC to mitigate risks associated with fluctuating Chinese imports, especially given the shift away from China as mentioned in “Brazil’s HRC imports decline in Sep“.